Understanding The Inflation Reduction Act's Effects On Social Security Benefits And Taxation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

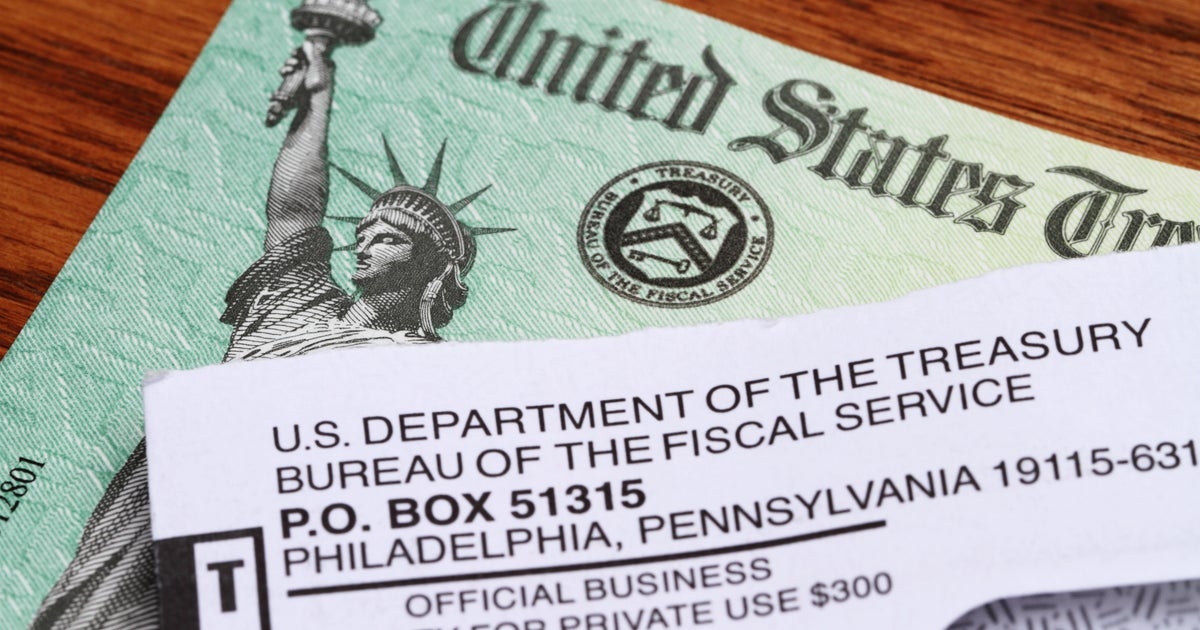

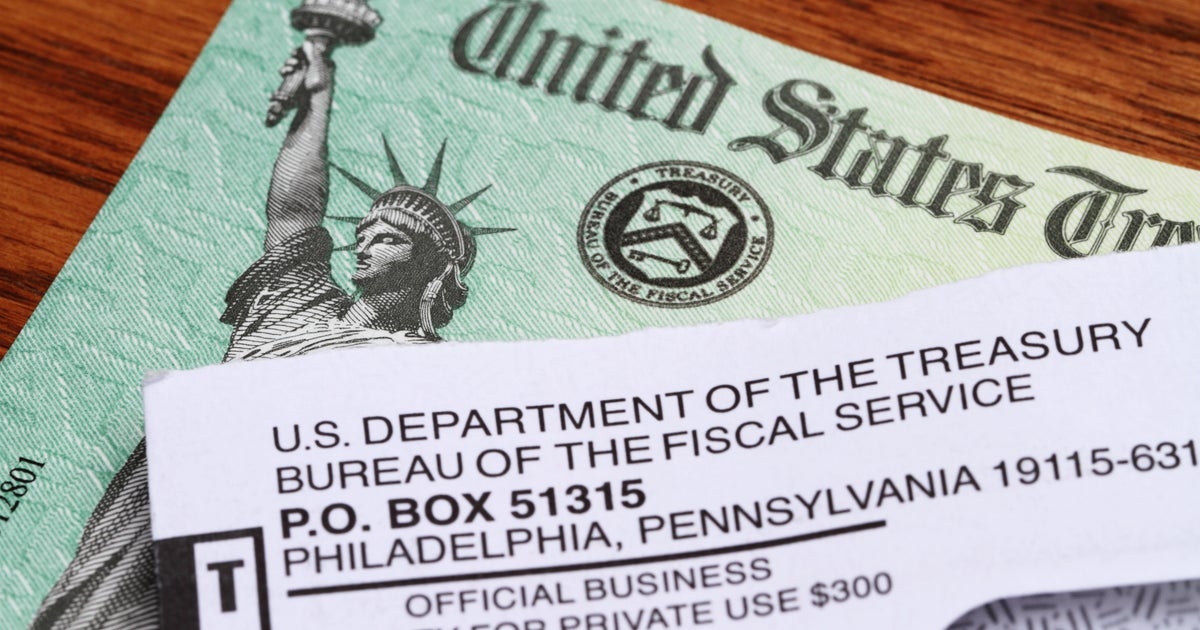

Understanding the Inflation Reduction Act's Effects on Social Security Benefits and Taxation

The Inflation Reduction Act (IRA), signed into law in August 2022, is a sweeping piece of legislation with far-reaching consequences. While primarily focused on climate change and healthcare, it also subtly impacts Social Security benefits and taxation, leading to questions for many Americans. This article will break down the key ways the IRA affects Social Security recipients and taxpayers.

How the IRA Impacts Social Security Benefits (Indirectly):

The IRA doesn't directly alter Social Security benefit calculations or eligibility. However, its impact on inflation plays a significant role. A core aim of the IRA is to combat inflation through various measures, including prescription drug price negotiations and investments in clean energy.

-

Lower Inflation, Indirect Benefit: If the IRA successfully reduces inflation, this indirectly benefits Social Security recipients. The annual cost-of-living adjustment (COLA) for Social Security benefits is directly tied to inflation. Lower inflation could mean smaller COLA increases, but it also means that the existing benefits retain more purchasing power. This is a double-edged sword, as lower COLAs could mean slower benefit growth, yet also a preservation of existing value.

-

The Importance of COLA: Understanding the intricacies of the COLA calculation is crucial. It’s based on the Consumer Price Index for Wage Earners and Clerical Workers (CPI-W). The IRA's impact on overall inflation will directly influence this index and therefore the future COLA adjustments. [Link to SSA website explaining COLA calculations]

Tax Implications of the IRA:

The IRA introduces several changes that affect taxation, indirectly impacting those who rely on Social Security income:

