USMCA's Impact On Mazda: 28% Export Decline Points To Tariff Barriers

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

USMCA's Impact on Mazda: A 28% Export Decline Highlights Tariff Barriers

Mazda's struggles underscore the complexities of navigating the USMCA agreement. The automotive industry, a key player in the North American economy, is feeling the pinch of the United States-Mexico-Canada Agreement (USMCA), and Mazda's recent export decline is a stark example. The Japanese automaker has reported a staggering 28% drop in exports from Mexico, raising serious questions about the effectiveness of the trade pact and the persistent impact of tariff barriers. This significant downturn highlights the challenges automakers face in optimizing their supply chains under the new trade rules.

Navigating the Nuances of USMCA

The USMCA, intended to replace NAFTA, aimed to streamline trade between the three North American nations. However, the reality on the ground proves more complicated. While the agreement eliminated tariffs on many goods, complexities remain, especially regarding rules of origin, which dictate the percentage of a product's value that must originate within the USMCA region to qualify for tariff-free treatment. These intricate regulations often create unforeseen hurdles for manufacturers like Mazda.

The 28% drop in Mazda's Mexican exports isn't solely attributable to USMCA, but the agreement’s intricacies certainly exacerbate pre-existing challenges. Increased regulatory compliance costs, combined with potential delays at border crossings, likely contribute to the overall decline. This situation underscores the need for clearer guidelines and improved cooperation between the three signatory nations to facilitate smoother trade flows.

Beyond Tariffs: Other Contributing Factors

While tariff barriers are a significant factor, it's crucial to consider other influences on Mazda's export performance. Global supply chain disruptions, the ongoing semiconductor shortage, and fluctuating global demand all play a role. However, the sheer magnitude of the decline suggests that USMCA-related complexities are a significant contributing factor.

- Rules of Origin Complexity: Meeting the stringent rules of origin for automotive parts is costly and time-consuming. Slight deviations can lead to significant tariffs, impacting profitability.

- Increased Administrative Burden: Navigating the USMCA's regulations requires significant administrative effort, increasing operational costs for companies like Mazda.

- Border Crossing Delays: Even with streamlined processes, border delays can disrupt supply chains and lead to production slowdowns.

The Future of USMCA and the Automotive Industry

The experience of Mazda serves as a cautionary tale for other automakers operating within the USMCA framework. To mitigate future challenges, collaboration between governments and the automotive industry is paramount. Clearer guidelines, streamlined border processes, and more flexible interpretations of rules of origin could significantly alleviate the burden on manufacturers.

The USMCA is a complex agreement, and its long-term impact on the automotive sector remains to be seen. However, Mazda's significant export decline serves as a critical reminder of the need for ongoing dialogue and adjustments to ensure the agreement fosters, rather than hinders, economic growth and trade within North America. Further analysis and policy adjustments are needed to unlock the full potential of USMCA for the automotive industry and prevent similar setbacks for other manufacturers.

Call to Action: Stay informed about the evolving dynamics of the USMCA and its impact on various industries by subscribing to our newsletter (link to newsletter signup). Understanding these complexities is crucial for businesses navigating the North American trade landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on USMCA's Impact On Mazda: 28% Export Decline Points To Tariff Barriers. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nationwide Anti Trump Protests Erupt Billionaires Federal Power Targeted

