Understanding The Upcoming Increase In Obamacare Healthcare Costs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Upcoming Increase in Obamacare Healthcare Costs

Are your Obamacare premiums about to jump? Here's what you need to know about the expected increases in healthcare costs and how to navigate them.

The rising cost of healthcare is a concern for many Americans, and those enrolled in the Affordable Care Act (ACA), often referred to as Obamacare, are no exception. Recent announcements point to significant premium increases for 2024, leaving many wondering what this means for their healthcare coverage and their wallets. This article breaks down the anticipated changes, explores the contributing factors, and offers advice on how to manage the increased costs.

Why are Obamacare Premiums Increasing?

Several factors contribute to the projected increase in Obamacare healthcare costs. These include:

- Inflation and Increased Healthcare Provider Costs: The rising cost of medical services, prescription drugs, and hospital stays directly impacts insurance premiums. Inflation plays a significant role, driving up the overall cost of healthcare delivery.

- Limited Competition in Some Markets: In certain areas, a lack of competition among insurance providers can lead to higher premiums as there's less pressure to keep costs down.

- Changes in the Healthcare Landscape: Ongoing shifts in the healthcare industry, including the increasing demand for specialized treatments and advanced technologies, contribute to higher costs passed on to consumers.

- Government Regulations and Subsidies: While government subsidies help make coverage more affordable, changes in these programs or the level of funding can impact premiums. Understanding these subsidies is crucial to knowing your actual out-of-pocket costs.

How Much Will Premiums Increase?

The exact amount of the premium increase varies depending on several factors, including your location, age, health status, and the specific plan you choose. While specific numbers won't be available until closer to the open enrollment period, early estimates suggest substantial increases in many areas. It's crucial to check your specific plan details when open enrollment begins.

What Can You Do to Manage the Increased Costs?

Facing rising premiums can be daunting, but there are steps you can take:

- Shop Around During Open Enrollment: Don't assume your current plan is the best option. Carefully compare plans during the open enrollment period to find one that fits your budget and health needs. Use the Healthcare.gov website or a licensed insurance broker to compare plans.

- Explore Subsidies and Tax Credits: The ACA offers subsidies to help individuals and families afford coverage. These subsidies are based on income, and eligibility requirements can change. Make sure you understand what you qualify for.

- Consider a Different Plan Tier: Higher-tier plans often have lower monthly premiums but higher out-of-pocket costs. Lower-tier plans have lower deductibles and co-pays but higher monthly premiums. Carefully weigh these factors to find the best balance for your needs and finances.

- Understand Your Plan's Deductible and Out-of-Pocket Maximum: Knowing these key elements of your plan will help you budget for potential healthcare expenses.

Navigating the Changes: Resources and Further Information

Staying informed is key. Utilize the following resources for up-to-date information and assistance:

- Healthcare.gov: The official website for the Affordable Care Act provides comprehensive information about plans, subsidies, and enrollment.

- State Insurance Marketplaces: Many states have their own insurance marketplaces that offer additional resources and support.

- Licensed Insurance Brokers: A licensed insurance broker can help you navigate the complexities of choosing a plan and understanding your coverage.

Conclusion:

The projected increase in Obamacare healthcare costs is a significant concern, but understanding the factors driving these increases and actively engaging in the plan selection process can help mitigate the impact. Remember to shop around, explore available subsidies, and thoroughly understand the details of any plan before enrolling. Don't hesitate to seek professional assistance if needed. Staying proactive and informed will be crucial during the upcoming open enrollment period.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Upcoming Increase In Obamacare Healthcare Costs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Nba 2 K26 Review Gameplay Graphics And More Updated Regularly

Sep 03, 2025

Nba 2 K26 Review Gameplay Graphics And More Updated Regularly

Sep 03, 2025 -

Helldivers 2 Invasion Begins September 2nd

Sep 03, 2025

Helldivers 2 Invasion Begins September 2nd

Sep 03, 2025 -

30 Carat Diamond Georgina Rodriguezs Stunning Ring At Venice

Sep 03, 2025

30 Carat Diamond Georgina Rodriguezs Stunning Ring At Venice

Sep 03, 2025 -

Russias Alleged Role In Gps Jamming Incident Targeting Eu Commission Presidents Plane

