U.S. Treasury Market Reaction: Fed's 2025 Rate Cut Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Treasury Market Reaction: Fed's 2025 Rate Cut Outlook Sends Shocks Through the System

The U.S. Treasury market experienced significant volatility following recent comments from Federal Reserve officials hinting at potential interest rate cuts as early as 2025. This unexpected shift in outlook has sent ripples through the financial landscape, prompting investors to reassess their strategies and sparking debate about the future trajectory of the American economy. The market's reaction underscores the sensitive interplay between central bank policy and investor sentiment.

The Catalyst: Shifting Expectations for the Fed's Rate Path

For months, the prevailing narrative had focused on the Fed's commitment to maintaining higher interest rates for an extended period to combat persistent inflation. However, recent statements from several Fed governors have suggested a more nuanced approach, acknowledging the possibility of rate reductions in 2025 should inflation cool significantly and economic growth slow. This departure from the previously hawkish stance caught many market participants off guard.

Treasury Yields Tumble: A Market Response to Rate Cut Speculation

The prospect of future rate cuts immediately impacted Treasury yields. Longer-term Treasury yields, which are highly sensitive to interest rate expectations, experienced a notable decline. This drop reflects the reduced attractiveness of holding longer-term bonds when the expectation is that future interest rates will be lower. The yield curve, the difference between short-term and long-term Treasury yields, also flattened, a common occurrence when rate cuts are anticipated.

Analyzing the Market's Reaction: Fear and Uncertainty

The market's reaction isn't simply a uniform response to lower rates. There's a significant element of uncertainty at play. Investors are grappling with several key questions:

- How credible are the 2025 rate cut projections? The Fed's forecasts are notoriously difficult to predict, and unforeseen economic developments could easily alter the course of monetary policy.

- What's the true state of the economy? Conflicting economic indicators make it challenging to gauge the actual strength of the economy and the effectiveness of the Fed's current policy. Are we headed for a soft landing or a recession? This uncertainty is fueling volatility.

- How will inflation behave in the coming months? Inflation remains a key factor influencing the Fed's decisions. Any resurgence in inflation could quickly derail the expectations of rate cuts.

Implications for Investors: Navigating the Shifting Landscape

The shifting landscape requires investors to reassess their portfolios. The decline in Treasury yields may impact the returns on fixed-income investments. This uncertainty necessitates a more cautious approach, focusing on diversification and risk management. Investors are advised to consult with financial advisors to adjust their strategies accordingly.

Looking Ahead: Uncertainty Remains Paramount

While the Fed's hints at potential 2025 rate cuts have significantly impacted the Treasury market, considerable uncertainty remains. The economic outlook continues to be volatile, making it challenging to accurately predict the future path of interest rates. Close monitoring of economic data, including inflation reports and employment figures, will be crucial in navigating this period of market uncertainty. Further clarity from the Fed regarding its policy intentions will be eagerly awaited by investors and market analysts alike. This situation highlights the dynamic and often unpredictable nature of the financial markets and the importance of staying informed.

Call to Action: Stay tuned for further updates on this developing story. Follow us for continuous coverage of the U.S. Treasury market and the Federal Reserve's monetary policy decisions. Learn more about [link to relevant financial news resource].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Treasury Market Reaction: Fed's 2025 Rate Cut Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

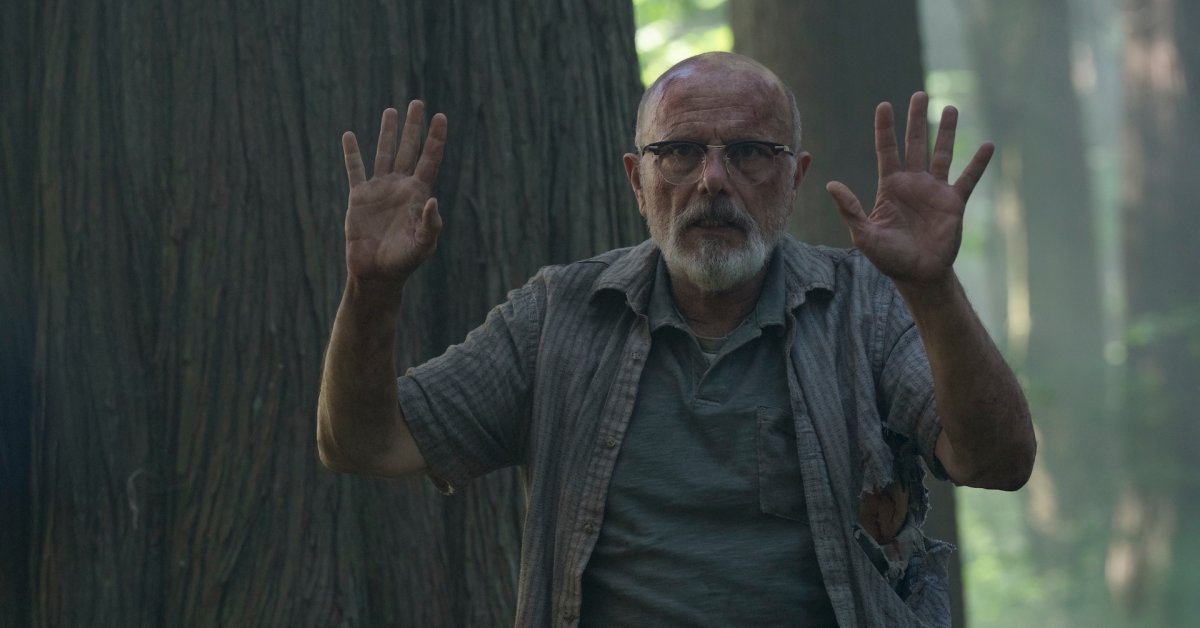

Reframing Relationships How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025

Reframing Relationships How The Last Of Us Show Diverges From The Games Narrative

May 20, 2025 -

Brett Favres Fall Espn Producer A J Perez Speaks Out On Threats

May 20, 2025

Brett Favres Fall Espn Producer A J Perez Speaks Out On Threats

May 20, 2025 -

Israel Faces Sanctions Threats As Initial Gaza Aid Delivery Falls Short

May 20, 2025

Israel Faces Sanctions Threats As Initial Gaza Aid Delivery Falls Short

May 20, 2025 -

Venezuela Tps Supreme Court Decision Opens Door To Mass Deportations

May 20, 2025

Venezuela Tps Supreme Court Decision Opens Door To Mass Deportations

May 20, 2025 -

Balis Tourism Safety An Appeal For International Collaboration

May 20, 2025

Balis Tourism Safety An Appeal For International Collaboration

May 20, 2025