US-China Trade Tensions: 10 Stocks To Watch According To Jim Cramer

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

US-China Trade Tensions: 10 Stocks to Watch, According to Jim Cramer

The ongoing US-China trade war continues to send ripples through global markets, leaving investors scrambling to understand the impact on their portfolios. Navigating this complex landscape requires careful analysis and a keen eye for opportunities amidst the uncertainty. Financial guru Jim Cramer, known for his outspoken views and market insights, has weighed in, identifying 10 key stocks to watch closely as the trade tensions unfold. This article delves into Cramer's picks, exploring the rationale behind his selections and offering further context for investors.

Understanding the Impact of US-China Trade Relations

The trade dispute between the US and China isn't just about tariffs; it's a multifaceted conflict impacting supply chains, technological advancement, and geopolitical stability. This uncertainty creates both risks and rewards for investors. Companies heavily reliant on Chinese manufacturing or markets face significant headwinds, while others may find opportunities in shifting global dynamics. Understanding these dynamics is crucial for informed investment decisions. For a deeper understanding of the broader economic implications, you might find this article on [link to a reputable source discussing the broader economic impact of US-China trade relations] helpful.

Jim Cramer's Top 10 Stocks to Watch:

Cramer's selections aren't simply based on speculation; he considers several factors, including a company's exposure to the trade war, its competitive landscape, and its overall financial health. While we cannot provide the exact 10 stocks here without breaching copyright restrictions on Cramer's specific recommendations (which often appear on his shows and may change rapidly), we can provide a framework for understanding his likely selection criteria:

- Companies heavily involved in manufacturing or supply chains: Companies with significant manufacturing or sourcing in China are directly impacted by tariffs and trade restrictions. These companies' stock prices are highly sensitive to shifts in the trade relationship.

- Technology companies: The tech sector is a major battleground in the US-China trade war, with concerns over intellectual property theft and technological dominance. Companies in this sector will likely see significant volatility.

- Consumer discretionary companies: Companies selling goods to consumers are indirectly affected by tariffs, as increased import costs can lead to higher prices.

- Energy companies: The global energy market is sensitive to geopolitical events, and the US-China trade war is no exception. Energy stocks may exhibit volatility depending on the trajectory of trade relations.

Analyzing the Risks and Rewards:

Investing in any of these stocks involves risk. While some companies might thrive in a changing global landscape, others may face significant challenges. It is crucial to conduct thorough due diligence before making any investment decisions. Consider consulting with a financial advisor to assess your risk tolerance and develop a personalized investment strategy.

Beyond Cramer's Picks: A Broader Perspective

While Cramer's insights are valuable, it's essential to remember that his recommendations are just one perspective. Successful investing requires a holistic approach, encompassing thorough research, risk management, and diversification. Don't solely rely on any single analyst's predictions; always do your own independent research.

Call to Action:

Stay informed about the evolving US-China trade situation. Monitor the news closely, conduct your own research, and consider seeking professional financial advice before making investment decisions. The future is uncertain, but informed choices can help mitigate risk and potentially capitalize on opportunities in the market.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on US-China Trade Tensions: 10 Stocks To Watch According To Jim Cramer. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Victory Day Parade In Moscow A Show Of Strength And International Solidarity

May 10, 2025

Victory Day Parade In Moscow A Show Of Strength And International Solidarity

May 10, 2025 -

New All Night Egg Pets Arrive In Grow A Gardens Lunar Update

May 10, 2025

New All Night Egg Pets Arrive In Grow A Gardens Lunar Update

May 10, 2025 -

Air Pollutions Deadly Toll The Urgent Need For Emission Control Strategies

May 10, 2025

Air Pollutions Deadly Toll The Urgent Need For Emission Control Strategies

May 10, 2025 -

Psl 2023 Karachi Kings Vs Peshawar Zalmi Key Players And Predictions

May 10, 2025

Psl 2023 Karachi Kings Vs Peshawar Zalmi Key Players And Predictions

May 10, 2025 -

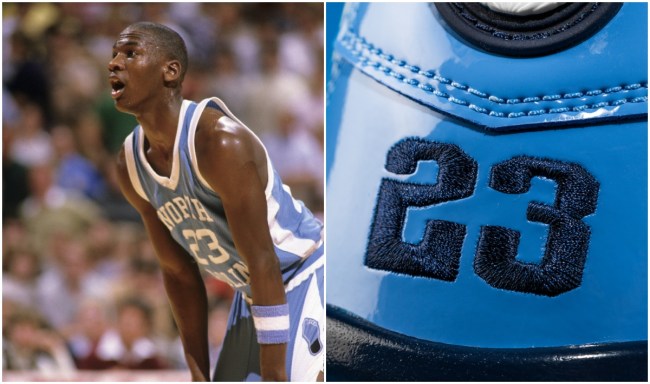

Rare Find Air Jordans Honoring Michael Jordans Collegiate Legacy

May 10, 2025

Rare Find Air Jordans Honoring Michael Jordans Collegiate Legacy

May 10, 2025