US Economic Stability Under Threat, Says JPMorgan CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Stability Under Threat, Warns JPMorgan Chase CEO Jamie Dimon

JPMorgan Chase CEO Jamie Dimon's stark warning about the US economy has sent shockwaves through financial markets. In a recent letter to shareholders, Dimon painted a picture of looming economic uncertainty, citing several key factors that could trigger a significant downturn. His concerns are not to be dismissed lightly, given JPMorgan Chase's position as one of the world's largest financial institutions. This article delves into the specifics of Dimon's warning and explores the potential implications for the US economy and global markets.

Dimon's Key Concerns: A Perfect Storm Brewing?

Dimon highlighted a confluence of factors contributing to his pessimistic outlook. These include:

-

Inflationary Pressures: Persistently high inflation remains a major concern. While the Federal Reserve has aggressively raised interest rates to combat inflation, Dimon suggests these measures may not be enough and could even trigger a recession. The ongoing struggle to balance price stability with economic growth is a key challenge. This is further complicated by [link to relevant article on inflation].

-

Geopolitical Instability: The ongoing war in Ukraine, coupled with escalating tensions in other regions, introduces significant uncertainty into the global economic landscape. These geopolitical events disrupt supply chains, impact energy prices, and generally create a climate of risk aversion, negatively impacting investor confidence. [link to external news source on geopolitical risks]

-

The Impact of Quantitative Tightening: The Federal Reserve's quantitative tightening (QT) policy, aimed at reducing its balance sheet, adds another layer of complexity. QT removes liquidity from the financial system, potentially impacting credit markets and slowing economic growth. Understanding the intricacies of QT is crucial to grasping Dimon's concerns. [link to an article explaining Quantitative Tightening]

-

Consumer Spending Slowdown: While consumer spending has remained relatively resilient, signs of a slowdown are emerging. Increased interest rates and persistent inflation are squeezing household budgets, leading to reduced consumer confidence and potentially decreased spending. This is a crucial factor as consumer spending significantly drives US economic growth.

What Does This Mean for the Average American?

Dimon's warning translates to potential challenges for everyday Americans. We could see:

- Higher Interest Rates: Continued efforts to combat inflation could lead to further increases in interest rates, impacting mortgage rates, loan costs, and the overall cost of borrowing.

- Reduced Job Growth: A potential recession could lead to job losses and increased unemployment.

- Increased Prices: While inflation may eventually ease, the price of essential goods and services could remain elevated for some time.

Looking Ahead: Navigating Uncertainty

Dimon's warning is not a prediction of inevitable doom, but rather a call for caution and preparedness. The US economy is resilient, but it's facing significant headwinds. The key takeaway is the need for prudent financial management by both individuals and businesses. Monitoring economic indicators, diversifying investments, and managing debt effectively are crucial strategies for navigating this period of uncertainty.

Call to Action: Stay informed about economic developments by following reputable financial news sources and consulting with financial advisors. Understanding the risks and proactively managing your finances will be key to weathering any potential economic storm.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Stability Under Threat, Says JPMorgan CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Following Backlash Patti Lu Pone Offers Public Apology

Jun 03, 2025

Following Backlash Patti Lu Pone Offers Public Apology

Jun 03, 2025 -

Joe Roots Unbeaten 166 Fuels Englands Narrow Win Against West Indies In Cardiff

Jun 03, 2025

Joe Roots Unbeaten 166 Fuels Englands Narrow Win Against West Indies In Cardiff

Jun 03, 2025 -

Sheinelle Jones Shares Family Update Following Husbands Passing

Jun 03, 2025

Sheinelle Jones Shares Family Update Following Husbands Passing

Jun 03, 2025 -

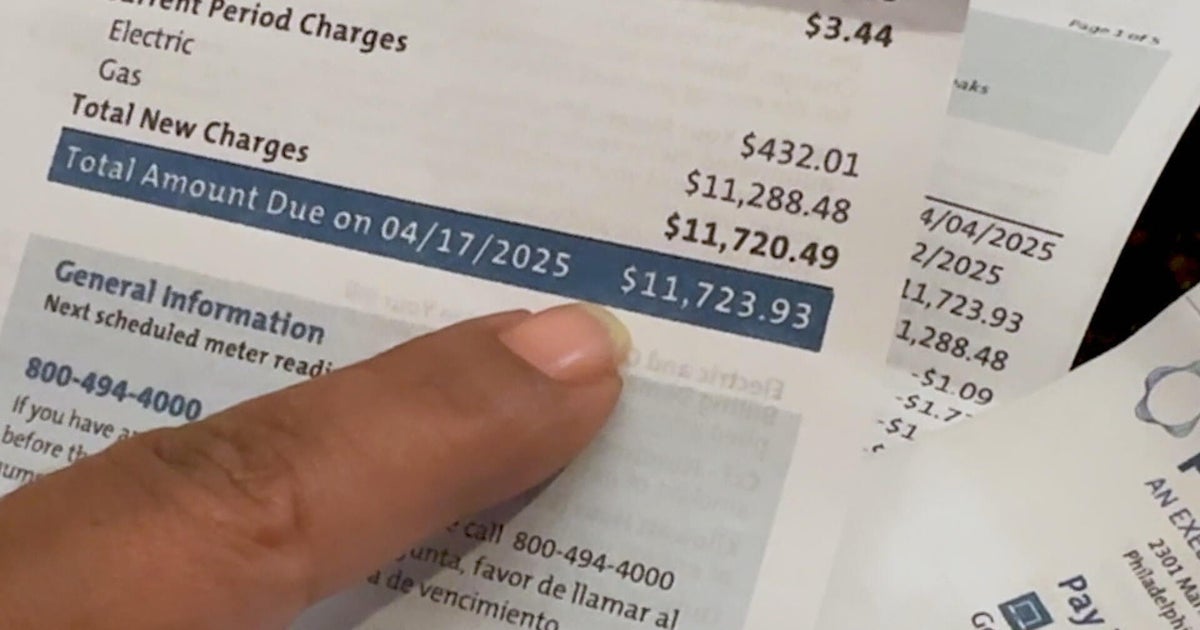

Peco Billing Chaos Thousands In Unexpected Charges Months Without Bills Reported

Jun 03, 2025

Peco Billing Chaos Thousands In Unexpected Charges Months Without Bills Reported

Jun 03, 2025 -

Update Sheinelle Jones And Family After Husbands Passing

Jun 03, 2025

Update Sheinelle Jones And Family After Husbands Passing

Jun 03, 2025