US Economy Faces Internal Risks, JPMorgan CEO Jamie Dimon Says

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economy Faces Internal Risks, JPMorgan CEO Jamie Dimon Warns

JPMorgan Chase CEO Jamie Dimon issued a stark warning about the US economy, highlighting significant internal risks that could derail the nation's economic progress. Dimon's comments, made during [insert context: e.g., an earnings call, a conference, etc.], sent ripples through financial markets, prompting renewed scrutiny of the nation's economic outlook. While acknowledging the current resilience of the economy, Dimon emphasized the potential for unforeseen challenges to emerge from within the US itself.

This isn't the first time Dimon has sounded the alarm. His cautious pronouncements often act as a barometer for the overall health of the US economy, making his latest warning particularly noteworthy.

Internal Risks Looming Large: Dimon's Key Concerns

Dimon pointed to several key internal factors that could significantly impact the US economy. These include:

-

Government Spending and Debt: The escalating national debt and ongoing debates surrounding government spending represent a significant long-term risk. Uncontrolled spending could lead to inflation and ultimately hinder economic growth. This concern is echoed by many economists who are increasingly worried about the sustainability of the current fiscal trajectory. [Link to a relevant article on US national debt].

-

Geopolitical Uncertainty and its Domestic Impact: While external factors like the war in Ukraine and global supply chain disruptions certainly play a role, Dimon stressed the importance of internal resilience in navigating these challenges. The US needs to be prepared for unforeseen shocks and develop strategies to mitigate their impact on the domestic economy. [Link to a relevant article on geopolitical risks].

-

Potential for Unexpected Economic Slowdowns: Dimon cautioned against complacency, suggesting that the current economic strength might mask underlying vulnerabilities. He warned of the possibility of a sharper-than-expected slowdown, potentially triggered by unforeseen events or a miscalculation of economic indicators.

-

Inflation and its Lingering Effects: While inflation has shown signs of cooling, Dimon remains cautious, noting that persistent inflationary pressures could significantly impact consumer spending and business investment. The Federal Reserve's monetary policy response and its impact on inflation remain key factors to watch. [Link to a relevant article on current inflation rates].

The Impact on Markets and Investors

Dimon's remarks have already had a noticeable impact on financial markets. Investors are closely monitoring economic indicators and adjusting their portfolios in response to the potential for increased economic uncertainty. The volatility in the stock market in recent weeks reflects this heightened sense of caution.

What Does This Mean for the Average American?

While the specifics are complex, Dimon's warnings translate into potential concerns for everyday Americans. These include:

- Potential for job losses: An economic slowdown could lead to reduced hiring and even job losses in certain sectors.

- Increased cost of living: Persistent inflation could continue to erode purchasing power and make essential goods and services more expensive.

- Uncertainty in the housing market: Economic uncertainty can impact the housing market, potentially affecting home values and mortgage rates.

Looking Ahead: Navigating the Challenges

Dimon's assessment underscores the need for proactive measures to mitigate these internal risks. This includes responsible fiscal policy, strategic investments in infrastructure and human capital, and a continued focus on fostering a resilient and adaptable economy. The coming months will be crucial in determining how effectively the US can navigate these challenges and maintain its economic strength. [Link to a relevant article on economic policy].

Call to Action: Stay informed about the latest economic developments by following reputable financial news sources and engaging in informed discussions about the future of the US economy. Understanding these challenges is the first step toward developing effective solutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economy Faces Internal Risks, JPMorgan CEO Jamie Dimon Says. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Long Running Podcast Wtf With Marc Maron Announces End Date

Jun 02, 2025

Long Running Podcast Wtf With Marc Maron Announces End Date

Jun 02, 2025 -

Stone Mountain Park Death Investigation Launched Following Discovery Of Burned Body

Jun 02, 2025

Stone Mountain Park Death Investigation Launched Following Discovery Of Burned Body

Jun 02, 2025 -

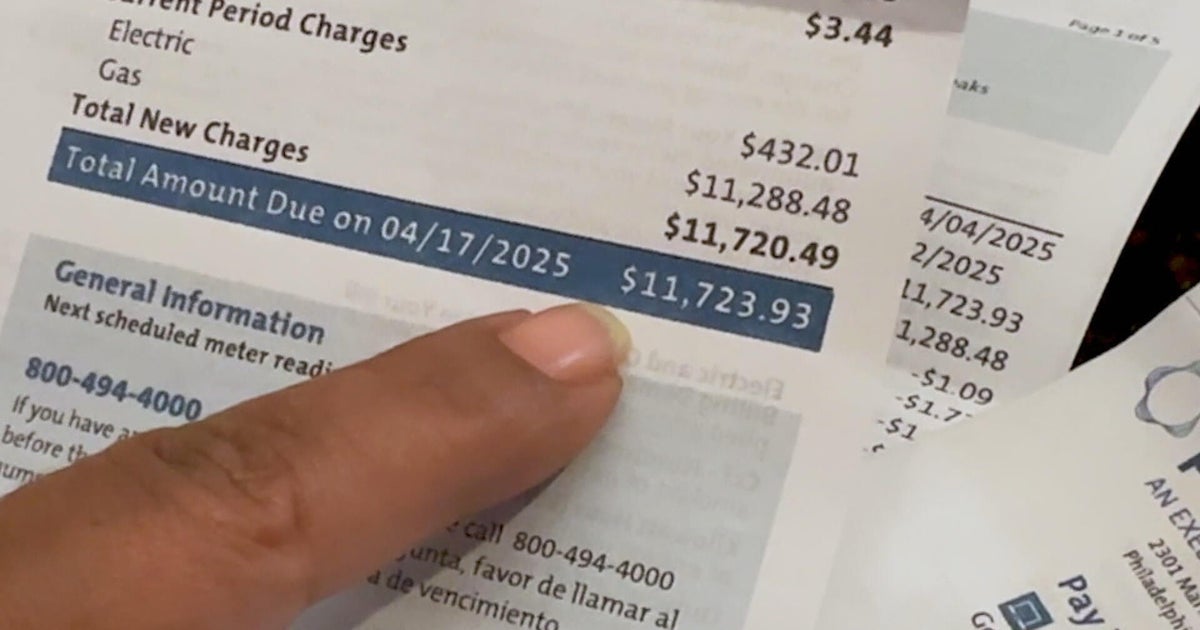

Anger Over Dte Energy Price Hikes Residents Demand Action

Jun 02, 2025

Anger Over Dte Energy Price Hikes Residents Demand Action

Jun 02, 2025 -

Taylor Jenkins Reid A Deep Dive Into The Making Of A Publishing Powerhouse

Jun 02, 2025

Taylor Jenkins Reid A Deep Dive Into The Making Of A Publishing Powerhouse

Jun 02, 2025 -

Investigating Pecos Billing System Massive Discrepancies And Customer Complaints

Jun 02, 2025

Investigating Pecos Billing System Massive Discrepancies And Customer Complaints

Jun 02, 2025