U.S. Treasury Market Reacts: One Fed Rate Cut Predicted For 2025

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reacts: One Fed Rate Cut Predicted for 2025

The U.S. Treasury market experienced a ripple effect following recent predictions forecasting only one Federal Reserve interest rate cut in 2025. This tempered expectation, a shift from previous forecasts predicting multiple cuts, reflects a recalibration of market sentiment regarding the future trajectory of inflation and the overall economic outlook. The implications for investors and the broader economy are significant.

Shifting Market Sentiment: From Multiple Cuts to One

For much of the year, market analysts had anticipated a series of interest rate reductions by the Federal Reserve throughout 2025, reflecting a belief that inflation would cool significantly and economic growth would slow. However, the recent consensus points to a single rate cut, suggesting a more persistent inflationary environment and a more resilient economy than initially projected. This shift has led to increased volatility in the Treasury market, particularly impacting longer-term yields.

Why the Change in Prediction?

Several factors contribute to this revised forecast:

- Persistent Inflation: While inflation has cooled from its peak, it remains stubbornly above the Federal Reserve's target of 2%. The continued strength in the labor market and robust consumer spending are contributing factors, indicating a less urgent need for aggressive rate cuts.

- Stronger-than-Expected Economic Growth: Recent economic data has shown surprising resilience, defying predictions of a significant slowdown or recession. This stronger-than-anticipated growth reduces the pressure on the Fed to stimulate the economy through rate cuts.

- Geopolitical Uncertainty: Global geopolitical instability, including the ongoing war in Ukraine and tensions in other regions, contributes to uncertainty in the market and influences the Fed's decision-making process. These uncertainties often necessitate a more cautious approach to monetary policy.

Impact on Treasury Yields and Investors

The prediction of a single rate cut has had a noticeable impact on Treasury yields. Longer-term yields, which are particularly sensitive to interest rate expectations, have risen slightly, reflecting investors' reassessment of the future monetary policy landscape. This means investors might see slightly lower returns on longer-term Treasury bonds compared to previous expectations.

What This Means for the Broader Economy

The revised forecast suggests a more prolonged period of higher interest rates, which could impact various sectors of the economy. Higher borrowing costs could potentially slow down business investment and consumer spending, though the current economic resilience might mitigate this impact.

Looking Ahead: Uncertainty Remains

While the current prediction anticipates a single rate cut in 2025, it's crucial to remember that the economic landscape remains fluid. Unforeseen events, shifts in inflation, and changes in the labor market could all alter the Federal Reserve's course. Continuous monitoring of economic indicators and Federal Reserve statements is essential for investors and businesses alike.

Call to Action: Stay informed about economic developments and consult with financial advisors to make informed investment decisions in this dynamic market environment. Understanding the nuances of the Treasury market and its response to Federal Reserve policy is crucial for navigating the complexities of the current economic climate. For more in-depth analysis on the Treasury market, explore resources from the Federal Reserve [link to Federal Reserve website] and reputable financial news outlets.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reacts: One Fed Rate Cut Predicted For 2025. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Beyond The Game Exploring Evolved Joel And Ellie Bond In The Last Of Us Season 2

May 21, 2025

Beyond The Game Exploring Evolved Joel And Ellie Bond In The Last Of Us Season 2

May 21, 2025 -

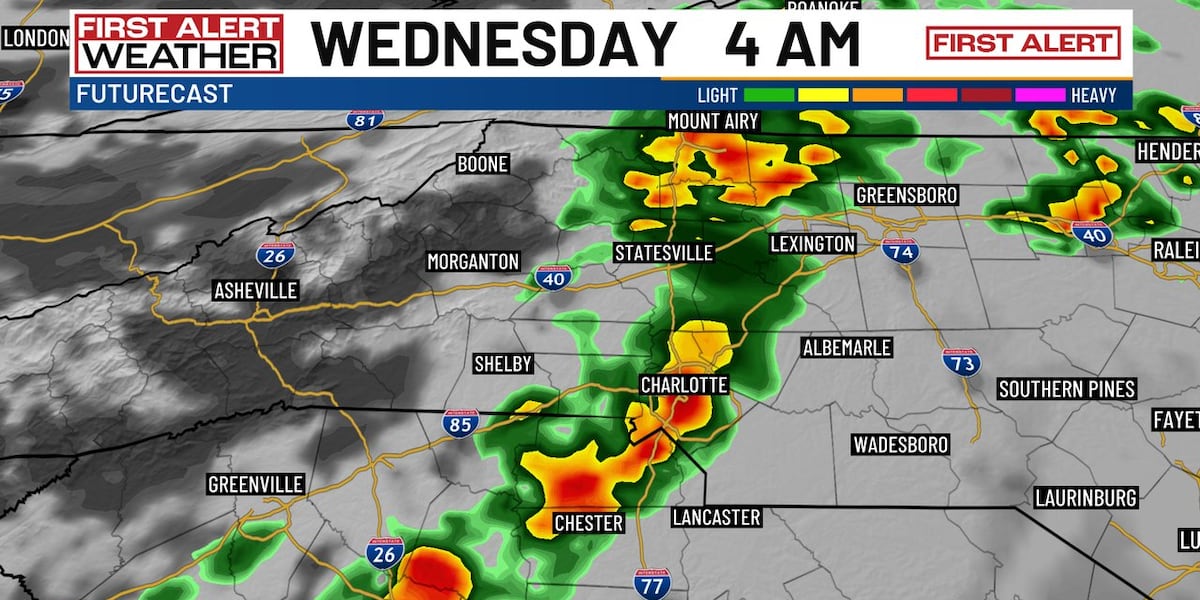

Charlotte Residents Urged To Prepare Severe Storms And Temperature Plunge Forecast

May 21, 2025

Charlotte Residents Urged To Prepare Severe Storms And Temperature Plunge Forecast

May 21, 2025 -

Jon Jones Vs Tom Aspinall Analyzing The Controversial Strip The Duck Statement

May 21, 2025

Jon Jones Vs Tom Aspinall Analyzing The Controversial Strip The Duck Statement

May 21, 2025 -

Stream The Intense Wwi Movie With Daniel Craig Cillian Murphy And Tom Hardy Today

May 21, 2025

Stream The Intense Wwi Movie With Daniel Craig Cillian Murphy And Tom Hardy Today

May 21, 2025 -

Ellen De Generes Shares Heartbreaking Post About Irreplaceable Family Loss

May 21, 2025

Ellen De Generes Shares Heartbreaking Post About Irreplaceable Family Loss

May 21, 2025