US Economic Outlook Imperiled: JPMorgan CEO Points To Internal Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook Imperiled: JPMorgan CEO Jamie Dimon Sounds Alarm on Internal Risks

The US economic outlook faces significant headwinds, according to JPMorgan Chase & Co. CEO Jamie Dimon, who recently warned of brewing internal risks that could derail the nation's economic progress. Dimon's stark assessment, delivered during a recent earnings call, sent shockwaves through financial markets, highlighting concerns beyond the well-publicized external challenges like inflation and geopolitical instability. This isn't just about external factors; Dimon emphasizes a growing threat from within the American economy itself.

Beyond Inflation: Internal Risks to the US Economy

While inflation and the ongoing war in Ukraine continue to pose substantial threats, Dimon's warning focuses on less visible, yet potentially more damaging, internal economic vulnerabilities. He didn't explicitly detail these risks, but his comments suggest a confluence of factors contributing to a pessimistic outlook. These likely include:

-

Overspending and Government Debt: The significant increase in government spending in recent years, coupled with a rising national debt, raises concerns about long-term economic sustainability. This unsustainable trajectory could lead to higher interest rates and reduced investment.

-

Geopolitical Instability and Supply Chain Disruptions: While acknowledged as external factors, the ongoing impact of these disruptions on the US economy remains a critical internal concern. The ripple effects on businesses and consumer confidence cannot be ignored.

-

Potential for Unexpected Economic Slowdowns: Dimon's cautionary tone suggests a heightened awareness of the potential for unforeseen economic downturns. The complex interplay of various economic indicators makes accurate prediction challenging, increasing the risk of unexpected shocks.

-

Labor Market Uncertainties: While the current unemployment rate appears healthy, underlying shifts in the labor market, such as potential skill gaps and wage inflation, represent significant internal challenges that could impact future economic growth.

Dimon's Warning: A Call for Prudence

Dimon's comments serve as a crucial reminder of the inherent fragility of the US economy. His warning isn't a prediction of imminent collapse, but rather a call for caution and proactive measures. The potential for internal risks to exacerbate existing external challenges necessitates a more nuanced and cautious approach to economic policy.

The implications of Dimon's assessment are far-reaching. Investors are likely to reassess their portfolios, businesses might postpone expansion plans, and policymakers could face pressure to adjust their economic strategies.

What's Next? Navigating the Uncertain Terrain

The US economy faces a complex and uncertain future. While external factors like inflation and geopolitical tensions remain significant, Dimon's emphasis on internal risks highlights the need for a comprehensive and proactive approach to economic management. This includes addressing issues like government debt, fostering greater economic resilience, and carefully monitoring potential labor market imbalances. The coming months will be crucial in determining how effectively the US can navigate these challenges and mitigate the potential for a more severe economic downturn. Further analysis and insights from economic experts will be essential in understanding the full scope of these internal risks and their potential impact on the US economy.

Keywords: US Economy, JPMorgan Chase, Jamie Dimon, Economic Outlook, Inflation, Recession, Government Debt, Geopolitical Risk, Supply Chain, Labor Market, Economic Risks, Internal Risks, Financial Markets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook Imperiled: JPMorgan CEO Points To Internal Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Brazils Finance Minister On Climate Change A Path To Economic Growth

Jun 02, 2025

Brazils Finance Minister On Climate Change A Path To Economic Growth

Jun 02, 2025 -

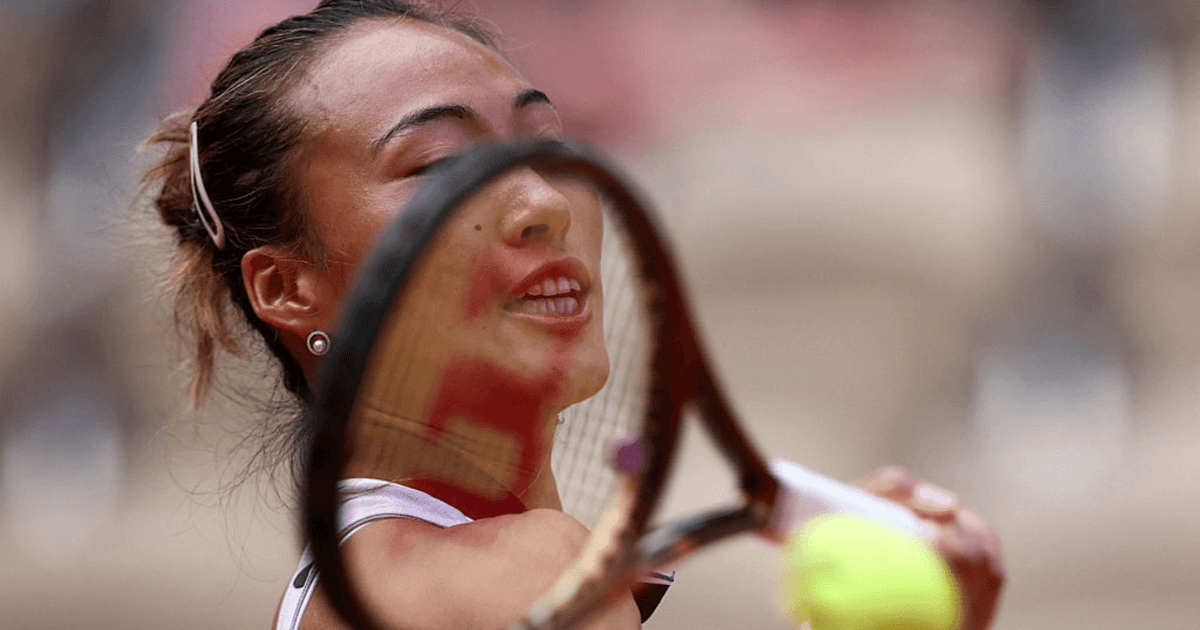

Roland Garros 2025 Live Scores And Highlights From Day 8 Swiatek Shelton Alcaraz

Jun 02, 2025

Roland Garros 2025 Live Scores And Highlights From Day 8 Swiatek Shelton Alcaraz

Jun 02, 2025 -

Murder Suspect Taken Into Custody In Separate State

Jun 02, 2025

Murder Suspect Taken Into Custody In Separate State

Jun 02, 2025 -

Minnesota Governor Walz Democrats Need To Be More Assertive Criticizes Trump

Jun 02, 2025

Minnesota Governor Walz Democrats Need To Be More Assertive Criticizes Trump

Jun 02, 2025 -

Is Sydney Sweeney Selling Her Bath Water As Soap The Facts

Jun 02, 2025

Is Sydney Sweeney Selling Her Bath Water As Soap The Facts

Jun 02, 2025