U.S. Treasury Yields Slip On Fed's Projected 2025 Rate Cut

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Yields Slip as Fed Hints at 2025 Rate Cut

U.S. Treasury yields experienced a decline on Wednesday following the Federal Reserve's latest projections, which hinted at a potential interest rate cut in 2025. This move sent ripples through the financial markets, prompting investors to reassess their strategies in light of the central bank's evolving outlook on inflation and economic growth. The shift suggests a potential softening of the aggressive monetary policy implemented to combat inflation over the past year.

The Federal Open Market Committee (FOMC) released its updated economic projections, revealing a median forecast that anticipates interest rates remaining at their current elevated levels through the end of 2024. However, the projections also suggested a potential rate cut in 2025, a departure from previous forecasts that had indicated rates remaining steady well into 2025 or even beyond. This subtle shift in expectation had a palpable impact on Treasury yields.

What Drove the Yield Dip?

The market's reaction to the Fed's projected rate cut stems from several factors:

-

Easing Inflation Concerns: While inflation remains stubbornly high, recent data suggests a potential cooling, prompting the Fed to become slightly less hawkish in its approach. The expectation of a future rate cut reflects a growing belief among policymakers that inflation is under control and less aggressive monetary policy will suffice.

-

Economic Growth Concerns: The projections also incorporated a slight downward revision of economic growth forecasts. This hints at a potential slowdown in the economy, which could necessitate a less restrictive monetary policy to stimulate growth. A slower-than-expected economic recovery could make higher interest rates less necessary.

-

Investor Sentiment: The change in the Fed's projections influenced investor sentiment, leading to a flight to safety. Investors, anticipating a less aggressive interest rate environment in the future, shifted their investments toward longer-term Treasury bonds, pushing yields lower. This reflects a belief that the risks associated with higher-yielding assets have increased.

Impact on the Broader Market

The decline in Treasury yields has implications that extend beyond the bond market. Lower yields can:

-

Boost Stock Prices: Lower interest rates generally stimulate borrowing and investment, potentially leading to higher corporate profits and increased stock valuations. The decreased cost of borrowing can fuel business expansion and investment.

-

Weaken the Dollar: Lower U.S. interest rates can make dollar-denominated assets less attractive to foreign investors, potentially weakening the U.S. dollar against other currencies.

-

Impact Mortgage Rates: While not immediately impactful, the projected rate cut could eventually influence mortgage rates, potentially making homeownership more affordable in the future. However, the current mortgage rate environment remains significantly impacted by various factors beyond just the Fed's actions.

Looking Ahead: Uncertainty Remains

While the Fed's projected rate cut in 2025 suggests a potential pivot in monetary policy, significant uncertainty remains. The actual timing and magnitude of any future rate cuts will depend heavily on evolving economic data and inflation trends. The global economic landscape also continues to present challenges, adding another layer of complexity to the forecast.

Investors and economists will closely monitor key economic indicators like inflation data, employment figures, and consumer spending to gauge the Fed's future actions. The coming months will be crucial in determining whether the projected rate cut materializes and the extent of its impact on the broader financial markets. Staying informed about economic developments and central bank pronouncements is vital for navigating this evolving landscape. For more in-depth analysis, consider exploring resources from reputable financial news outlets and economic research institutions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Yields Slip On Fed's Projected 2025 Rate Cut. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Diminished Role Putins Actions Speak Volumes

