Two-Year Low: Australia Cuts Interest Rates As Inflation Recedes

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Two-Year Low: Australia Cuts Interest Rates as Inflation Recedes

Australia's central bank, the Reserve Bank of Australia (RBA), has delivered a significant blow to mortgage holders hoping for further rate hikes, slashing the official cash rate by 25 basis points to a two-year low of 3.75%. This move, announced this morning, marks the first rate cut since November 2021 and signals a shift in the RBA's strategy as inflation shows signs of cooling. The decision comes as a welcome relief to many homeowners struggling with rising living costs, but also raises questions about the ongoing economic outlook.

The RBA Governor, Philip Lowe, cited easing inflation pressures as the primary reason for the cut. While inflation remains above the bank's target range of 2-3%, recent data suggests a significant slowdown from the peak of 7.8% seen earlier this year. This deceleration, attributed to factors such as falling energy prices and a softening housing market, has allowed the RBA to adopt a more dovish stance.

Easing Inflation: A Key Factor

The RBA's decision highlights a growing trend globally: central banks are beginning to pause or reverse their aggressive interest rate hiking cycles as inflation shows signs of abating. While persistent inflation remains a concern, the RBA's assessment points towards a less severe inflationary environment than previously anticipated. This assessment is supported by recent data from the Australian Bureau of Statistics (ABS) showing a moderation in consumer price growth.

- Falling Energy Prices: A significant contributor to the easing inflation is the decline in global energy prices, reducing the impact on household energy bills.

- Softening Housing Market: The cooling housing market, marked by a decrease in house prices and slower growth in rents, has also contributed to lower inflation.

- Improved Supply Chains: Easing global supply chain disruptions have also helped to alleviate inflationary pressures.

What This Means for Homeowners and Borrowers:

The rate cut is expected to provide immediate relief to homeowners with variable-rate mortgages. This reduction will translate into lower monthly repayments, freeing up disposable income for many families. However, the impact will vary depending on individual loan structures and lender policies. Borrowers are encouraged to contact their lenders to understand the specific impact on their mortgage repayments.

While the cut is positive news for borrowers, it also raises concerns for savers who may see a further reduction in interest earned on their savings accounts. The RBA's focus remains on balancing inflation control with sustainable economic growth, a delicate balancing act requiring careful monitoring of economic indicators.

Looking Ahead: Uncertainty Remains

While the rate cut offers short-term respite, the RBA acknowledges the persistence of uncertainty in the economic outlook. Global economic conditions, potential further inflation pressures, and the ongoing impact of geopolitical events remain key factors that will influence future monetary policy decisions. The RBA has indicated it will closely monitor economic data and adjust its policy settings as needed. Further rate cuts or even potential hikes remain possibilities depending on the evolving economic landscape.

Call to Action: Stay informed about the latest economic news and updates by subscribing to our newsletter for regular financial insights. [Link to Newsletter Signup] Understanding these shifts is crucial for making informed financial decisions in the current economic climate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Two-Year Low: Australia Cuts Interest Rates As Inflation Recedes. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trump Plans Monday Call With Putin To Discuss Ending The Ukraine War

May 20, 2025

Trump Plans Monday Call With Putin To Discuss Ending The Ukraine War

May 20, 2025 -

Medical And Scientific Research A Foundation Of American Strength

May 20, 2025

Medical And Scientific Research A Foundation Of American Strength

May 20, 2025 -

Exclusive Jamie Lee Curtis Reveals Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025

Exclusive Jamie Lee Curtis Reveals Her Relationship With Lindsay Lohan After Freaky Friday

May 20, 2025 -

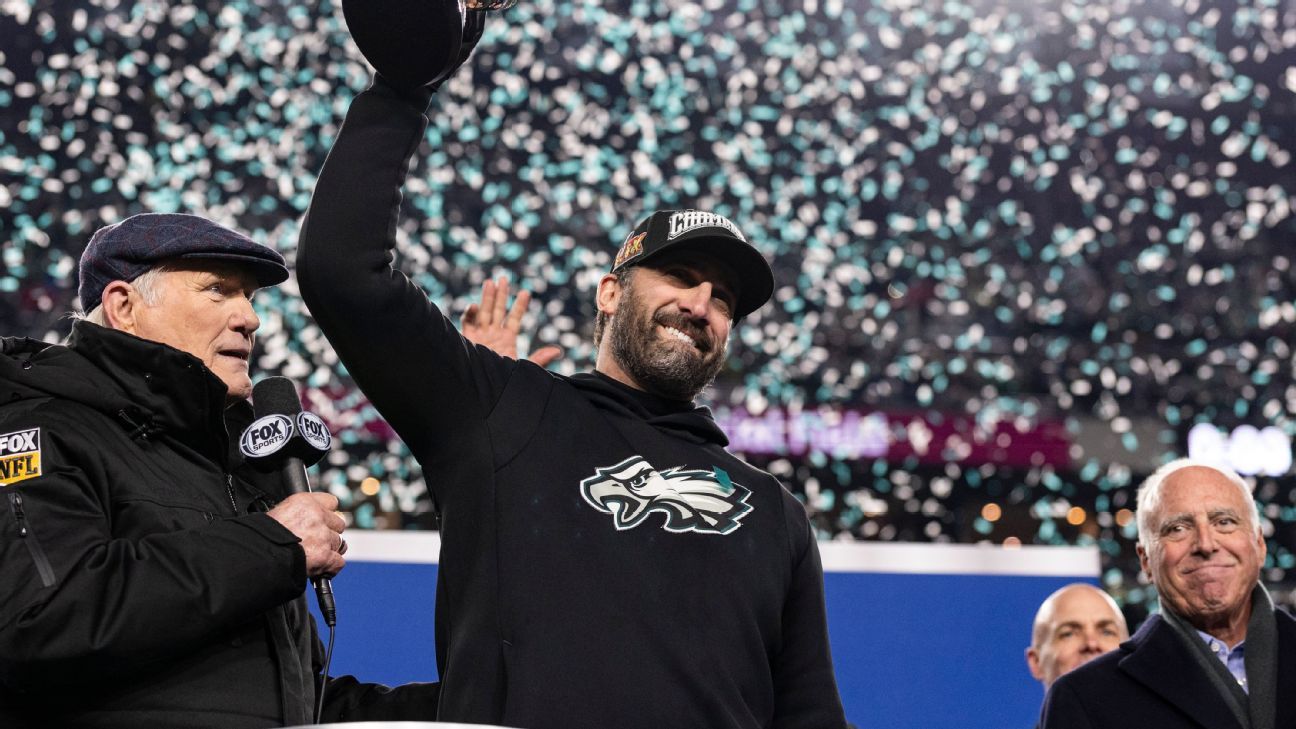

Eagles Lock Up Sirianni Coach Receives Deserved Contract Extension

May 20, 2025

Eagles Lock Up Sirianni Coach Receives Deserved Contract Extension

May 20, 2025 -

War 2 Teaser Unveiled Kabirs Fierce Return And Clash With Jr Ntr

May 20, 2025

War 2 Teaser Unveiled Kabirs Fierce Return And Clash With Jr Ntr

May 20, 2025