US Treasury Yields Fall As Fed Hints At One 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Fall as Fed Hints at One 2025 Rate Cut

Investors react to the Federal Reserve's less hawkish stance, sending Treasury yields lower.

The US Treasury market experienced a significant shift on [Date of News], with yields on government bonds falling sharply following the Federal Reserve's latest policy statement. The central bank hinted at a potential single interest rate cut in 2025, a more dovish outlook than many analysts had predicted. This shift in expectations immediately impacted investor sentiment, leading to a decline in Treasury yields across the maturity spectrum.

The 10-year Treasury yield, a key benchmark for borrowing costs, dropped to [Specific Yield Percentage]% after the announcement, marking a [Percentage Change]% decrease from the previous day's close. Similarly, the 2-year yield fell to [Specific Yield Percentage]%, reflecting a reduced expectation of further aggressive rate hikes by the Fed. This movement demonstrates the market's sensitivity to even subtle changes in the Fed's forward guidance.

Why the Shift in Yields?

The Fed's statement, while acknowledging persistent inflation, emphasized the ongoing assessment of incoming economic data. The language used suggested a less aggressive approach to future rate hikes than previously anticipated. This less hawkish tone, a departure from the more aggressive stance seen earlier in the year, fueled speculation of a potential rate cut sooner than previously forecast.

This subtle shift in the Fed's communication strategy had a profound impact on market expectations. Investors, anticipating a less restrictive monetary policy environment, flocked to Treasury bonds, driving up demand and consequently pushing yields lower. The inverse relationship between bond prices and yields means that increased demand leads to higher prices and lower yields.

What This Means for Investors

The decline in Treasury yields presents both opportunities and challenges for investors. Lower yields generally mean lower returns for bondholders, but also suggest a potentially less volatile market environment. For investors seeking safety and stability, Treasury bonds can still provide a relatively secure investment, though the returns may be more modest than in previous periods of higher yields.

However, the reduced yields also raise concerns about the potential for inflation to erode purchasing power over time. Investors need to carefully consider their risk tolerance and investment horizon when making decisions in this changing environment. Diversification across asset classes remains a crucial strategy for managing risk.

Looking Ahead: Uncertainty Remains

While the Fed's suggestion of a single rate cut in 2025 provides some clarity, uncertainty remains. The actual timing and magnitude of any future rate adjustments will depend heavily on upcoming economic data, including inflation figures, employment reports, and overall economic growth.

Key factors to watch in the coming months include:

- Inflation data: Persistent inflation could prompt the Fed to maintain a more hawkish stance.

- Economic growth: Slowing economic growth might increase the likelihood of rate cuts.

- Geopolitical events: Global events can significantly impact market sentiment and Treasury yields.

The recent decline in Treasury yields underscores the dynamic nature of the bond market and its sensitivity to central bank policy. Investors should stay informed about the evolving economic landscape and consult with financial advisors to make informed investment decisions. Staying updated on [link to reputable financial news source] can provide valuable insights into market trends.

Disclaimer: This article provides general information and should not be considered financial advice. Consult a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yields Fall As Fed Hints At One 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Spanish Authorities Shut Down 65 000 Airbnb Properties For Non Compliance

May 20, 2025

Spanish Authorities Shut Down 65 000 Airbnb Properties For Non Compliance

May 20, 2025 -

Stream The Critically Acclaimed Wwi Drama With Daniel Craig And Cillian Murphy

May 20, 2025

Stream The Critically Acclaimed Wwi Drama With Daniel Craig And Cillian Murphy

May 20, 2025 -

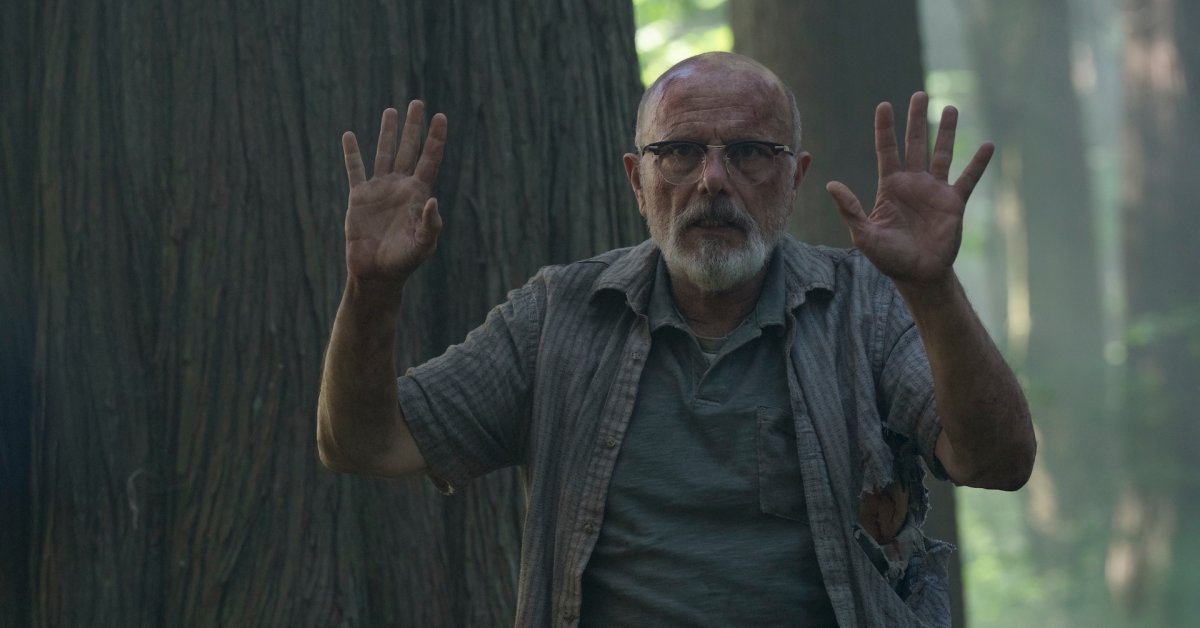

Reframing Relationships How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025

Reframing Relationships How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025 -

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025 -

Balis Tourism Overhaul Stricter Guidelines To Curb Negative Tourist Impact

May 20, 2025

Balis Tourism Overhaul Stricter Guidelines To Curb Negative Tourist Impact

May 20, 2025