Uber Stock: Is Now The Time To Sell?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Uber Stock: Is Now the Time to Sell? Navigating the Ride-Sharing Giant's Uncertain Future

Uber. The name conjures images of convenient rides, food delivery, and a tech giant disrupting traditional industries. But for investors, the question remains: is now the time to cash in on their Uber stock (UBER)? The ride hasn't always been smooth, and understanding the current market landscape is crucial before making any decisions.

The past few years have been a rollercoaster for Uber investors. While the company has demonstrated impressive growth in its core ride-sharing and food delivery segments (Uber Eats), profitability has remained elusive. This has led to significant stock price fluctuations, leaving many investors questioning their next move.

Analyzing the Current Market Conditions Affecting UBER Stock

Several factors are currently influencing Uber's stock price and investor sentiment:

-

Inflation and Economic Uncertainty: Rising inflation and fears of a recession are impacting consumer spending, potentially reducing demand for ride-sharing and food delivery services. This macroeconomic headwind is impacting many companies, and Uber is no exception. [Link to a reputable source discussing current economic conditions]

-

Competition: Uber faces stiff competition from rivals like Lyft, as well as newer entrants in the food delivery market. This competitive landscape necessitates continued investment in technology and marketing, putting pressure on profit margins.

-

Driver Shortages and Labor Costs: Ongoing challenges in recruiting and retaining drivers continue to impact Uber's operational efficiency and costs. This is a significant concern, directly affecting the company's ability to meet demand and maintain service quality.

-

Regulatory Hurdles: Uber operates in a heavily regulated environment, facing ongoing legal battles and regulatory changes in various markets. These uncertainties contribute to the overall risk associated with investing in the company.

Signs Suggesting a Potential Sell:

While Uber has shown resilience and continues to innovate, several signs might suggest considering a sale:

-

Persistent Unprofitability: Despite significant revenue growth, Uber's consistent struggle to achieve consistent profitability raises concerns about its long-term sustainability.

-

High Valuation: Some analysts argue that Uber's current stock price may not fully reflect its underlying fundamentals, potentially indicating an overvalued asset. [Link to an analyst report supporting this view]

Reasons to Hold or Buy:

However, it's not all doom and gloom. Arguments for holding or even buying Uber stock include:

-

Dominant Market Position: Uber remains a dominant player in the ride-sharing and food delivery markets, possessing significant brand recognition and network effects.

-

Technological Innovation: Uber continues to invest heavily in technology, exploring autonomous vehicles and other innovations that could significantly impact its future profitability.

-

Growth Potential in Emerging Markets: Significant growth opportunities exist in expanding into new and developing markets.

Conclusion: A Calculated Decision

Ultimately, the decision of whether to sell your Uber stock is a deeply personal one, dependent on your individual risk tolerance, investment timeline, and overall portfolio strategy. Thorough research and consideration of the factors outlined above are paramount. Consulting with a qualified financial advisor can provide personalized guidance based on your specific circumstances. Don't rely solely on short-term market fluctuations; focus on the long-term potential and the risks involved.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Uber Stock: Is Now The Time To Sell?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wedbush Maintains Positive Outlook For Oklo Inc Oklo Raises Target

May 28, 2025

Wedbush Maintains Positive Outlook For Oklo Inc Oklo Raises Target

May 28, 2025 -

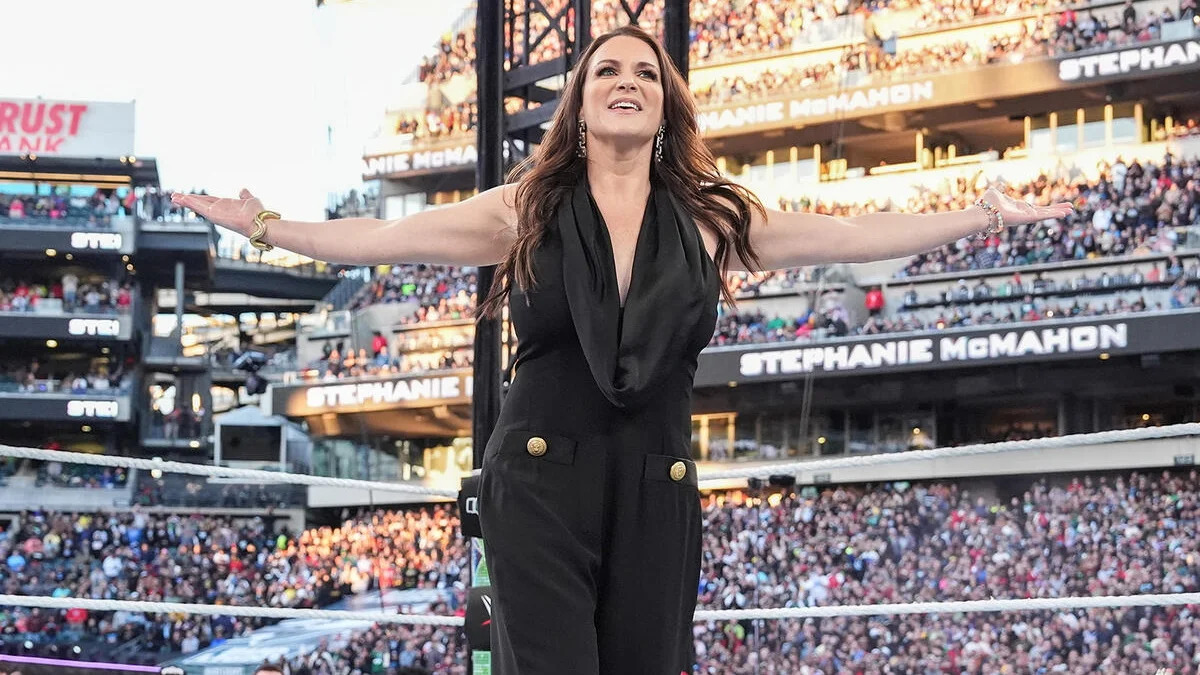

Stephanie Mc Mahon Opens Up About A Tattoo Decision Shes Glad She Avoided

May 28, 2025

Stephanie Mc Mahon Opens Up About A Tattoo Decision Shes Glad She Avoided

May 28, 2025 -

Lincoln Financials Tender Offer A 45 Million Increase And 812 Million In Securities

May 28, 2025

Lincoln Financials Tender Offer A 45 Million Increase And 812 Million In Securities

May 28, 2025 -

Economic Benefits Of Climate Action Brazils Finance Chiefs Vision

May 28, 2025

Economic Benefits Of Climate Action Brazils Finance Chiefs Vision

May 28, 2025 -

Los Angeles Sparks Fans Rejoice Cameron Brink Video Signals Potential Return

May 28, 2025

Los Angeles Sparks Fans Rejoice Cameron Brink Video Signals Potential Return

May 28, 2025