Understanding The $449 Million Powerball Win: Taxes And Net Payout

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Understanding the $449 Million Powerball Win: Taxes and Net Payout

The Powerball jackpot has once again captivated the nation, with a lucky winner claiming a staggering $449 million. While the headline figure is undoubtedly exciting, the reality of receiving that much money is significantly more complex, particularly when considering the hefty tax burden associated with such a massive windfall. Let's delve into the details to understand the true net payout after taxes.

The Impact of Federal and State Taxes

The $449 million represents the annuity option, paid out in 30 installments over 29 years. However, most winners opt for the cash value lump-sum payment, which is significantly lower. For this hypothetical $449 million jackpot, the cash value would likely be around $225 million before taxes. This is where the complexities of taxation come into play.

The IRS levies a hefty federal tax on lottery winnings. For 2023, the top federal income tax bracket is 37%, meaning a significant chunk of the winnings will go directly to the federal government. Furthermore, most states also tax lottery winnings, with rates varying considerably. For instance, some states have no lottery tax, while others impose a tax rate as high as 8.97%. This means our hypothetical winner could face a combined federal and state tax rate anywhere from 37% to potentially over 45%, depending on their state of residence.

Calculating the Net Payout: A Realistic Look

Let's illustrate the impact with a simplified calculation. Assume a combined federal and state tax rate of 40% on the $225 million cash value. This translates to a tax liability of $90 million. Subtracting this from the initial cash value leaves a net payout of approximately $135 million. This figure represents a stark contrast to the initial headline-grabbing $449 million.

Beyond the Numbers: Financial Planning and Expert Advice

Receiving such a large sum of money necessitates immediate and comprehensive financial planning. Simply put, managing this kind of wealth requires professional assistance. Hiring a team of experienced financial advisors, tax attorneys, and estate planners is crucial to protect the winnings and ensure long-term financial security. These professionals can help with:

- Investment Strategies: Diversifying the winnings across a range of low-risk and high-growth investments.

- Tax Optimization: Minimizing tax liabilities through legal and legitimate means.

- Estate Planning: Protecting the assets for future generations and avoiding potential inheritance issues.

- Charitable Giving: Strategically planning charitable donations to maximize tax benefits and contribute to worthy causes.

Finding Reliable Financial Professionals

Finding the right financial team is critical. Look for professionals with experience handling high-net-worth individuals and a proven track record of success. Check references, seek recommendations, and ensure they hold the necessary certifications and licenses. Don't rush into any decisions; thorough research and due diligence are paramount.

Conclusion: The Powerball Dream and Financial Reality

Winning the lottery is a life-changing event, but it's crucial to understand the financial realities involved. While the advertised jackpot is impressive, the net payout after taxes is significantly lower. Proactive financial planning with the guidance of experienced professionals is essential to safeguard the winnings and ensure a secure financial future. Remember, the true wealth lies not just in the initial win, but in the wise management of the funds afterward.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Understanding The $449 Million Powerball Win: Taxes And Net Payout. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mariners Top Prospects Rodriguez Emerson And Cijntjes Performance On 8 4 25