1. Prescription Drug Price Negotiation: The IRA allows Medicare to negotiate drug prices for certain high-cost medications. While this doesn't directly affect Social Security taxes, it could indirectly impact beneficiaries by lowering their out-of-pocket healthcare expenses, potentially freeing up more disposable income.

2. Increased IRS Funding: The IRA provides significant funding to the IRS for enforcement and modernization. This could lead to increased scrutiny of tax returns, potentially affecting both those who receive Social Security and those who pay taxes that support the Social Security system. More effective tax collection could ultimately benefit the long-term solvency of Social Security.

3. No Direct Changes to Social Security Taxes: It's crucial to note that the IRA does not change the Social Security tax rates themselves. The existing tax rates remain unchanged for both employees and employers.

What This Means For You:

The IRA's impact on Social Security and taxation is complex and indirect. While no immediate changes to benefit calculations or tax rates are implemented, the long-term effects depend heavily on the success of the IRA's inflation-reducing measures.

-

Stay Informed: Keep abreast of economic updates and official government announcements regarding inflation and Social Security adjustments.

-

Consult a Professional: If you have specific concerns about how the IRA might affect your personal finances, consult a financial advisor or tax professional. They can offer tailored advice based on your individual circumstances.

Keywords: Inflation Reduction Act, IRA, Social Security, Social Security benefits, COLA, cost-of-living adjustment, taxation, Medicare, prescription drug prices, IRS, inflation, retirement, senior citizens, financial planning.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Inflation Reduction Act's Effects On Social Security Benefits And Taxation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Dogecoin Price Analysis 0 16 Support Level Under Scrutiny

