US Economic Outlook: JPMorgan CEO Sounds Alarm On Internal Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook: JPMorgan CEO Sounds Alarm on Internal Risks

Jamie Dimon's stark warning casts a shadow over optimistic economic forecasts.

The US economic outlook, often painted in optimistic hues by analysts, has received a jarring dose of reality from an unexpected source: Jamie Dimon, CEO of JPMorgan Chase & Co. Dimon, known for his candid assessments of the financial landscape, recently issued a stark warning, highlighting significant internal risks that could derail the current trajectory of the US economy. His comments, delivered during a recent earnings call, have sent ripples through financial markets and sparked renewed debate about the fragility of the seemingly robust US economic recovery.

Beyond Inflation: A Deeper Dive into Internal Economic Threats

While inflation remains a dominant concern, Dimon's warning points to a more nuanced set of internal pressures threatening the US economy. He didn't mince words, emphasizing that these are not external shocks like a geopolitical crisis or a sudden supply chain disruption, but rather issues stemming from within the US economic system itself. These internal risks, according to Dimon, include:

-

Geopolitical Uncertainty: While technically external, the ongoing war in Ukraine and escalating tensions with China significantly impact the US economy, creating uncertainty and affecting various sectors. This uncertainty directly impacts investment decisions and consumer confidence. [Link to article on geopolitical impact on US economy]

-

Government Spending and Debt: The substantial increase in government spending in recent years, coupled with a rising national debt, presents a long-term risk to economic stability. The potential for future interest rate hikes to manage this debt could stifle economic growth. [Link to article on US national debt]

-

Labor Market Imbalances: While unemployment remains low, significant labor shortages persist in certain sectors. This imbalance impacts productivity and contributes to inflationary pressures. [Link to article on US labor market]

-

Consumer Behavior Shifts: Changing consumer spending patterns, potentially fueled by inflation and economic uncertainty, could negatively impact economic growth. [Link to article on consumer spending trends]

Dimon's Call for Fiscal Responsibility and Prudence

Dimon's message wasn't solely one of doom and gloom. He emphasized the need for fiscal responsibility and prudent financial management from both the government and individuals. He urged a cautious approach, advocating for sensible spending policies and responsible debt management to mitigate the potential impact of these internal risks.

He stressed the importance of addressing these underlying issues proactively to prevent a potential economic downturn. His comments served as a wake-up call, highlighting the need for a more nuanced understanding of the economic landscape beyond headline inflation figures.

What does this mean for the average American?

Dimon's concerns translate to potential challenges for everyday Americans. Increased interest rates, higher prices, and potential job insecurity are all possibilities if these internal risks materialize. Staying informed about economic developments and practicing sound financial management are crucial in navigating this uncertain climate.

Looking Ahead: Navigating Uncertainty

The US economic outlook remains complex and filled with uncertainty. While many indicators point to continued growth, Dimon's warning serves as a crucial reminder of the potential for internal risks to disrupt this trajectory. The coming months will be critical in determining how these challenges are addressed and what the ultimate impact will be on the US economy and its citizens. Staying informed and adapting to changing economic conditions will be key for both individuals and businesses.

Call to Action: Stay informed about economic developments by subscribing to our newsletter [link to newsletter signup] for regular updates and analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook: JPMorgan CEO Sounds Alarm On Internal Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

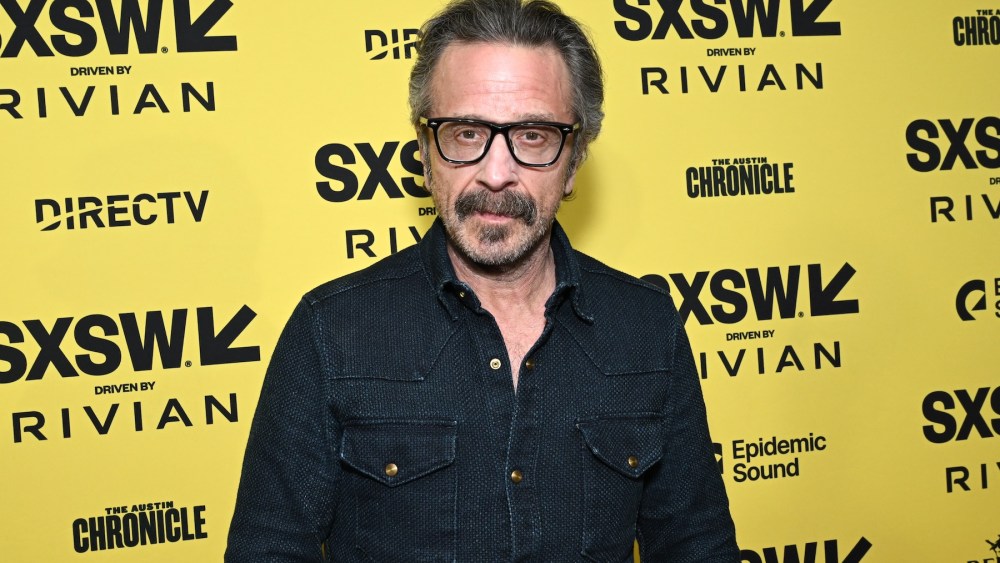

The End Of An Era Marc Marons Wtf Podcast Signs Off After 16 Years

Jun 03, 2025

The End Of An Era Marc Marons Wtf Podcast Signs Off After 16 Years

Jun 03, 2025 -

Did Scott Walkers Handling Of Trump Cost Him The Presidency A Retrospective

Jun 03, 2025

Did Scott Walkers Handling Of Trump Cost Him The Presidency A Retrospective

Jun 03, 2025 -

Examining The Impact Of Trumps Criticism On Scott Walkers Career

Jun 03, 2025

Examining The Impact Of Trumps Criticism On Scott Walkers Career

Jun 03, 2025 -

Internal Factors Threaten Us Economy Says Jp Morgans Ceo

Jun 03, 2025

Internal Factors Threaten Us Economy Says Jp Morgans Ceo

Jun 03, 2025 -

Lu Pones Apology Broadway Star Addresses Controversial Comments

Jun 03, 2025

Lu Pones Apology Broadway Star Addresses Controversial Comments

Jun 03, 2025