US Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Yields Tumble After Fed Hints at 2025 Rate Cuts

The US Treasury market experienced a significant shift following the Federal Reserve's projection of interest rate cuts in 2025. This unexpected forecast sent yields on government bonds plummeting, signaling a potential change in the economic outlook. Investors are now reassessing their expectations for future monetary policy and its impact on inflation and economic growth.

The Fed's recent announcement, deviating from previous hawkish stances, sparked a wave of speculation and triggered a sell-off in the dollar. This article delves into the reasons behind the yield decline, its implications for the broader economy, and what investors should expect moving forward.

H2: Understanding the Yield Curve Shift

The yield curve, which illustrates the relationship between Treasury bond yields and their maturities, reacted strongly to the Fed's projection. Longer-term yields, particularly those on 10-year and 30-year Treasury bonds, experienced the most dramatic decline. This inversion of the yield curve, where short-term yields exceed long-term yields, is often seen as a harbinger of an economic recession. However, the current situation is more nuanced, reflecting investor sentiment regarding future interest rate adjustments.

- Impact on Long-Term Yields: The anticipation of future rate cuts led investors to flock to longer-term Treasury bonds, driving up their prices and consequently lowering their yields. This reflects a belief that future interest rates will be lower than currently anticipated.

- Short-Term Yields Remain Elevated: Despite the overall decline, short-term Treasury yields remain relatively high, reflecting the Fed's ongoing efforts to combat inflation. This divergence between short and long-term yields highlights the complexity of the current economic landscape.

H2: What Drove the Fed's Projection?

The Fed's decision to project rate cuts in 2025 is likely a response to several interconnected factors:

- Easing Inflationary Pressures: While inflation remains above the Fed's target, recent data suggests a gradual cooling. This gives the central bank some room to maneuver and potentially ease monetary policy in the future.

- Economic Slowdown Concerns: Concerns about a potential economic slowdown are also playing a significant role. Recent economic indicators, including weaker-than-expected GDP growth, have raised questions about the resilience of the US economy.

- Data Dependency: The Fed's decision underscores its commitment to a data-dependent approach to monetary policy. Future rate adjustments will hinge on incoming economic data and the evolving inflation picture.

H2: Implications for Investors and the Economy

The decline in Treasury yields has significant implications for both investors and the broader economy:

- Impact on Investment Strategies: Investors are now reassessing their portfolios in light of the changed outlook. This might involve shifting allocations towards longer-term bonds or adjusting their exposure to interest-rate sensitive assets.

- Mortgage Rates and Borrowing Costs: Lower long-term yields could potentially translate into lower mortgage rates, making homeownership more affordable. However, the impact will depend on the actions of other financial institutions.

- Economic Growth: The anticipated rate cuts could stimulate economic growth by making borrowing cheaper for businesses and consumers. However, this also carries the risk of reigniting inflationary pressures if implemented too aggressively.

H2: Looking Ahead: Uncertainty Remains

While the Fed's projection offers a glimpse into potential future monetary policy, uncertainty remains. The actual timing and magnitude of future rate cuts will depend on several unpredictable factors, including the trajectory of inflation, economic growth, and geopolitical events. Investors should closely monitor economic data and Fed communications for further insights. Staying informed about macroeconomic trends and consulting with a financial advisor is crucial for navigating this dynamic market environment. Learn more about {:target="_blank"} and {:target="_blank"} involved in investing.