Aug 07, 2025

Mariners Top Prospects Rodriguez Emerson And Cijntjes Performance On 8 4 25

Aug 07, 2025 -

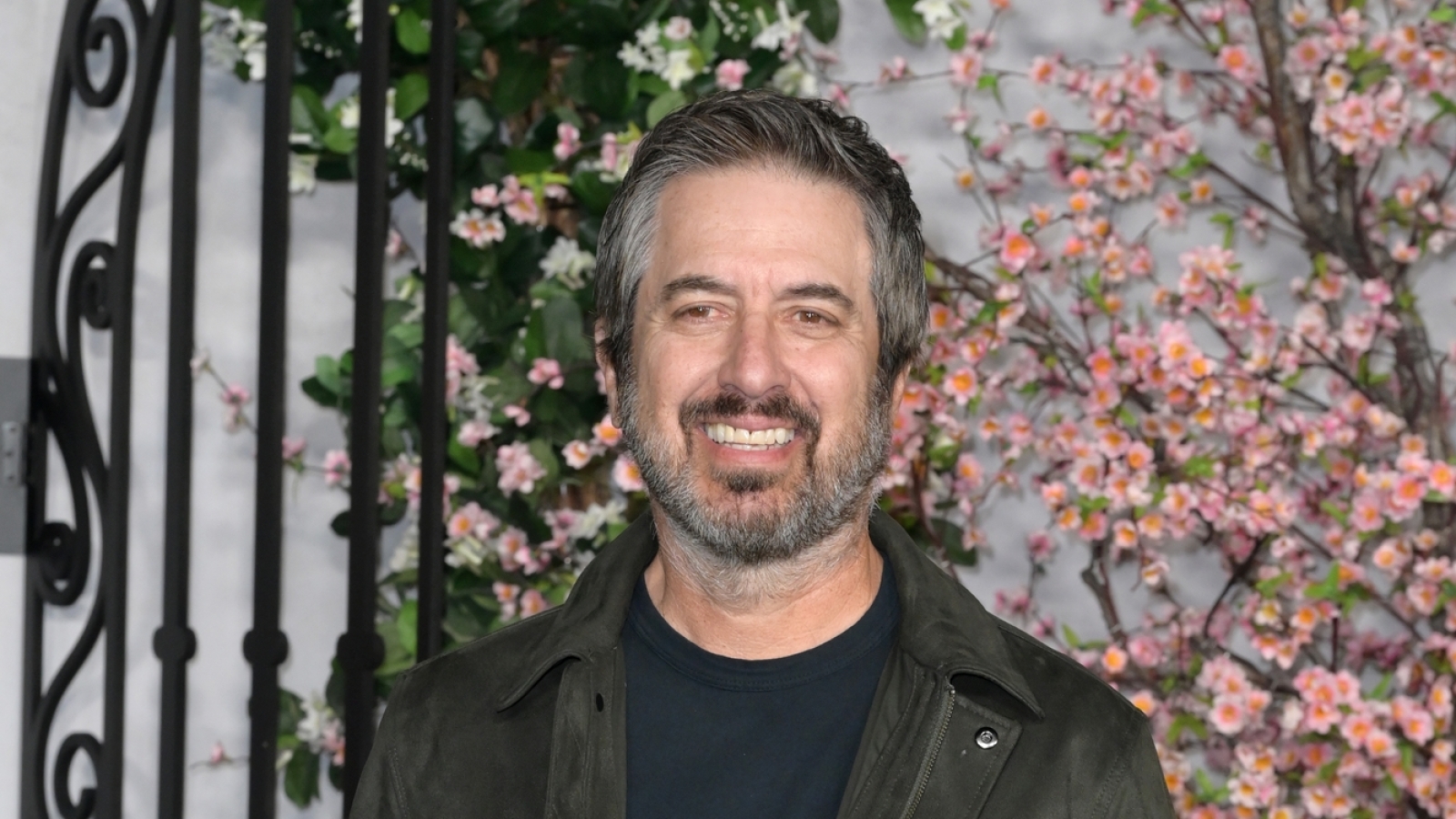

How Ray Romanos Everybody Loves Raymond Reshaped Kevin James Sitcom Approach

Aug 07, 2025

How Ray Romanos Everybody Loves Raymond Reshaped Kevin James Sitcom Approach

Aug 07, 2025 -

From Cinema To Streaming How Platonic Shows Comedys Tv Migration

Aug 07, 2025

From Cinema To Streaming How Platonic Shows Comedys Tv Migration

Aug 07, 2025 -

How Ray Romanos Everybody Loves Raymond Reshaped Kevin Jamess Sitcom Approach

Aug 07, 2025

How Ray Romanos Everybody Loves Raymond Reshaped Kevin Jamess Sitcom Approach

Aug 07, 2025 -

Inside The Campaign Parents Demand Tech Free Learning Environments

Aug 07, 2025

Inside The Campaign Parents Demand Tech Free Learning Environments

Aug 07, 2025

Latest Posts

-

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025

Film Review Weapons Does It Live Up To The Barbarian Hype

Aug 08, 2025 -

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025

Weapons A Review Of Creggers Latest Horror Thriller

Aug 08, 2025 -

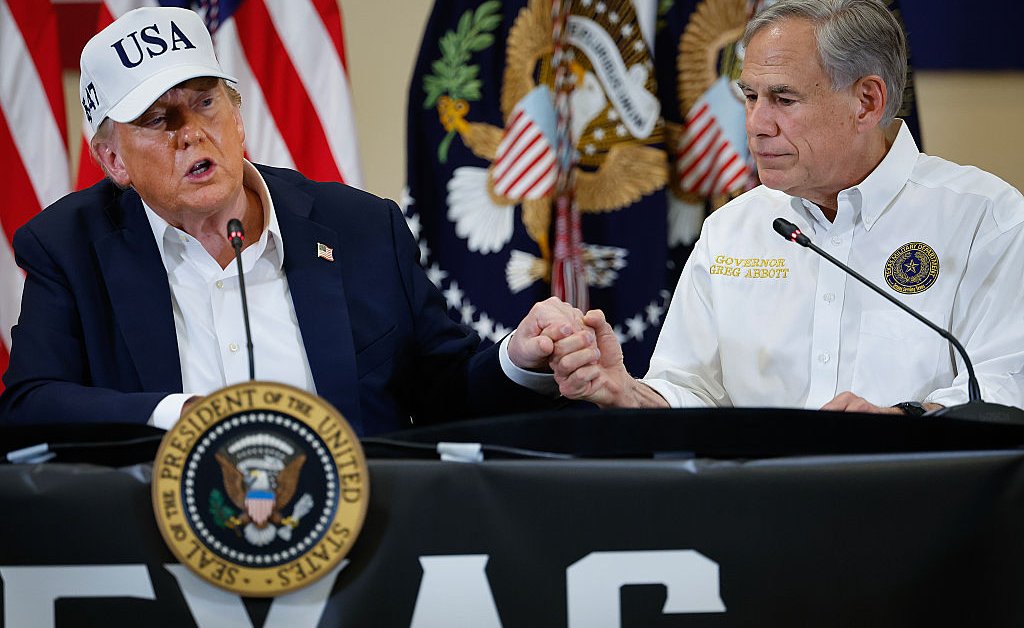

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025

Did Texas Redistricting Swing The 2022 Midterms Towards Trump Analysis And Implications

Aug 08, 2025 -

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025

When To Go To The Er 10 Critical Symptoms To Watch For

Aug 08, 2025