Sep 04, 2025

Nationwide Anti Trump Protests Erupt Billionaires Federal Power Targeted

Sep 04, 2025 -

Wednesday Season 2 Part 2 Netflix Release Date Time And Plot Details

Sep 04, 2025

Wednesday Season 2 Part 2 Netflix Release Date Time And Plot Details

Sep 04, 2025 -

Michael Jackson Biopic Clarification From Paris Jackson On Involvement

Sep 04, 2025

Michael Jackson Biopic Clarification From Paris Jackson On Involvement

Sep 04, 2025 -

Metal Eden Review Gameplay Graphics And Replayability Analyzed

Sep 04, 2025

Metal Eden Review Gameplay Graphics And Replayability Analyzed

Sep 04, 2025 -

New Music Release Metal Eden Now Available

Sep 04, 2025

New Music Release Metal Eden Now Available

Sep 04, 2025

Latest Posts

-

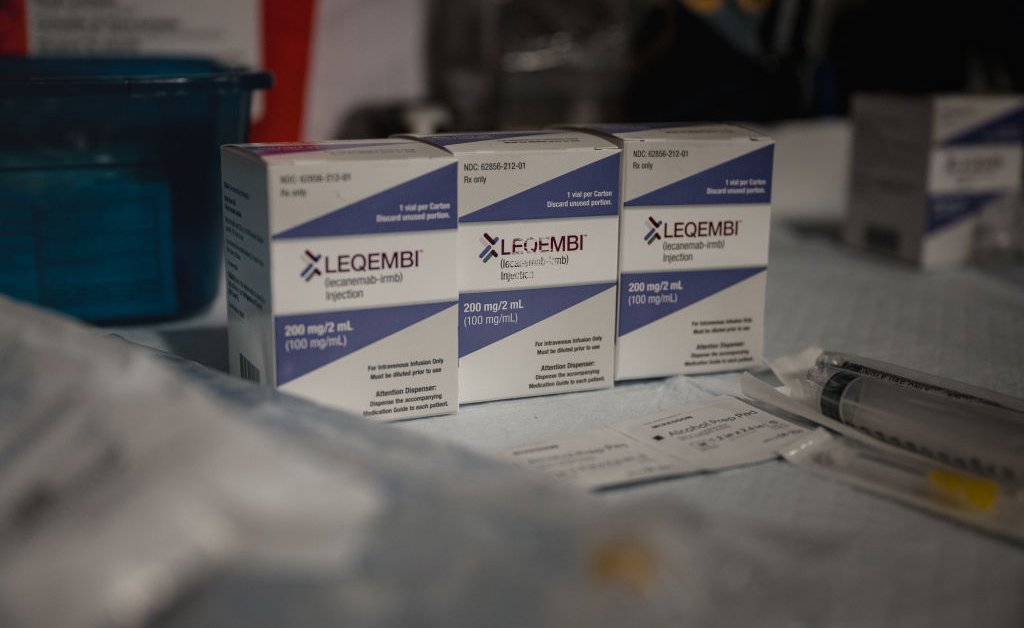

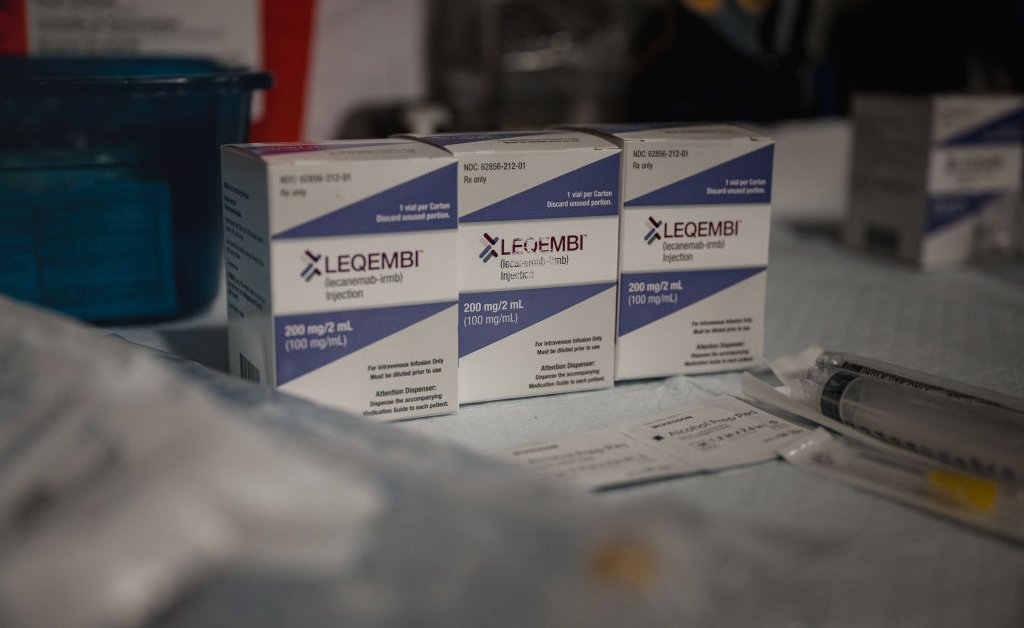

Self Administered Alzheimers Medication A Closer Look

Sep 06, 2025

Self Administered Alzheimers Medication A Closer Look

Sep 06, 2025 -

Tragedy Strikes Lisbon Funicular Crash Claims 15 Lives

Sep 06, 2025

Tragedy Strikes Lisbon Funicular Crash Claims 15 Lives

Sep 06, 2025 -

At Home Alzheimers Treatment Is Self Injection The Future

Sep 06, 2025

At Home Alzheimers Treatment Is Self Injection The Future

Sep 06, 2025 -

China Flexes Military Muscle Strengthening Anti West Ties

Sep 06, 2025

China Flexes Military Muscle Strengthening Anti West Ties

Sep 06, 2025 -

Lisbon Funicular Crash A Detailed Account Of The Deadly Incident

Sep 06, 2025

Lisbon Funicular Crash A Detailed Account Of The Deadly Incident

Sep 06, 2025