Understanding The Financial Industry's Approach To Climate Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the Financial Industry's Evolving Approach to Climate Risk

The financial industry, long seen as a driver of carbon emissions through investments in fossil fuels, is increasingly grappling with the profound implications of climate change. No longer a fringe concern, climate risk is now firmly on the agenda of major banks, insurers, and investment firms globally. But how are these institutions adapting, and what challenges remain?

This article explores the financial industry's evolving understanding and management of climate-related financial risks, examining both the progress made and the significant hurdles still to overcome.

The Growing Awareness of Climate-Related Financial Risks

The past decade has witnessed a dramatic shift in the financial sector's perception of climate change. No longer dismissed as a distant threat, climate risks – physical and transition – are now recognized as posing significant threats to financial stability.

-

Physical risks: These encompass the direct impacts of climate change, such as extreme weather events (hurricanes, floods, wildfires), sea-level rise, and changes in temperature and precipitation patterns. These events can cause direct damage to assets, disrupt supply chains, and lead to significant losses for businesses and investors.

-

Transition risks: These stem from the global shift towards a low-carbon economy. Policies aimed at reducing greenhouse gas emissions, such as carbon pricing and stricter environmental regulations, can render carbon-intensive assets stranded, leading to significant write-downs and losses. The increasing prevalence of ESG (Environmental, Social, and Governance) investing further intensifies this pressure.

The Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board, has played a crucial role in raising awareness and promoting consistent climate-related financial reporting. Many financial institutions are now adopting TCFD recommendations, although implementation varies widely.

Strategies for Managing Climate Risk

Financial institutions are employing various strategies to manage climate-related risks:

-

Scenario analysis: This involves modelling the potential financial impacts of different climate scenarios, enabling firms to assess their vulnerability and develop appropriate mitigation strategies.

-

Carbon footprint reduction: Many firms are setting ambitious targets to reduce their own operational carbon footprint and are increasingly engaging with portfolio companies to encourage emissions reductions.

-

Green finance initiatives: Investments in renewable energy, green infrastructure projects, and sustainable technologies are gaining momentum. This includes the development of green bonds and other sustainable finance instruments.

-

Divestment from fossil fuels: Some institutions are actively divesting from fossil fuel companies, aligning their investment portfolios with the goals of the Paris Agreement.

Challenges and Obstacles

Despite growing awareness and efforts, significant challenges remain:

-

Data limitations: Accurate and comprehensive data on climate-related risks are often lacking, hindering effective risk assessment and management.

-

Lack of standardization: The absence of globally consistent standards for climate-related disclosures makes it difficult to compare the climate performance of different institutions.

-

Political and regulatory uncertainty: The evolving regulatory landscape surrounding climate change creates uncertainty for businesses and investors.

The Path Forward: Collaboration and Transparency

Successfully managing climate risk requires a collaborative effort. Increased transparency, standardization of reporting frameworks, and stronger regulatory oversight are crucial. The financial industry must continue to refine its methodologies, enhance data collection, and develop innovative financial instruments to support the transition to a low-carbon economy. The future of finance is inextricably linked to the successful mitigation of climate change. Further research and development in climate risk modelling and sustainable finance are essential for navigating this complex landscape effectively. The ultimate success will depend on the collective commitment of all stakeholders to build a more sustainable and resilient financial system.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The Financial Industry's Approach To Climate Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Us China Trade Tensions Ease Understanding The Significance Of Trumps Tariff Concession

May 15, 2025

Us China Trade Tensions Ease Understanding The Significance Of Trumps Tariff Concession

May 15, 2025 -

Previa El Descenso Y La Europa Se Juegan En Mendizorroza Y La Ceramica

May 15, 2025

Previa El Descenso Y La Europa Se Juegan En Mendizorroza Y La Ceramica

May 15, 2025 -

Inigo Realismo Y Esperanza En La Lucha Por Europa

May 15, 2025

Inigo Realismo Y Esperanza En La Lucha Por Europa

May 15, 2025 -

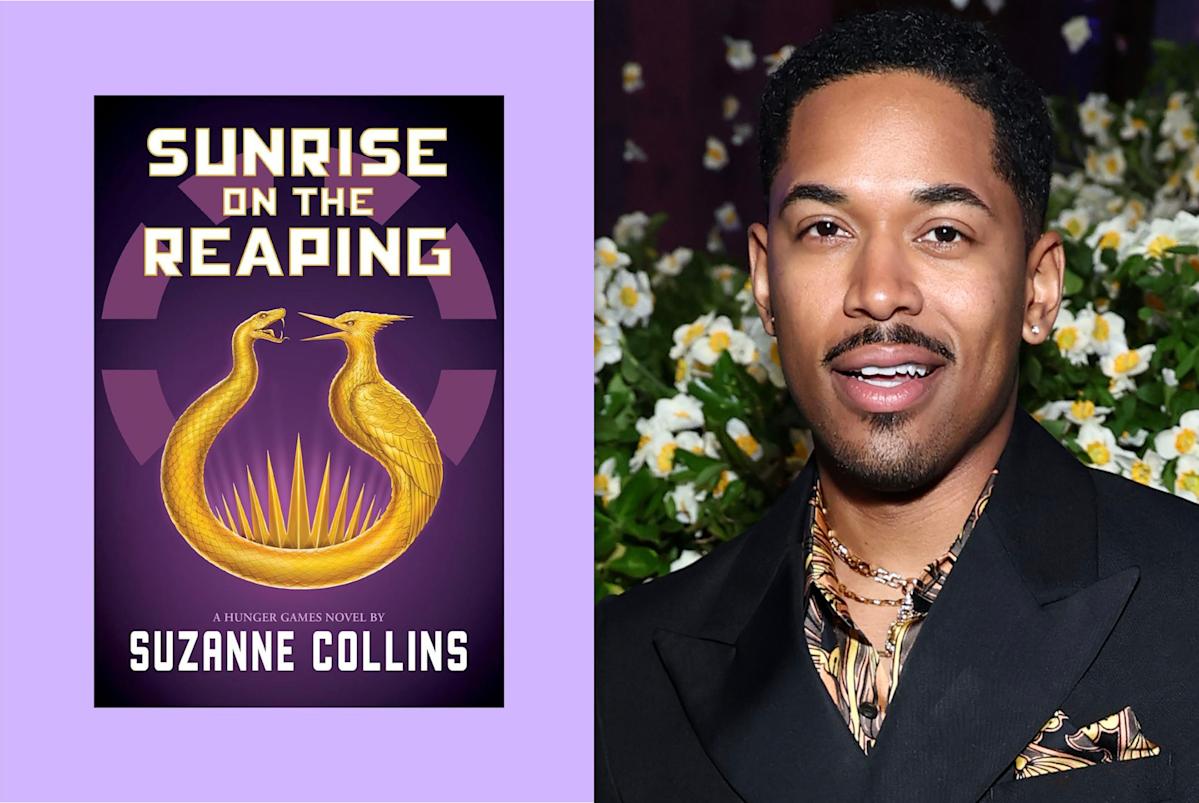

Meet The Actors The Hunger Games Sunrise On The Reaping Cast Revealed

May 15, 2025

Meet The Actors The Hunger Games Sunrise On The Reaping Cast Revealed

May 15, 2025 -

Wirtz England Reise Hinweise Auf Bayern Wechsel

May 15, 2025

Wirtz England Reise Hinweise Auf Bayern Wechsel

May 15, 2025