May 20, 2025

Trumps Diminished Role Putins Actions Speak Volumes

May 20, 2025 -

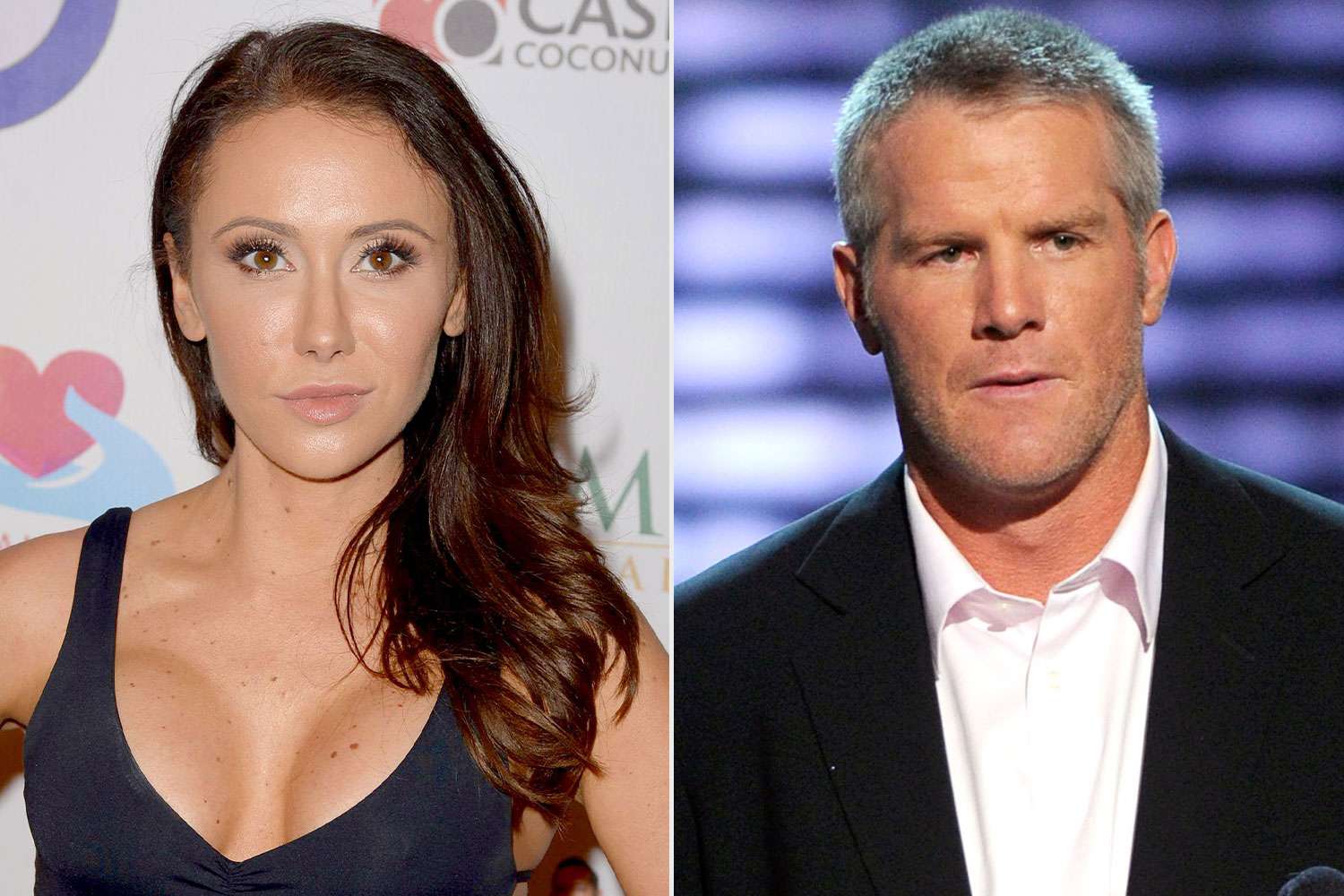

The Lasting Effects Jenn Sterger Reflects On The Brett Favre Sexting Controversy

May 20, 2025

The Lasting Effects Jenn Sterger Reflects On The Brett Favre Sexting Controversy

May 20, 2025 -

Stream The Critically Acclaimed Ww 1 Film Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025

Stream The Critically Acclaimed Ww 1 Film Starring Daniel Craig Cillian Murphy And Tom Hardy

May 20, 2025 -

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025

Stock Market Soars S And P 500s 6 Day Rally Continues Dow And Nasdaq Join The Surge

May 20, 2025 -

Get Master Of Ceremony Rewards In Helldivers 2 Warbond Drop On May 15th

May 20, 2025

Get Master Of Ceremony Rewards In Helldivers 2 Warbond Drop On May 15th

May 20, 2025