US Economic Outlook Clouded: JPMorgan CEO Identifies Internal Threats

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US Economic Outlook Clouded: JPMorgan CEO Identifies Internal Threats

The US economic outlook, already facing headwinds from inflation and geopolitical instability, has been further dimmed by a stark warning from Jamie Dimon, CEO of JPMorgan Chase. Dimon, known for his candid assessments of the financial landscape, recently pointed to significant internal threats that could derail the nation's economic recovery. His concerns, voiced during a recent earnings call, send ripples through the financial world and warrant careful consideration.

Internal Threats: More Than Just Inflation

While inflation remains a significant external challenge, Dimon highlighted several internal factors posing considerable risks. He didn't shy away from naming specific issues, painting a picture of a potentially fragile economic foundation. These internal threats extend beyond typical economic indicators and delve into the fabric of the US economy itself.

1. Government Spending and Debt: A Looming Crisis?

Dimon expressed serious concerns about the escalating national debt and the potential for unsustainable government spending. He warned that the current trajectory could lead to a significant economic crisis. This concern is echoed by many economists who are increasingly worried about the long-term implications of unchecked fiscal policy. The potential for a debt ceiling crisis further exacerbates this risk, potentially triggering market volatility and impacting investor confidence. [Link to a relevant article on government debt].

2. Geopolitical Uncertainty and its Domestic Impact

While not strictly an "internal" threat, the impact of geopolitical instability, particularly the ongoing war in Ukraine and tensions with China, significantly impacts the US economy. Dimon highlighted how these uncertainties can disrupt supply chains, fuel inflation, and create economic volatility. This external pressure interacts with internal vulnerabilities, making the overall picture even more precarious.

3. The Looming Recession: A Matter of When, Not If?

Dimon’s comments reinforce growing concerns among experts about the possibility of a recession. While not explicitly predicting an imminent downturn, his warning about internal weaknesses suggests that the US economy is more vulnerable than some might believe. Several leading economic indicators are already flashing warning signs, adding weight to the recessionary concerns. [Link to a relevant article on recession predictions].

4. The Human Element: Labor Shortages and Skills Gaps

Beyond macroeconomic factors, Dimon hinted at the impact of structural issues within the US economy. The ongoing labor shortages and skills gaps are preventing businesses from fully capitalizing on economic opportunities and contribute to inflationary pressures. Addressing these deep-seated issues requires long-term strategies and investments in education and workforce development.

What Does This Mean for Investors and Consumers?

Dimon's warning serves as a crucial reminder of the complexities facing the US economy. Investors should prepare for potential market volatility and consider diversifying their portfolios. Consumers should be mindful of potential inflationary pressures and plan accordingly. While panic is unwarranted, a cautious approach is advisable given the current climate.

Looking Ahead: Navigating Uncertainty

The US economy faces a complex web of intertwined challenges. Addressing these issues requires a multi-pronged approach involving fiscal responsibility, strategic investments in infrastructure and human capital, and a proactive response to geopolitical uncertainties. Only through careful navigation of these internal and external threats can the US ensure a stable and prosperous future. The coming months will be crucial in determining the trajectory of the US economy, and close monitoring of key indicators is essential.

Call to Action: Stay informed about economic developments by following reputable financial news sources and consulting with financial advisors. Understanding the risks and opportunities in the current climate is crucial for making informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US Economic Outlook Clouded: JPMorgan CEO Identifies Internal Threats. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Update Tray Chaneys Son Fighting For Life After Tornado Trauma In Georgia

Jun 03, 2025

Update Tray Chaneys Son Fighting For Life After Tornado Trauma In Georgia

Jun 03, 2025 -

Sydney Sweeneys Controversial New Bath Water Soap A Closer Look

Jun 03, 2025

Sydney Sweeneys Controversial New Bath Water Soap A Closer Look

Jun 03, 2025 -

Sahara Dust Cloud Engulfs Caribbean Headed For Us

Jun 03, 2025

Sahara Dust Cloud Engulfs Caribbean Headed For Us

Jun 03, 2025 -

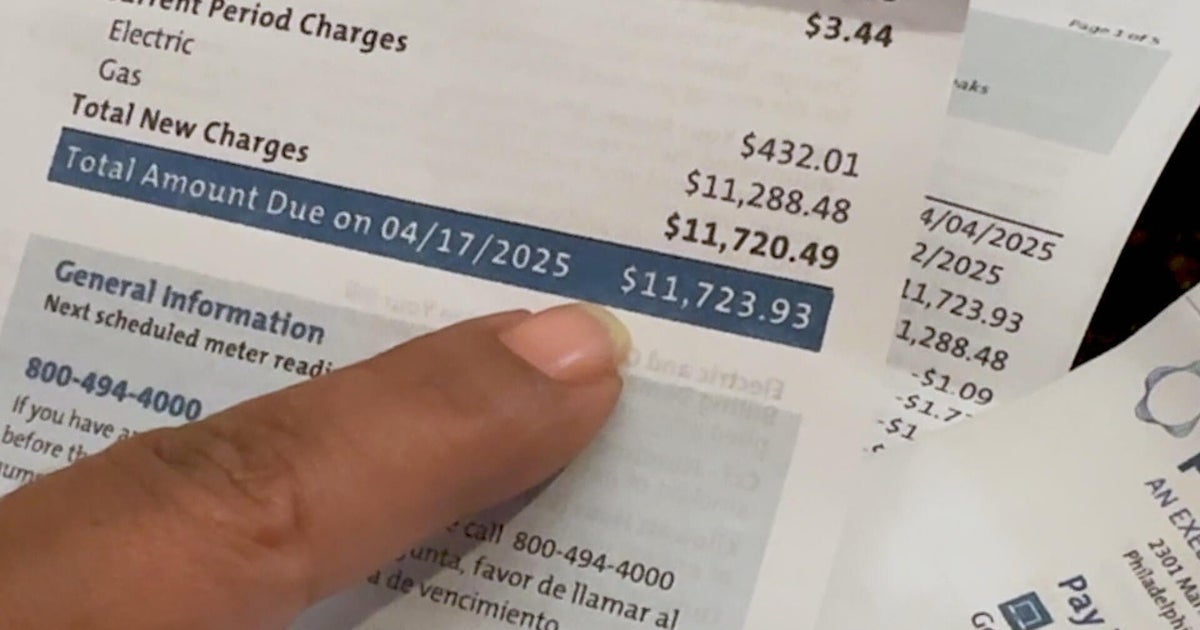

Peco Billing System Failure Massive Bill Discrepancies Leave Customers Frustrated

Jun 03, 2025

Peco Billing System Failure Massive Bill Discrepancies Leave Customers Frustrated

Jun 03, 2025 -

Maintaining A 100 Pound Weight Loss Lessons From Al Roker

Jun 03, 2025

Maintaining A 100 Pound Weight Loss Lessons From Al Roker

Jun 03, 2025