Call to Action: Stay tuned for further updates on the evolving economic landscape and the impact on the Treasury market by subscribing to our newsletter.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Yield Decline Follows Fed's 2025 Rate Cut Projection. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Venezuelan Migrants Face Deportation Supreme Court Upholds Trump Administration Policy

May 21, 2025

Venezuelan Migrants Face Deportation Supreme Court Upholds Trump Administration Policy

May 21, 2025 -

International Assistance Sought By Bali To Enhance Tourist Safety Standards

May 21, 2025

International Assistance Sought By Bali To Enhance Tourist Safety Standards

May 21, 2025 -

League Of Legends Pro Uzi Receives Electric G Wagon From Mercedes Benz

May 21, 2025

League Of Legends Pro Uzi Receives Electric G Wagon From Mercedes Benz

May 21, 2025 -

Irreplaceable Loss Ellen De Generes Grief And Family Tribute

May 21, 2025

Irreplaceable Loss Ellen De Generes Grief And Family Tribute

May 21, 2025 -

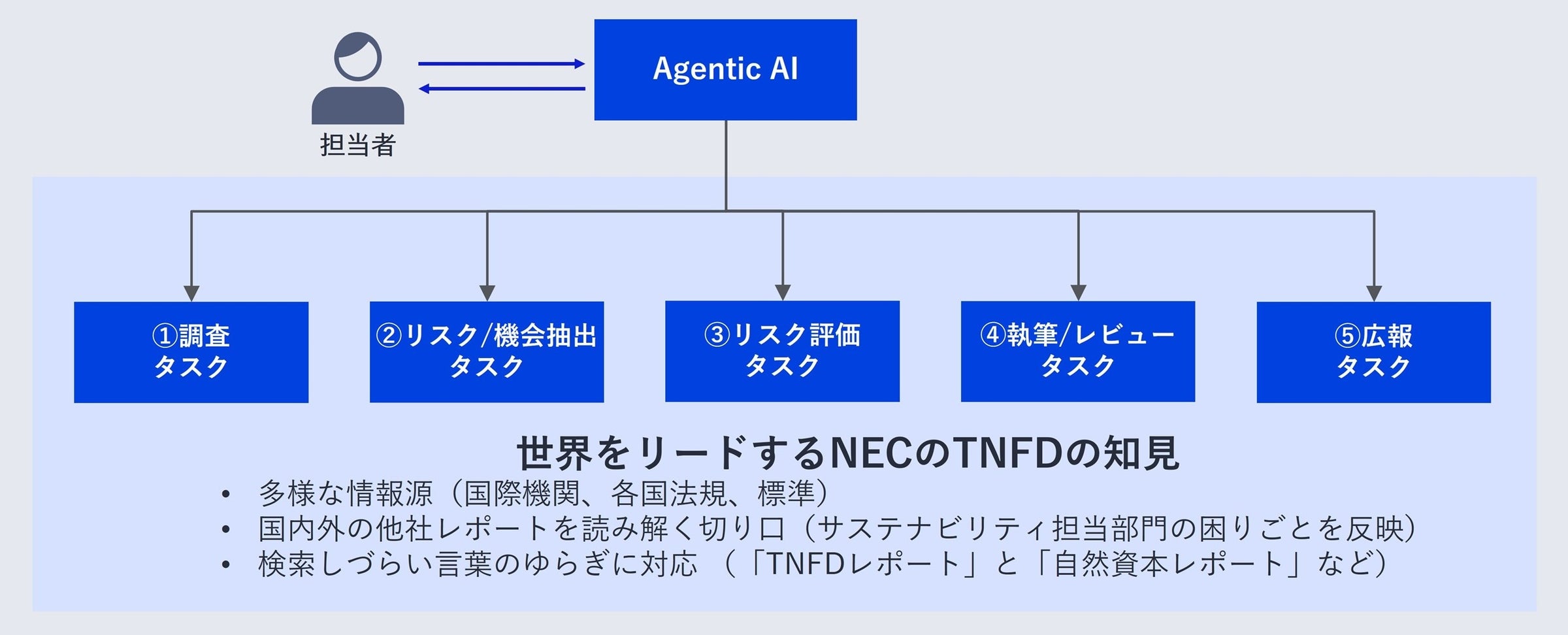

Nec Tnfd Ai

May 21, 2025

Nec Tnfd Ai

May 21, 2025