US Economic Outlook Under Threat: JPMorgan CEO Highlights Internal Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook Under Threat: JPMorgan CEO Highlights Internal Risks

The US economy, already navigating choppy waters, faces a heightened threat according to Jamie Dimon, CEO of JPMorgan Chase & Co., one of the world's largest financial institutions. Dimon's recent warnings about internal economic risks paint a concerning picture for investors and consumers alike, highlighting vulnerabilities that extend beyond the typical external pressures. This isn't just about inflation or interest rates; it's about deeper, more systemic issues brewing within the American financial landscape.

Dimon's Dire Predictions: More Than Just Inflation

While inflation and rising interest rates remain significant headwinds, Dimon's concerns go beyond these widely discussed factors. His recent comments focused on less predictable, internal risks that could trigger a significant economic downturn. These include:

-

A potential banking crisis: The collapse of several regional banks earlier this year served as a stark reminder of the fragility within the financial system. Dimon's warnings suggest lingering vulnerabilities that could be exacerbated by unforeseen circumstances. The ripple effects of such a crisis could be devastating, impacting lending, credit availability, and overall economic confidence.

-

Geopolitical uncertainty: The ongoing war in Ukraine, tensions with China, and other geopolitical flashpoints contribute to market volatility and uncertainty. These factors create headwinds for businesses, impacting investment decisions and potentially hindering economic growth. [Link to a reputable source discussing geopolitical risks to the US economy]

-

Consumer spending slowdown: Despite persistent inflation, consumer spending has remained relatively resilient. However, Dimon's comments suggest this resilience may be waning. A significant slowdown in consumer spending could have a cascading effect, impacting businesses and further slowing economic growth. Understanding consumer behavior is crucial for navigating these turbulent times. [Link to an article on current consumer spending trends]

-

The lingering effects of quantitative easing: The massive injection of liquidity into the financial system during the pandemic, while necessary at the time, has left its mark. The unwinding of this policy, coupled with rising interest rates, presents unique challenges and potential risks that are still unfolding.

What Does This Mean for the Average American?

Dimon's warnings are not just relevant to Wall Street; they have significant implications for the average American. A weakening economy could translate to:

- Higher unemployment: A slowdown in economic activity often leads to job losses, affecting individuals and families across the country.

- Reduced purchasing power: Inflation, combined with a potential economic slowdown, could further erode purchasing power, making it harder for families to make ends meet.

- Increased financial stress: Economic uncertainty can lead to increased financial stress and anxiety, impacting mental health and overall well-being.

Looking Ahead: Navigating Uncertainty

While the outlook appears challenging, it's crucial to remember that the US economy has demonstrated resilience in the past. However, proactive measures and careful risk management are essential. Businesses need to adapt to changing market conditions, consumers need to be mindful of their spending, and policymakers need to implement effective strategies to mitigate potential risks.

Call to Action: Stay informed about economic developments and consult with financial advisors to navigate these uncertain times. Understanding the potential risks and taking proactive steps can help you protect your financial well-being. Regularly review your financial plan and adjust it as needed based on the evolving economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook Under Threat: JPMorgan CEO Highlights Internal Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Pga Tour Return Justin Roses Take On Sergio Garcias Liv Golf Journey

Jun 02, 2025

Pga Tour Return Justin Roses Take On Sergio Garcias Liv Golf Journey

Jun 02, 2025 -

Huitiemes De Finale De Roland Garros Dimanche 1er Juin En Direct

Jun 02, 2025

Huitiemes De Finale De Roland Garros Dimanche 1er Juin En Direct

Jun 02, 2025 -

Barcelona 2025 Oscar Piastri Takes Pole Position From Lando Norris At Spanish Grand Prix

Jun 02, 2025

Barcelona 2025 Oscar Piastri Takes Pole Position From Lando Norris At Spanish Grand Prix

Jun 02, 2025 -

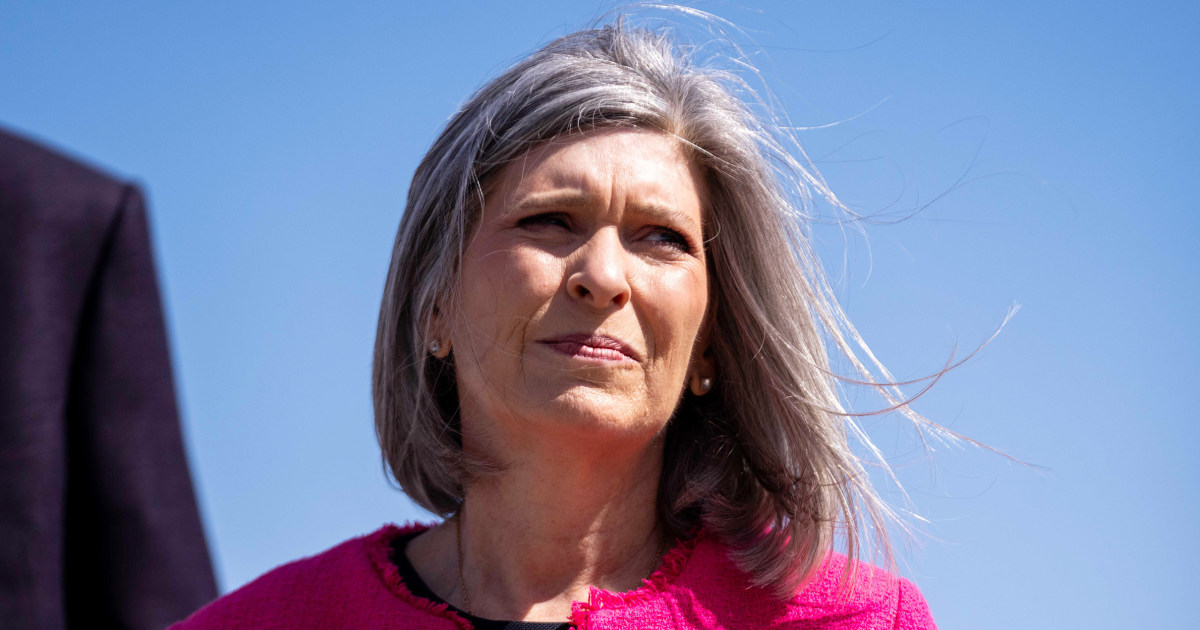

Joni Ernsts Controversial Justification For Medicaid Cuts A Closer Look

Jun 02, 2025

Joni Ernsts Controversial Justification For Medicaid Cuts A Closer Look

Jun 02, 2025 -

Tenis Znakomity Pojedynek Swiatek Rybakina Na Roland Garros Relacja Live

Jun 02, 2025

Tenis Znakomity Pojedynek Swiatek Rybakina Na Roland Garros Relacja Live

Jun 02, 2025