US Economic Outlook: JPMorgan CEO Highlights Internal Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook: JPMorgan CEO Jamie Dimon Highlights Internal Risks, Warns of Potential Storm

The US economy is facing a turbulent period, and according to JPMorgan Chase CEO Jamie Dimon, the brewing storm might be closer than many anticipate. Dimon, known for his frank assessments of the economic landscape, recently highlighted significant internal risks that could significantly impact the nation's financial health. His warnings, delivered during JPMorgan's recent earnings call, sent ripples through the financial markets, prompting investors and economists to re-evaluate their projections.

This isn't just another prediction of a potential recession; Dimon's concerns delve into the specifics of underlying vulnerabilities within the US economic system, offering a more nuanced perspective than typical macro-economic forecasts. His comments underscore the need for careful navigation in the coming months.

Internal Risks: Beyond Inflation and Interest Rates

While inflation and rising interest rates remain significant external headwinds, Dimon emphasized the importance of focusing on internal vulnerabilities. He pointed to several key areas:

-

Geopolitical Uncertainty: The ongoing war in Ukraine, tensions with China, and other global conflicts create significant uncertainty, impacting supply chains, energy prices, and overall economic stability. This uncertainty is a major factor influencing investor sentiment and business investment decisions.

-

Commercial Real Estate Concerns: Dimon expressed concerns about the commercial real estate sector, highlighting the potential for significant losses as interest rates rise and remote work continues to reshape office space demand. This could have a domino effect on the broader economy. [Link to relevant article on commercial real estate].

-

Consumer Spending Slowdown: While consumer spending has remained relatively resilient, Dimon suggested that a potential slowdown is on the horizon, fueled by inflation and rising interest rates eroding consumer purchasing power. This decreased spending could trigger a ripple effect throughout the economy.

-

Government Spending and Debt: The substantial national debt and ongoing government spending raise concerns about long-term economic sustainability. The impact of these fiscal policies on inflation and interest rates needs careful monitoring. [Link to relevant government debt data].

Navigating the Storm: A Call for Prudence

Dimon’s message wasn’t purely doom and gloom. He emphasized the resilience of the US economy and the strength of the American consumer. However, he urged caution and proactive risk management. He stressed the importance of:

-

Prudent Fiscal Policy: Responsible government spending and debt management are crucial for long-term economic stability.

-

Strong Banking Regulation: Robust regulation and oversight of the financial sector are vital to mitigate potential risks and maintain financial stability.

-

Adaptive Business Strategies: Businesses need to adapt to the changing economic environment and proactively manage their risks.

The Outlook: A Cautious Optimism

While Dimon’s warnings are serious, they shouldn’t be interpreted as an outright prediction of an imminent economic collapse. Instead, his comments serve as a crucial reminder of the inherent complexities and risks within the current economic landscape. A cautious optimism, coupled with proactive risk management, seems to be the prevailing sentiment within the JPMorgan leadership. The coming months will be critical in determining the trajectory of the US economy.

Keywords: US economy, economic outlook, JPMorgan, Jamie Dimon, inflation, interest rates, recession, commercial real estate, geopolitical uncertainty, consumer spending, government debt, economic risks, financial stability.

Call to Action (subtle): Stay informed about the evolving economic landscape by following reputable financial news sources and analyzing economic indicators. Understanding these trends can help individuals and businesses make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook: JPMorgan CEO Highlights Internal Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Breaking News Arrest Made In State Wide Murder Investigation

Jun 02, 2025

Breaking News Arrest Made In State Wide Murder Investigation

Jun 02, 2025 -

Brazils Finance Chief Views Climate Change As Economic Opportunity

Jun 02, 2025

Brazils Finance Chief Views Climate Change As Economic Opportunity

Jun 02, 2025 -

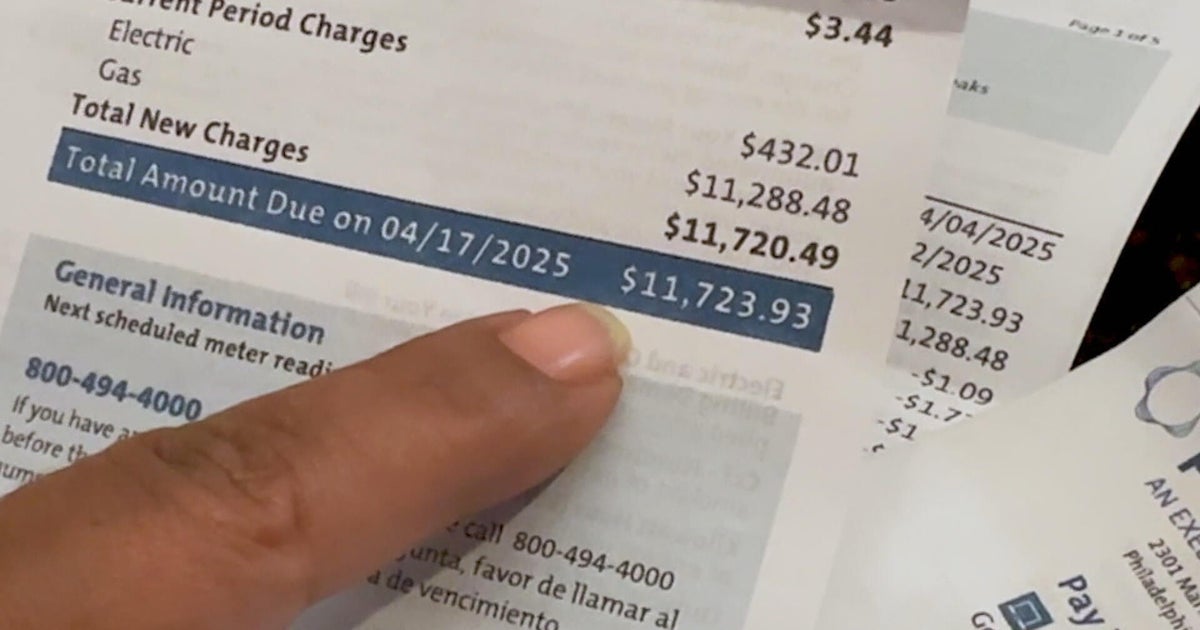

12 000 Peco Bill Stuns Customer Months Of Missing Bills Leave Many Confused

Jun 02, 2025

12 000 Peco Bill Stuns Customer Months Of Missing Bills Leave Many Confused

Jun 02, 2025 -

Harvard Israeli Students And The Paradox Of Trumps Antisemitism Initiatives

Jun 02, 2025

Harvard Israeli Students And The Paradox Of Trumps Antisemitism Initiatives

Jun 02, 2025 -

Asian Markets Monday June 2nd 2025 Economic Data And Events

Jun 02, 2025

Asian Markets Monday June 2nd 2025 Economic Data And Events

Jun 02, 2025