U.S. Private Sector Hiring Slows In May: ADP Report Shows 37,000 Job Gains, 4.5% Annual Pay Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

U.S. Private Sector Hiring Slows in May: ADP Report Reveals Tepid Job Growth

The U.S. private sector added a significantly smaller number of jobs in May than anticipated, signaling a potential cooling in the labor market. The ADP National Employment Report revealed a mere 132,000 jobs created, a stark contrast to the robust growth seen in previous months and far below the expected 180,000. This slowdown raises questions about the overall health of the U.S. economy and the Federal Reserve's ongoing efforts to combat inflation.

A Significant Drop from Previous Months

The May figures represent a dramatic decrease from the upwardly revised 296,000 jobs added in April. Economists and market analysts had projected a more modest decline, but the actual numbers underscore a more pronounced weakening in hiring activity. This slowdown could indicate that businesses are becoming more cautious in their hiring practices, possibly in response to persistent inflation and rising interest rates.

Wage Growth Remains Persistent Despite Hiring Slowdown

Despite the weaker-than-expected job growth, average private sector wages continued to climb. The report showed a 4.5% year-over-year increase in compensation, demonstrating a continuing, albeit perhaps moderating, level of inflationary pressure within the labor market. This sustained wage growth may complicate the Federal Reserve's efforts to cool inflation, as robust wage increases can fuel further price hikes. The continued wage growth highlights the ongoing tightness within the labor market, even as hiring slows.

What Does this Mean for the Economy?

The ADP report's findings add another layer of complexity to the ongoing economic narrative. While a slowdown in job growth can be interpreted as a positive sign in the fight against inflation, it also raises concerns about potential economic stagnation. The relatively high wage growth, combined with the decelerating job creation, presents a challenging scenario for policymakers. Further complicating matters is the divergence between the ADP report and the upcoming official employment numbers from the Bureau of Labor Statistics (BLS). The BLS's nonfarm payroll report, typically released on the first Friday of each month, is considered the benchmark for employment data and often provides a different perspective.

Looking Ahead: Uncertainty Remains

The ADP report's findings leave economists and investors with considerable uncertainty regarding the future trajectory of the economy. The relatively low job growth coupled with continued wage increases suggests a complex interplay of economic forces. The upcoming BLS report will be crucial in providing a clearer picture of the employment situation and in guiding the Federal Reserve's future monetary policy decisions. This situation highlights the ongoing delicate balance between controlling inflation and avoiding a potential economic downturn.

Key Takeaways:

- Significant Hiring Slowdown: Only 132,000 private sector jobs were added in May, far below expectations.

- Persistent Wage Growth: Annual pay increased by 4.5%, indicating continued inflationary pressure.

- Uncertainty Remains: The ADP report raises concerns about the economic outlook and the effectiveness of current monetary policy.

- Upcoming BLS Report Crucial: The official jobs report from the BLS will offer further insight.

Stay informed about the latest economic news by subscribing to our newsletter! (This is a subtle CTA). We will keep you updated on significant economic developments as they unfold. The evolving employment situation in the United States remains a critical indicator of overall economic health.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on U.S. Private Sector Hiring Slows In May: ADP Report Shows 37,000 Job Gains, 4.5% Annual Pay Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Twenty Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Plan

Jun 04, 2025

Twenty Years 100 Pounds Lighter Al Rokers Lasting Weight Loss Plan

Jun 04, 2025 -

Pitt Vs Wvu Twitter Reacts To Logo Disrespect

Jun 04, 2025

Pitt Vs Wvu Twitter Reacts To Logo Disrespect

Jun 04, 2025 -

Saharan Dust Storm Current Path And Potential Impacts On The Caribbean And Us

Jun 04, 2025

Saharan Dust Storm Current Path And Potential Impacts On The Caribbean And Us

Jun 04, 2025 -

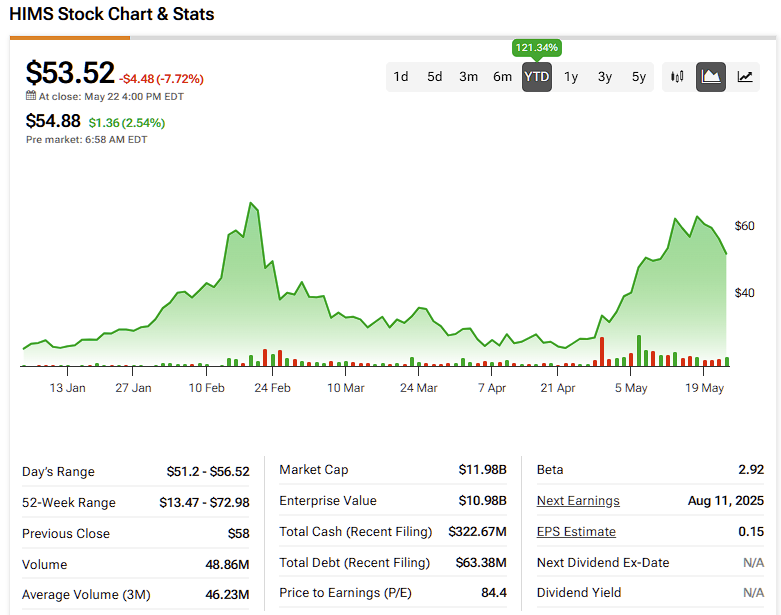

Is Hims And Hers Hims Stock A Buy Or Sell In 2024

Jun 04, 2025

Is Hims And Hers Hims Stock A Buy Or Sell In 2024

Jun 04, 2025 -

Did Scott Walkers Endorsement Backfire Analyzing Trumps Reaction

Jun 04, 2025

Did Scott Walkers Endorsement Backfire Analyzing Trumps Reaction

Jun 04, 2025