Understanding The Financial Industry's Climate Change Response

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Financial Industry's Climate Change Response: A Slow Burn or a Rapid Shift?

The financial industry, long a driver of economic growth, is increasingly facing pressure to address its role in climate change. From fossil fuel financing to carbon emissions from operations, the sector's impact is undeniable. But is the response fast enough? This article delves into the evolving landscape of climate action within the financial world, exploring both the progress made and the significant challenges that remain.

The Growing Pressure: Regulatory Scrutiny and Investor Demands

The impetus for change is multifaceted. Governments worldwide are implementing stricter regulations, demanding greater transparency and accountability from financial institutions regarding their climate-related risks. The EU's Sustainable Finance Disclosure Regulation (SFDR), for example, mandates detailed disclosures on Environmental, Social, and Governance (ESG) factors, including climate-related risks. Similarly, the Task Force on Climate-related Financial Disclosures (TCFD) recommendations are influencing corporate reporting globally. [Link to TCFD website]

Beyond regulation, investors are increasingly incorporating ESG criteria into their investment decisions. This growing demand for sustainable and responsible investments is driving a shift towards climate-conscious practices within the industry. Pension funds, asset managers, and individual investors are actively seeking out companies with strong climate action plans.

Strategies for a Sustainable Future: Beyond Greenwashing

Financial institutions are responding in a variety of ways. Some key strategies include:

- Divestment from Fossil Fuels: Many institutions are reducing their exposure to fossil fuel companies, aligning their portfolios with the goals of the Paris Agreement. This involves phasing out investments in coal, oil, and gas, and redirecting capital towards renewable energy sources.

- Green Financing: There's a surge in green bonds, loans, and other financial instruments designed to fund climate-friendly projects. These instruments channel capital towards renewable energy, energy efficiency, and sustainable infrastructure development. [Link to an example of a green bond issuance]

- Climate Risk Assessment and Management: Leading financial institutions are integrating climate-related risks into their risk management frameworks. This involves assessing the potential financial impacts of climate change, such as physical risks from extreme weather events and transition risks from the shift to a low-carbon economy.

- Carbon Offset Programs: While debated, carbon offsetting remains a component of some institutions' strategies. This involves investing in projects that reduce greenhouse gas emissions to compensate for emissions elsewhere. However, the effectiveness and integrity of carbon offsetting remain a subject of ongoing scrutiny.

Challenges and Obstacles: The Path to Net-Zero

Despite the progress, significant challenges remain. These include:

- Data Gaps and Standardization: Inconsistent data and a lack of standardized methodologies for measuring and reporting climate-related impacts hinder accurate assessment and comparison across institutions.

- Greenwashing Concerns: Some institutions face accusations of "greenwashing," making misleading or exaggerated claims about their sustainability efforts. This undermines trust and necessitates greater transparency and verification.

- Political and Economic Headwinds: The transition to a low-carbon economy faces political and economic obstacles, including lobbying from fossil fuel interests and concerns about economic competitiveness.

Conclusion: A Critical Turning Point

The financial industry's response to climate change is at a critical juncture. While progress is evident, significant hurdles remain. Increased regulatory pressure, investor demand, and growing public awareness are driving change, but a more concerted and coordinated effort is needed to effectively address the climate crisis and build a truly sustainable financial system. The future will depend on the industry's ability to move beyond rhetoric and deliver tangible action, ensuring a just and equitable transition to a net-zero economy. This requires collaboration, innovation, and a clear commitment to a sustainable future for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Financial Industry's Climate Change Response. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

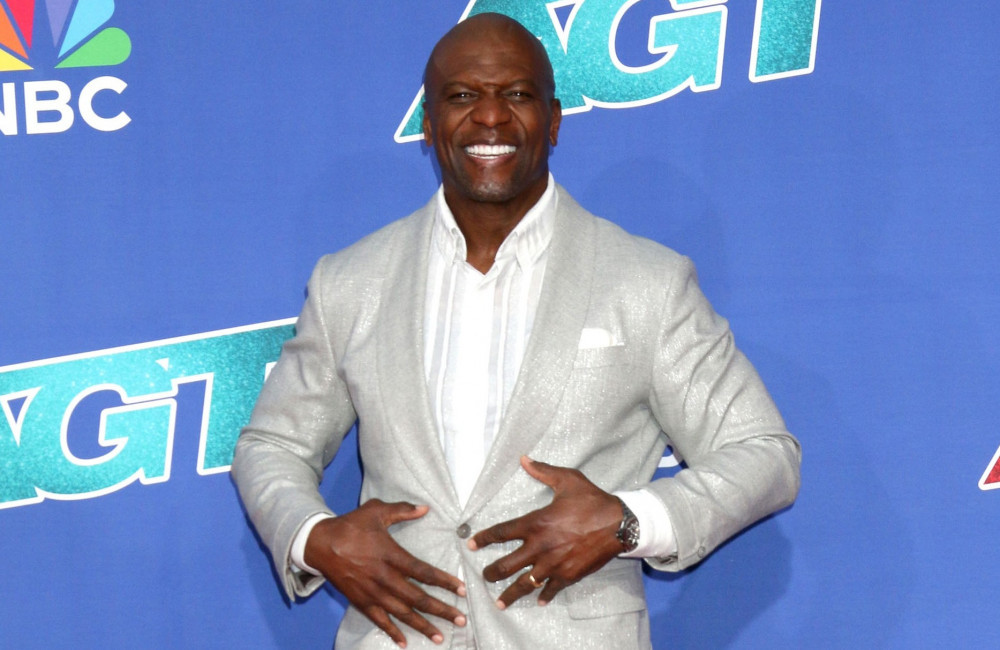

Terry Crews Wants Everybody Hates Chris To Become A Television Legacy

May 12, 2025

Terry Crews Wants Everybody Hates Chris To Become A Television Legacy

May 12, 2025 -

The Time 100 Unveiling The Most Influential Individuals Of 2025

May 12, 2025

The Time 100 Unveiling The Most Influential Individuals Of 2025

May 12, 2025 -

New Fc Barcelona Shirt A Closer Look Ahead Of El Clasico

May 12, 2025

New Fc Barcelona Shirt A Closer Look Ahead Of El Clasico

May 12, 2025 -

Estrategia Ganadora Descifrando Un Clasico

May 12, 2025

Estrategia Ganadora Descifrando Un Clasico

May 12, 2025 -

Lewandowski Pokazal Klase Zmiazdzyl Real Madryt

May 12, 2025

Lewandowski Pokazal Klase Zmiazdzyl Real Madryt

May 12, 2025