US Treasury Yield Decline Follows Fed's Projection Of Single 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Dip as Fed Hints at Single 2025 Rate Cut

US Treasury yields experienced a decline following the Federal Reserve's latest projections, which anticipate a single interest rate cut in 2025. This shift in expectations has sent ripples through the financial markets, prompting investors to reassess their strategies. The move signifies a potential easing of monetary policy, a departure from the more hawkish stance observed earlier this year.

The Fed's projection, unveiled during its September meeting, contrasts with previous forecasts suggesting a more aggressive approach to interest rate adjustments. This more dovish outlook is largely attributed to recent economic data, which suggests a cooling inflation rate and a slower-than-expected economic growth trajectory. The implication for investors is clear: lower interest rates typically lead to lower bond yields, making existing bonds more attractive.

<br>

Understanding the Impact on Treasury Yields

The relationship between Federal Reserve policy and Treasury yields is crucial for understanding current market dynamics. When the Fed raises interest rates, it becomes more expensive for the government to borrow money, leading to higher yields on Treasury bonds. Conversely, when the Fed lowers rates, yields tend to fall. This inverse relationship is a cornerstone of fixed-income investing.

The recent decline in Treasury yields reflects a reassessment of the economic outlook. While inflation remains a concern, the Fed's projection suggests a belief that inflation is under control and that aggressive rate hikes are no longer necessary. This tempered approach has calmed some investor anxieties, contributing to the decreased demand for higher-yielding bonds.

<br>

What Does This Mean for Investors?

This shift in the Federal Reserve's stance presents both opportunities and challenges for investors. For those holding Treasury bonds, the decline in yields could be seen as positive, as the value of their holdings may appreciate. However, it also means potentially lower returns on future investments in Treasury securities.

- Fixed-Income Investors: Should consider adjusting their portfolios based on the new projected rate cut. Diversification across different maturities and credit ratings remains crucial.

- Equity Investors: The lower yields might signal a less aggressive monetary policy environment, potentially benefiting growth stocks. However, the overall economic outlook still needs careful consideration.

- Real Estate Investors: Lower interest rates generally translate to lower borrowing costs, which can positively impact the real estate market. However, other economic factors should be weighed.

<br>

Looking Ahead: Uncertainty Remains

While the Fed's projection offers some clarity, uncertainty remains. The actual path of interest rates depends on various factors, including inflation data, economic growth, and geopolitical events. Therefore, it's vital for investors to stay informed and adapt their strategies accordingly. Monitoring key economic indicators and remaining flexible are critical components of successful investing in this evolving environment.

Further Reading: For a deeper dive into Federal Reserve policy and its impact on the economy, we recommend exploring resources from the Federal Reserve itself [link to Federal Reserve website] and reputable financial news sources.

Disclaimer: This article provides general information and should not be construed as financial advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yield Decline Follows Fed's Projection Of Single 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

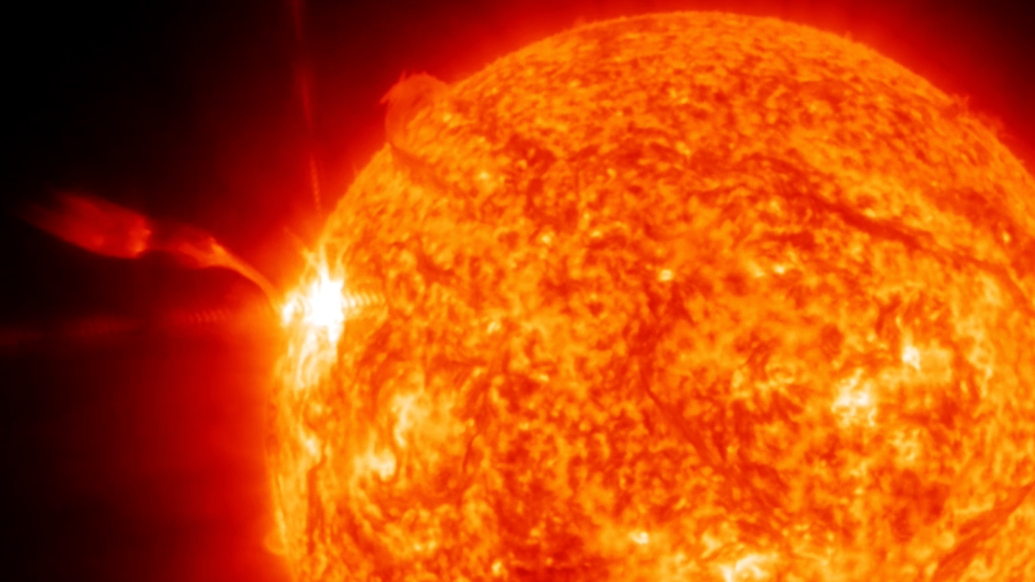

Geomagnetic Storm Warning 2025s Largest Solar Flare And Its Consequences

May 20, 2025

Geomagnetic Storm Warning 2025s Largest Solar Flare And Its Consequences

May 20, 2025 -

New Rules Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025

New Rules Target Bad Tourist Behavior In Bali What You Need To Know

May 20, 2025 -

Watch Now Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Watch Now Powerful Wwi Drama Featuring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Lsg Vs Srh Live Score Ipl 2025 Heated Confrontation Steals The Spotlight

May 20, 2025

Lsg Vs Srh Live Score Ipl 2025 Heated Confrontation Steals The Spotlight

May 20, 2025 -

Supreme Court Decision Impacts Venezuelan Migrants Loss Of Protected Status Under Scrutiny

May 20, 2025

Supreme Court Decision Impacts Venezuelan Migrants Loss Of Protected Status Under Scrutiny

May 20, 2025