Sep 03, 2025

Russias Alleged Role In Gps Jamming Incident Targeting Eu Commission Presidents Plane

Sep 03, 2025 -

Helldivers 2 Release Date Dive Into Strategic Warfare On September 2nd

Sep 03, 2025

Helldivers 2 Release Date Dive Into Strategic Warfare On September 2nd

Sep 03, 2025

Latest Posts

-

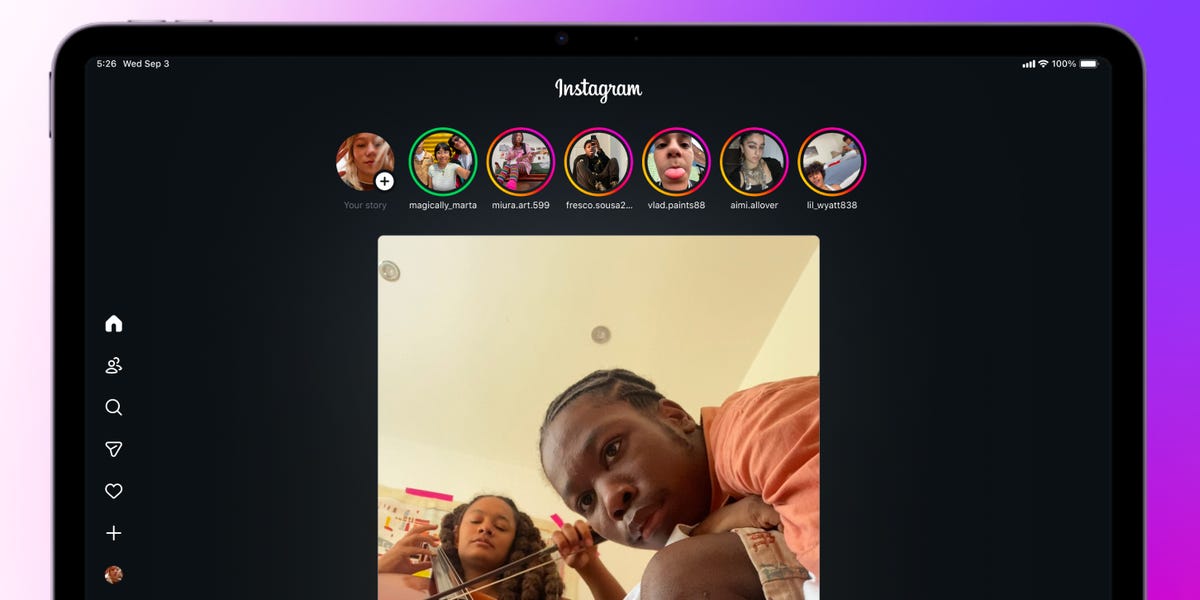

The Instagram I Pad App Is Here A Comprehensive Guide

Sep 05, 2025

The Instagram I Pad App Is Here A Comprehensive Guide

Sep 05, 2025 -

X Ais Shadow Falls On Memphis Local Residents Face Displacement And Uncertainty

Sep 05, 2025

X Ais Shadow Falls On Memphis Local Residents Face Displacement And Uncertainty

Sep 05, 2025 -

Fbi Investigation Into 12 Year Olds Nuclear Fusion Reactor Project

Sep 05, 2025

Fbi Investigation Into 12 Year Olds Nuclear Fusion Reactor Project

Sep 05, 2025 -

Analyzing Canelo And Crawfords Careers 10 Crucial Matches

Sep 05, 2025

Analyzing Canelo And Crawfords Careers 10 Crucial Matches

Sep 05, 2025 -

Canelo Alvarez Vs Terence Crawford A Career Retrospective In 10 Fights

Sep 05, 2025

Canelo Alvarez Vs Terence Crawford A Career Retrospective In 10 Fights

Sep 05, 2025