US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook And Yield Impact

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook and Yield Impact

The US Treasury market experienced a significant shift following the Federal Reserve's recent commentary hinting at potential interest rate cuts as early as 2025. This unexpected outlook sent ripples through the bond market, impacting yields across the curve and sparking debate among economists and investors alike. Understanding this reaction is crucial for anyone invested in or following the US financial landscape.

The Fed's Shift in Stance:

For months, the Fed maintained a hawkish stance, emphasizing its commitment to fighting inflation even if it meant risking a recession. However, recent economic data, showing a slowdown in inflation and robust employment figures, has prompted a subtle shift. While the Fed isn't explicitly promising rate cuts, their projections suggest a possibility of easing monetary policy by the end of 2025. This change in tone is what triggered the Treasury market's response.

Impact on Treasury Yields:

The prospect of future rate cuts directly influences Treasury yields. Yields and prices have an inverse relationship; when yields fall, prices rise, and vice versa. The expectation of lower rates in 2025 led to a decline in longer-term Treasury yields. This is because investors are less incentivized to hold longer-term bonds offering higher yields if they anticipate lower rates in the near future. The impact was most pronounced in longer-dated bonds, reflecting the market's anticipation of future rate cuts.

Short-Term vs. Long-Term Yields:

The impact wasn't uniform across the yield curve. Short-term yields remained relatively stable, reflecting the Fed's current commitment to maintaining higher rates to combat inflation in the near term. The divergence between short-term and long-term yields – a phenomenon known as the yield curve – flattened slightly, indicating a decreased expectation of future rate hikes.

Market Uncertainty and Volatility:

While the market reacted positively to the potential of future rate cuts, uncertainty remains. The actual timing and magnitude of any rate cuts will depend heavily on future economic data and inflation trends. This uncertainty is contributing to some volatility in the Treasury market. Investors are closely watching key economic indicators like inflation reports (CPI and PCE), employment data (Nonfarm Payrolls), and consumer confidence indices.

What this Means for Investors:

This situation presents a complex scenario for investors. While lower yields might seem less attractive initially, they can also indicate a stabilizing economic environment. For long-term investors, the potential for capital appreciation in bonds as yields fall might outweigh the lower income stream. However, it's crucial to diversify portfolios and carefully consider individual risk tolerance. Consulting a financial advisor is strongly recommended before making any significant investment decisions.

Key Takeaways:

- The Fed's subtle shift towards potential rate cuts in 2025 has significantly impacted the Treasury market.

- Longer-term Treasury yields have fallen, reflecting the market's anticipation of lower rates.

- The yield curve flattened slightly, indicating reduced expectations of future rate hikes.

- Uncertainty remains, and market volatility is likely to continue.

- Investors should carefully consider their risk tolerance and seek professional advice.

Looking Ahead:

The coming months will be crucial in determining the actual trajectory of interest rates. Closely monitoring economic indicators and the Fed's subsequent pronouncements will be essential for investors navigating this dynamic environment. The Treasury market's reaction will continue to provide valuable insights into market sentiment and future economic prospects. Stay informed and make informed decisions based on the latest market data. For more in-depth analysis on the US economy and bond markets, consider exploring resources like the and .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Treasury Market Reacts: Fed's 2025 Rate Cut Outlook And Yield Impact. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

