US Private Sector Employment Up 37,000 In May: ADP National Employment Report

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Private Sector Employment Inches Upward: ADP Report Shows 37,000 New Jobs in May

The ADP National Employment Report for May reveals a modest increase in private sector jobs, signaling a potential slowdown in hiring despite persistent labor market strength. The report, released on [Date of Release], showed a gain of 37,000 jobs, significantly lower than the anticipated 170,000 and a sharp contrast to the upward revisions seen in previous months. This slower-than-expected growth fuels ongoing debate about the health of the US economy and the Federal Reserve's next steps regarding interest rate hikes.

The figure represents a substantial deceleration compared to the upwardly revised 292,000 jobs added in April. This considerable drop immediately sparks questions about the trajectory of the US economy. Economists are closely analyzing the data to gauge the impact of persistent inflation and rising interest rates on businesses' hiring decisions.

What the ADP Numbers Mean for the US Economy

The ADP report, while not the official government jobs report (that comes from the Bureau of Labor Statistics), provides a valuable early indicator of employment trends. It's crucial to remember that the ADP data focuses solely on the private sector, excluding government jobs.

This modest increase in private sector employment could be interpreted in several ways:

-

Cooling Economy: Some economists suggest that the lower-than-expected job growth points to a cooling economy, potentially indicating that the Federal Reserve's interest rate hikes are beginning to impact hiring. This could signal a softening of the labor market, although not necessarily a significant downturn.

-

Revisions and Volatility: It's important to consider the volatility and potential for revisions inherent in these monthly reports. Past data has often been revised, highlighting the need for caution in interpreting single-month figures. Further analysis and the upcoming BLS report are crucial for a more comprehensive picture.

-

Shifting Employment Landscape: The report may also reflect shifts within the employment landscape, with potential job losses in some sectors balanced by gains in others. A detailed breakdown of employment gains and losses across different industries will provide more nuanced insights.

The Impact on the Federal Reserve's Decisions

The ADP report's findings will undoubtedly influence the Federal Reserve's deliberations on future interest rate policies. A slower-than-expected job growth might lead the Fed to consider a more cautious approach to further rate hikes, aiming to avoid triggering a recession. However, persistent inflation remains a key concern, and the Fed may still opt for further tightening if inflation remains stubbornly high.

Looking Ahead: The Importance of the BLS Report

The ADP report serves as a precursor to the official employment situation summary released by the Bureau of Labor Statistics (BLS) later this month. This report will provide a more comprehensive picture of employment trends, including both private and public sector jobs, and will offer critical context for understanding the overall state of the US labor market. The BLS report is widely anticipated and will likely cause significant market fluctuation based on its findings. Stay tuned for further updates and analysis as the data unfolds.

Keywords: ADP National Employment Report, May Employment Report, US Private Sector Employment, Job Growth, US Economy, Federal Reserve, Interest Rates, BLS Employment Report, Labor Market, Hiring, Inflation, Recession

Call to Action (subtle): Stay informed about critical economic news by regularly checking back for updates on the upcoming BLS report and further analysis of the US employment landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Private Sector Employment Up 37,000 In May: ADP National Employment Report. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

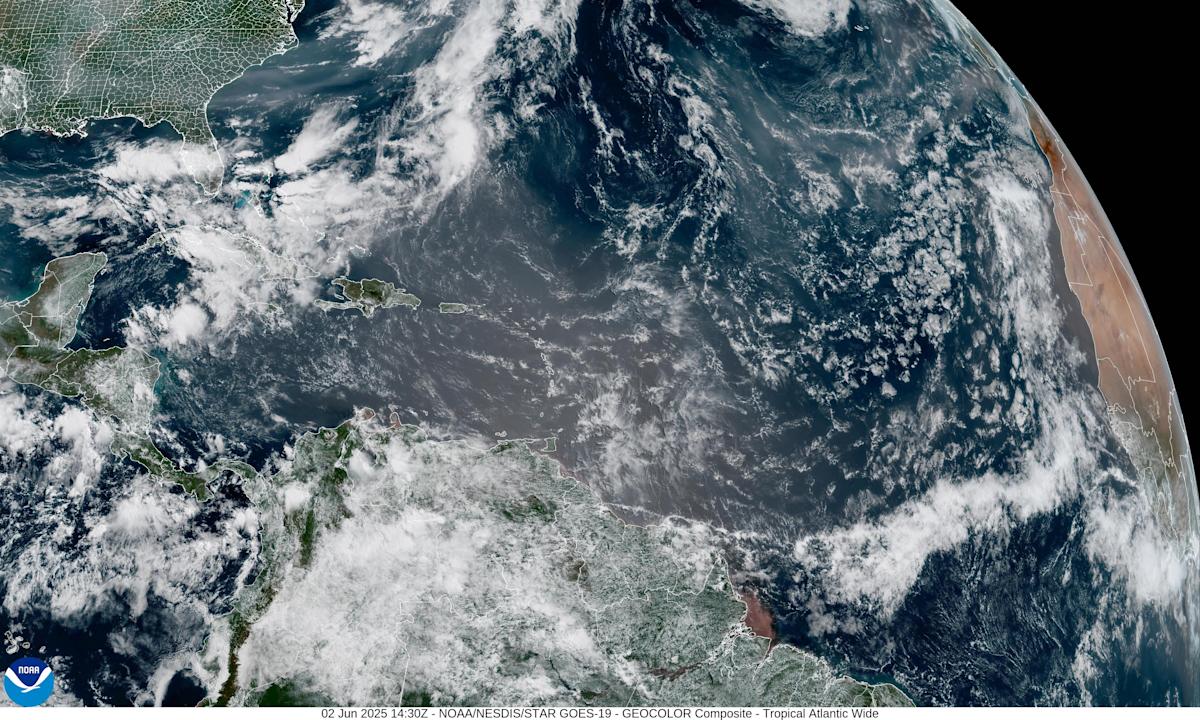

Air Quality Alert Florida Faces Dual Threat From Saharan Dust And Canadian Wildfires

Jun 04, 2025

Air Quality Alert Florida Faces Dual Threat From Saharan Dust And Canadian Wildfires

Jun 04, 2025 -

Billionaire Deal Subway Owners Strategic Acquisition Of Major Chicken Restaurant

Jun 04, 2025

Billionaire Deal Subway Owners Strategic Acquisition Of Major Chicken Restaurant

Jun 04, 2025 -

Fact Vs Fiction The Real Tech Executives That Influenced Successions Mountainhead

Jun 04, 2025

Fact Vs Fiction The Real Tech Executives That Influenced Successions Mountainhead

Jun 04, 2025 -

City Of St Louis Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025

City Of St Louis Announces Demolition Of 200 Lra Buildings After Tornado

Jun 04, 2025 -

Brazils Economic Outlook Harnessing The Potential Of Climate Change

Jun 04, 2025

Brazils Economic Outlook Harnessing The Potential Of Climate Change

Jun 04, 2025