Understanding The Trump Tax Plan: Avoiding Future Tax Scams

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Trump Tax Plan: Avoiding Future Tax Scams

The 2017 Tax Cuts and Jobs Act, often referred to as the Trump tax plan, significantly altered the US tax code. While offering potential benefits, its complexities also created fertile ground for tax scams. Understanding the intricacies of this plan is crucial for taxpayers to protect themselves from fraudulent schemes. This article will delve into key aspects of the Trump tax plan and highlight common scams to watch out for.

Key Changes Introduced by the Trump Tax Plan:

The Trump tax plan implemented several major changes, including:

- Reduced individual income tax rates: This resulted in lower tax bills for many, but also altered bracket thresholds.

- Standard deduction increases: The standard deduction was significantly raised, impacting who itemizes and how much they deduct.

- Child Tax Credit expansion: The Child Tax Credit (CTC) was expanded, benefiting families with children.

- Corporate tax rate reduction: The corporate tax rate was slashed from 35% to 21%, impacting business profitability and investment.

- Elimination of personal and dependent exemptions: This change further complicated tax calculations.

These changes, while seemingly straightforward, introduced complexities that unscrupulous individuals exploit.

Common Tax Scams Targeting the Trump Tax Plan:

Scammers often capitalize on confusion surrounding new tax laws. Be aware of these common scams:

- Phishing emails and fake IRS websites: These scams often mimic official IRS communications, urging immediate payment of bogus tax debts related to the Trump tax plan changes. Never click on links or provide personal information in unsolicited emails.

- False claims regarding the Child Tax Credit: Scammers may promise inflated refunds or claim eligibility for those who don't qualify.

- Inflated tax deductions: Be wary of schemes promising unrealistic deductions related to the changes in standard deduction or itemized deductions. Always verify the legitimacy of any deduction claimed.

- Promised refunds for non-existent credits: Scammers may invent new tax credits connected to the Trump tax plan to lure unsuspecting victims.

- Advance fee scams: Beware of services promising guaranteed refunds or tax resolution for a large upfront fee. Legitimate tax professionals work on a contingency basis or charge reasonable fees.

How to Protect Yourself from Tax Scams:

- File your taxes electronically: Electronic filing reduces the risk of errors and makes it easier to track your return.

- Use reputable tax preparation software or a qualified tax professional: A qualified professional can help you navigate the complexities of the tax code and identify potential scams.

- Verify the identity of anyone contacting you about your taxes: The IRS will never contact you via email, text, or social media to demand immediate payment.

- Don't fall for promises of unusually large refunds: If something sounds too good to be true, it probably is.

- Report suspicious activity: If you suspect a tax scam, report it immediately to the IRS and the Federal Trade Commission (FTC).

Understanding the nuances of the Trump tax plan is key to avoiding scams. By staying informed and practicing caution, you can protect yourself from fraudulent activities and ensure you receive the correct tax benefits. Remember, vigilance is your best defense against tax fraud.

Further Resources:

- IRS Website:

- Federal Trade Commission (FTC):

Call to Action: Share this article with your friends and family to help spread awareness about these important tax scams and protect them from becoming victims.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Trump Tax Plan: Avoiding Future Tax Scams. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dogecoin Investment 10 000 In 2018 Current Value Revealed

Aug 14, 2025

Dogecoin Investment 10 000 In 2018 Current Value Revealed

Aug 14, 2025 -

Stay Safe Metro Detroit Facing Strong Storms Tonight And Overnight

Aug 14, 2025

Stay Safe Metro Detroit Facing Strong Storms Tonight And Overnight

Aug 14, 2025 -

Resident Evil 9 Leak Leon Kennedys Departure Confirmed

Aug 14, 2025

Resident Evil 9 Leak Leon Kennedys Departure Confirmed

Aug 14, 2025 -

Roblox Stock Drops 4 4 Analyzing The Market Decline

Aug 14, 2025

Roblox Stock Drops 4 4 Analyzing The Market Decline

Aug 14, 2025 -

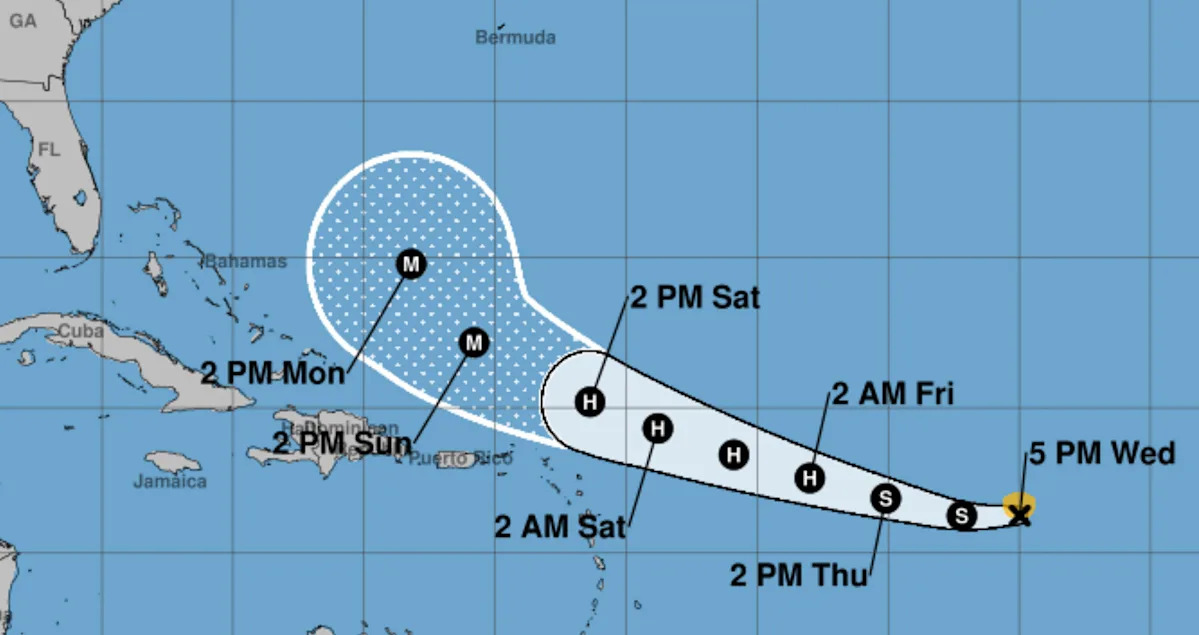

Tropical Storm Erin Tracker Will It Become The First Hurricane Of 2025

Aug 14, 2025

Tropical Storm Erin Tracker Will It Become The First Hurricane Of 2025

Aug 14, 2025

Latest Posts

-

Taylor Swift Unveils The Life Of A Showgirl Album Details And Tracklist

Aug 14, 2025

Taylor Swift Unveils The Life Of A Showgirl Album Details And Tracklist

Aug 14, 2025 -

The Secret Path To The Trump Putin Summit A Detailed Account Of The Backchannel Negotiations

Aug 14, 2025

The Secret Path To The Trump Putin Summit A Detailed Account Of The Backchannel Negotiations

Aug 14, 2025 -

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025

West Virginia Lottery Powerball And Lotto America Winning Numbers August 13 2025

Aug 14, 2025 -

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025

Hurricane Erins Path Latest Forecast From Bryan Norcross

Aug 14, 2025 -

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025