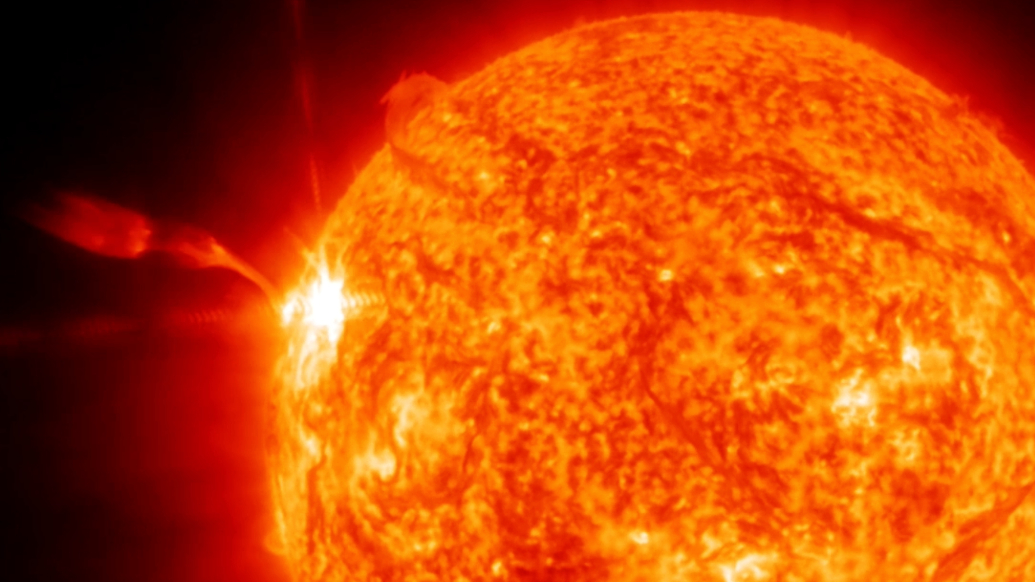

Geomagnetic Storm Major Solar Flare Impacts Radio Networks Globally Video

May 20, 2025

Geomagnetic Storm Major Solar Flare Impacts Radio Networks Globally Video

May 20, 2025 -

Severe Weather Outbreak Tornado Threat Looms Across Plains Midwest And South

May 20, 2025

Severe Weather Outbreak Tornado Threat Looms Across Plains Midwest And South

May 20, 2025 -

New Streaming Release A Critically Acclaimed Wwi Movie With A Stellar Cast

May 20, 2025

New Streaming Release A Critically Acclaimed Wwi Movie With A Stellar Cast

May 20, 2025 -

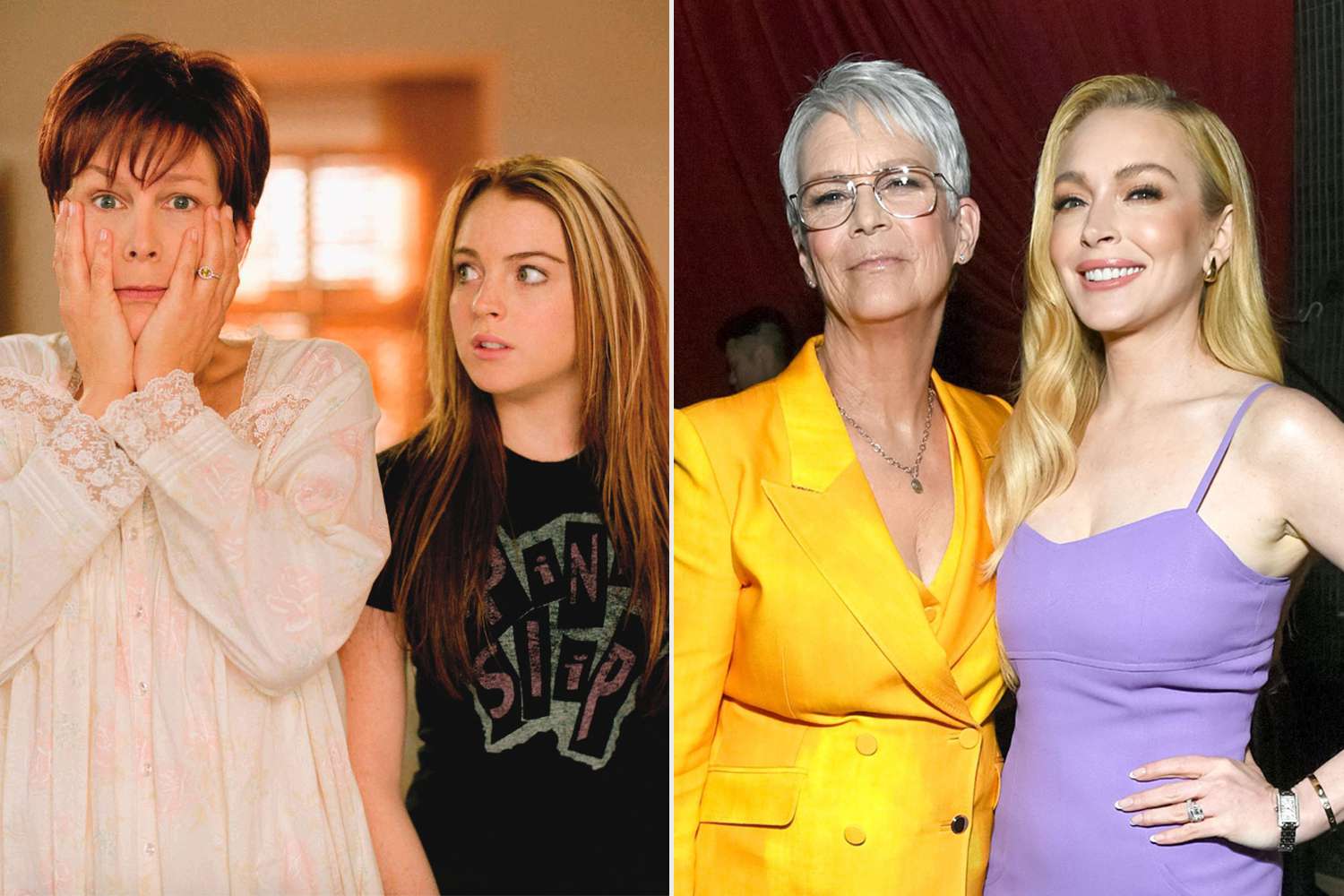

Freaky Friday Stars Jamie Lee Curtis Talks About Her Friendship With Lindsay Lohan

May 20, 2025

Freaky Friday Stars Jamie Lee Curtis Talks About Her Friendship With Lindsay Lohan

May 20, 2025 -

Exclusive Interview The Making Of Netflixs Fall Of Favre Documentary

May 20, 2025

Exclusive Interview The Making Of Netflixs Fall Of Favre Documentary

May 20, 2025