Understanding The Link: Trump's Tax Bill And Diminished Healthcare Access

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Link: Trump's Tax Bill and Diminished Healthcare Access

The 2017 Tax Cuts and Jobs Act: An Unintended Consequence?

The 2017 Tax Cuts and Jobs Act, a signature legislative achievement of the Trump administration, significantly reshaped the American tax code. While proponents touted economic benefits like job growth and increased investment, a less discussed consequence has been a demonstrable decline in healthcare access for millions of Americans. This article explores the complex relationship between the tax bill and the subsequent erosion of healthcare coverage, examining the key mechanisms that contributed to this outcome.

The Repeal of the Individual Mandate: A Crucial Element

A key provision of the Affordable Care Act (ACA), the individual mandate, required most Americans to obtain health insurance or pay a penalty. The 2017 tax bill effectively eliminated this penalty, removing a crucial incentive for individuals to enroll in health insurance plans. This had a ripple effect, impacting both the individual market and the overall stability of the healthcare system. The Congressional Budget Office (CBO) predicted, and subsequent data confirmed, a significant increase in the number of uninsured Americans following the mandate's repeal. This translates directly to diminished access to preventative care, routine check-ups, and crucial treatments for millions.

Impact on Medicaid Expansion States:

The tax bill's impact wasn't uniform across the country. States that expanded Medicaid under the ACA saw a less dramatic increase in the uninsured rate compared to states that did not. However, even in expansion states, the repeal of the individual mandate created pressure on the system, leading to increased costs and potential challenges in maintaining adequate coverage. This highlights the interconnectedness of various aspects of the healthcare landscape and the cascading effects of policy changes.

Increased Premiums and Reduced Coverage Options:

The decrease in the insured population, due to the repeal of the individual mandate, led to a predictable consequence: increased premiums for those who remained insured. A smaller, healthier risk pool translates to higher costs for everyone within the system. Furthermore, some insurance providers withdrew from the marketplaces in several states, leading to fewer choices and potentially higher costs for consumers. This reduction in competition further exacerbated the problem of access to affordable and comprehensive healthcare.

Long-Term Implications and Future Policy Debates:

The link between the 2017 tax bill and diminished healthcare access is a complex issue with far-reaching consequences. The long-term implications for public health and the overall financial stability of the healthcare system remain a subject of ongoing debate and research. Understanding this connection is crucial for informing future policy discussions and finding effective solutions to improve healthcare access and affordability for all Americans.

Further Research and Resources:

For deeper insights into the impact of the 2017 tax bill on healthcare, we recommend exploring resources from the Kaiser Family Foundation (KFF) and the Centers for Medicare & Medicaid Services (CMS). These organizations provide detailed data and analysis on healthcare coverage trends in the United States.

Call to Action: Staying informed about healthcare policy is crucial for advocating for better access and affordability. Encourage your representatives to prioritize policies that expand healthcare coverage and reduce the cost of healthcare for all Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Link: Trump's Tax Bill And Diminished Healthcare Access. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Urgent Recall Oscar Mayer Turkey Bacon Pulled From Shelves Due To Listeria Risk

Jul 04, 2025

Urgent Recall Oscar Mayer Turkey Bacon Pulled From Shelves Due To Listeria Risk

Jul 04, 2025 -

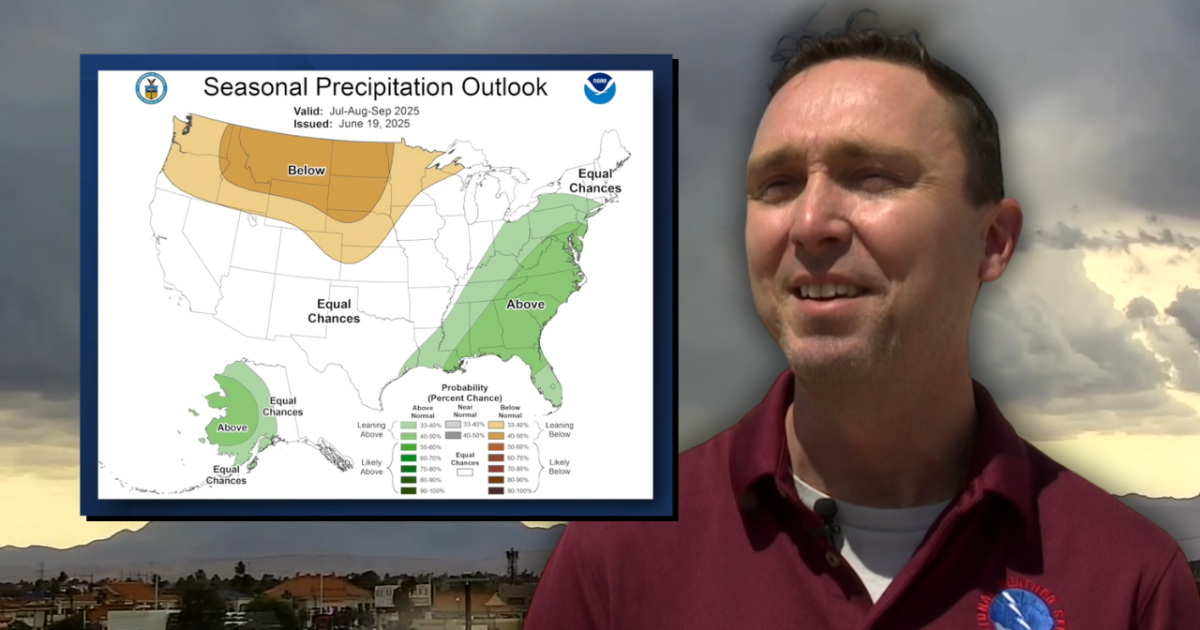

Experts Predict Southern Nevadas 2024 Monsoon Season What To Expect

Jul 04, 2025

Experts Predict Southern Nevadas 2024 Monsoon Season What To Expect

Jul 04, 2025 -

Parkinsons Dementia Breakthrough Cough Medicine Shows Promise

Jul 04, 2025

Parkinsons Dementia Breakthrough Cough Medicine Shows Promise

Jul 04, 2025 -

The Jaws Effect How A Blockbuster Movie Shaped Marine Conservation Efforts

Jul 04, 2025

The Jaws Effect How A Blockbuster Movie Shaped Marine Conservation Efforts

Jul 04, 2025 -

The Sandmans Fate Examining The Reasons Behind Netflixs Cancellation

Jul 04, 2025

The Sandmans Fate Examining The Reasons Behind Netflixs Cancellation

Jul 04, 2025

Latest Posts

-

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025 -

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025

France Vs Iceland 2026 World Cup Qualifying Live Stream And Tv Guide

Sep 10, 2025 -

Portugals World Cup Dream Can They Win It All

Sep 10, 2025

Portugals World Cup Dream Can They Win It All

Sep 10, 2025 -

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025

Mundial 2026 Francia Vs Islandia Horario Y Canales De Tv

Sep 10, 2025 -

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025

Preventing Racist Abuse Englands Plan To Protect Kane And Other Players

Sep 10, 2025