US Economic Stability Threatened From Within, Says JPMorgan CEO

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Stability Threatened From Within, Warns JPMorgan Chase CEO Jamie Dimon

JPMorgan Chase CEO Jamie Dimon's stark warning about the US economy has sent shockwaves through financial markets. In a recent letter to shareholders, Dimon highlighted several significant internal threats to the nation's economic stability, urging caution and proactive measures. His concerns extend beyond the ongoing geopolitical uncertainties and inflation, focusing instead on internal factors that could trigger a significant economic downturn. This article delves into Dimon's key concerns and analyzes their potential impact.

Internal Threats to US Economic Stability:

Dimon's concerns aren't about external factors like the war in Ukraine or global supply chain issues, although he acknowledges their impact. Instead, he points to several domestic issues as the primary threats:

-

Government Spending and the Debt Ceiling: The ongoing debate surrounding the US debt ceiling is a major source of concern for Dimon. He warns that a failure to raise the debt ceiling could trigger a catastrophic financial crisis, potentially leading to a recession. The sheer scale of the US national debt and the ongoing political gridlock surrounding its management pose a significant risk to economic stability. [Link to relevant article on US debt ceiling]

-

Inflation and Interest Rate Hikes: While inflation is a global concern, Dimon emphasizes its particularly strong impact on the US economy. The Federal Reserve's aggressive interest rate hikes, aimed at curbing inflation, carry the risk of triggering a recession. Finding the right balance between controlling inflation and avoiding a recession is a significant challenge. [Link to article on Federal Reserve interest rate hikes]

-

Geopolitical Uncertainty and its Ripple Effect: Although technically external, the consequences of geopolitical instability are acutely felt within the US economy. Dimon notes the impact of the war in Ukraine on energy prices and global supply chains, exacerbating inflationary pressures.

-

Political Polarization and Its Economic Ramifications: Dimon indirectly addresses the impact of political polarization on economic policymaking. The inability to reach bipartisan consensus on critical economic issues hinders effective policy implementation and creates uncertainty for businesses and investors.

What does this mean for the average American?

Dimon's warning isn't just for Wall Street. The potential consequences of these internal threats are far-reaching and could significantly impact everyday Americans. A recession, triggered by any of these factors, would lead to:

- Job losses: Increased unemployment rates and difficulty finding new employment.

- Reduced consumer spending: Lower disposable income and decreased purchasing power.

- Higher prices: Continued inflation and increased cost of living.

- Increased uncertainty: A climate of economic uncertainty can impact investment and business growth.

What can be done?

Dimon's message isn't solely one of doom and gloom. He advocates for responsible fiscal policy, including a swift resolution to the debt ceiling debate and a cautious approach to monetary policy by the Federal Reserve. He also implicitly calls for greater political cooperation and a focus on long-term economic stability over short-term political gains.

Conclusion:

Jamie Dimon's warning serves as a crucial reminder of the fragility of the US economy. While external factors play a role, the internal threats highlighted by the JPMorgan Chase CEO demand immediate attention. The need for responsible governance, bipartisan cooperation, and a long-term perspective on economic policy is paramount to navigating the challenges ahead and ensuring the continued stability of the US economy. Ignoring these warnings could have devastating consequences. The coming months will be critical in determining whether the US can successfully address these internal threats and avert a potential economic crisis.

Keywords: US Economy, JPMorgan Chase, Jamie Dimon, Economic Stability, Debt Ceiling, Inflation, Recession, Federal Reserve, Interest Rates, Geopolitical Uncertainty, Political Polarization, Economic Crisis, Financial Markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Stability Threatened From Within, Says JPMorgan CEO. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Celebrity Cruises Ship Upgrades A Comprehensive Look

Jun 02, 2025

Celebrity Cruises Ship Upgrades A Comprehensive Look

Jun 02, 2025 -

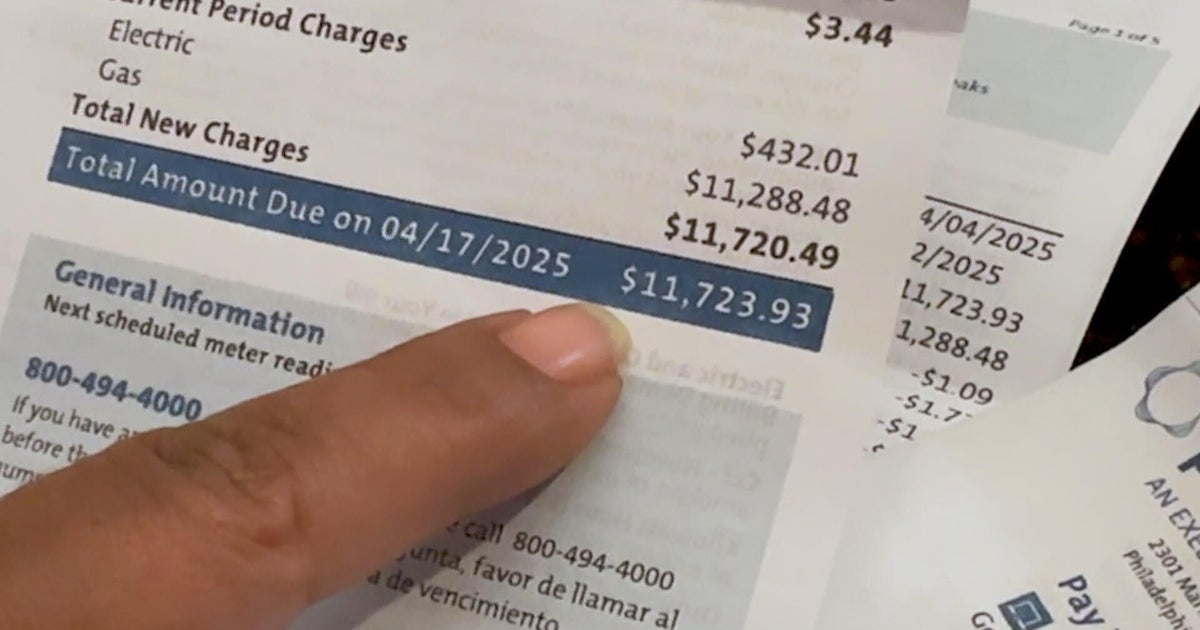

Peco Billing Problems One Customers 12 000 Bill And Widespread Delays

Jun 02, 2025

Peco Billing Problems One Customers 12 000 Bill And Widespread Delays

Jun 02, 2025 -

Ou Regarder Les Huitiemes De Finale Le Dimanche 1er Juin

Jun 02, 2025

Ou Regarder Les Huitiemes De Finale Le Dimanche 1er Juin

Jun 02, 2025 -

Us China Trade War Jamie Dimons Direct Warning On The Ineffectiveness Of Tariffs

Jun 02, 2025

Us China Trade War Jamie Dimons Direct Warning On The Ineffectiveness Of Tariffs

Jun 02, 2025 -

Sergio Garcia Key Developments In His Ryder Cup Comeback Attempt

Jun 02, 2025

Sergio Garcia Key Developments In His Ryder Cup Comeback Attempt

Jun 02, 2025