Jul 08, 2025

Dogecoin Price Analysis 0 16 Support Level Under Scrutiny

Jul 08, 2025 -

Tony Khan Jim Ross Essential To Aew Hopes For His Presence At All In

Jul 08, 2025

Tony Khan Jim Ross Essential To Aew Hopes For His Presence At All In

Jul 08, 2025 -

Mulder Impresses As Stand In Test Captain On Opening Day

Jul 08, 2025

Mulder Impresses As Stand In Test Captain On Opening Day

Jul 08, 2025 -

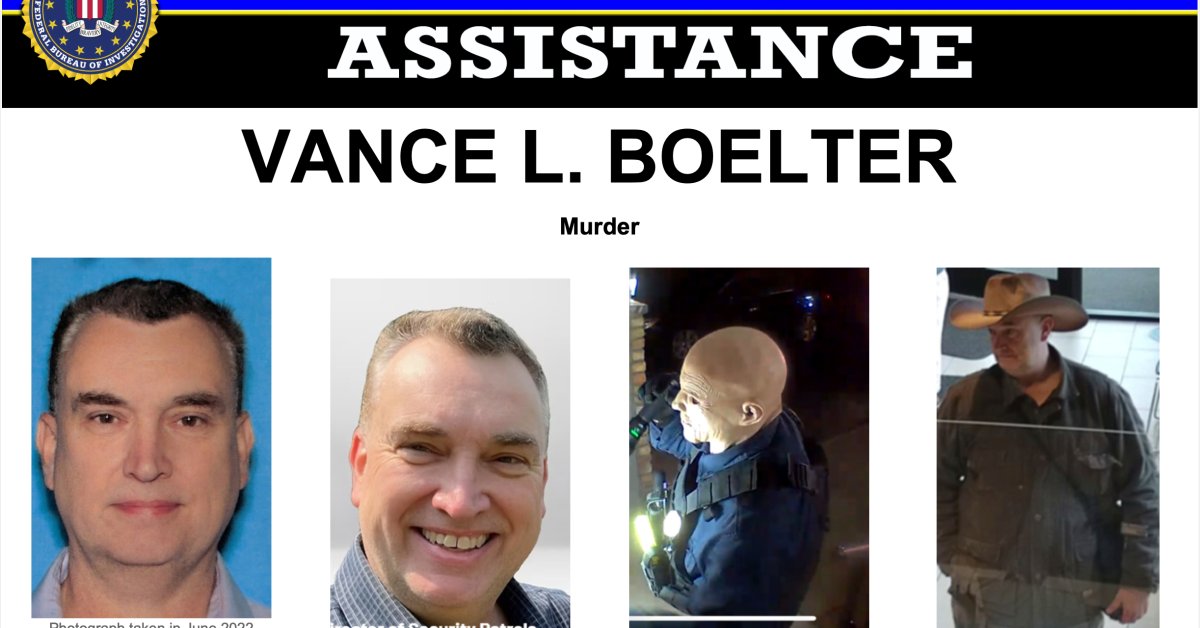

Police Capture Vance Boelter Suspect In Minnesota Lawmaker Shooting Incident

Jul 08, 2025

Police Capture Vance Boelter Suspect In Minnesota Lawmaker Shooting Incident

Jul 08, 2025 -

Dogecoin Price Surge Are Whale Movements A Buy Signal

Jul 08, 2025

Dogecoin Price Surge Are Whale Movements A Buy Signal

Jul 08, 2025

Latest Posts

-

Trumps New Ice Directive Targeting Deportations In Democratic Areas

Jul 09, 2025

Trumps New Ice Directive Targeting Deportations In Democratic Areas

Jul 09, 2025 -

Royal Snub Sarah Fergusons Surprising Reason For Rejecting The Kings Invitation

Jul 09, 2025

Royal Snub Sarah Fergusons Surprising Reason For Rejecting The Kings Invitation

Jul 09, 2025 -

Claim Your Free Spirit Empress A New Clash Royale Legendary Card

Jul 09, 2025

Claim Your Free Spirit Empress A New Clash Royale Legendary Card

Jul 09, 2025 -

Cape Canaveral Launch Schedule Space X Nasa And Ula Upcoming Missions

Jul 09, 2025

Cape Canaveral Launch Schedule Space X Nasa And Ula Upcoming Missions

Jul 09, 2025 -

Babydoll Archi And Kendra Lust Analyzing The Viral Photo And Online Reaction

Jul 09, 2025

Babydoll Archi And Kendra Lust Analyzing The Viral Photo And Online Reaction

Jul 09, 2025