Trump's Tax Bill: A Looming Crisis For Iowa Food Pantries?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tax Bill: A Looming Crisis for Iowa Food Pantries?

The 2017 tax cuts, championed by then-President Donald Trump, may be silently starving Iowa's most vulnerable. While touted as economic stimulus, the changes are now raising serious concerns about the long-term viability of food pantries across the state, leaving many wondering if a looming crisis is on the horizon. The ripple effects of these seemingly unrelated policy changes are starkly impacting the organizations dedicated to feeding Iowa's hungry.

The initial euphoria surrounding the Trump tax cuts has faded, replaced by a growing unease among non-profit organizations. The cuts, which significantly lowered the corporate tax rate, initially seemed to offer benefits across the board. However, the reality for many smaller charities, including food pantries reliant on charitable donations and corporate sponsorships, is far more complex.

The Impact on Charitable Giving

One key element of the 2017 tax bill was the standardized deduction increase. While intended to simplify tax filings for individuals, this change inadvertently reduced the incentive for itemized deductions – a crucial mechanism for many high-income donors who previously claimed deductions for charitable contributions. This shift has led to a demonstrable decrease in overall charitable giving, impacting organizations that rely heavily on these donations to operate.

- Reduced Incentive: The larger standard deduction means fewer taxpayers are itemizing, leading to fewer charitable deduction claims.

- Decreased Donations: Food pantries across Iowa report a noticeable decline in individual donations since the tax law changes.

- Corporate Impact: While corporate tax cuts were intended to boost giving, many corporations have prioritized shareholder returns over increased charitable contributions.

Many Iowa food banks, like the Food Bank of Iowa, are already struggling to meet the rising demand for food assistance. The combination of inflation, increased food prices, and reduced donations is creating a perfect storm. This isn't just about numbers; it's about real people facing real hunger.

A State-Wide Struggle

The problem isn't isolated to a single region. Reports from across Iowa paint a consistent picture of dwindling resources and increased demand. Food pantries in rural areas, often already operating on limited budgets, are particularly vulnerable. Smaller, independent organizations lack the resources to weather this storm, potentially leading to closures and leaving communities without vital support.

The consequences of these closures would be devastating. Food insecurity in Iowa is a significant issue, and the potential loss of these critical services could have catastrophic consequences for vulnerable populations, including children, the elderly, and the working poor.

Looking Ahead: Solutions and Advocacy

Addressing this looming crisis requires a multi-pronged approach. Advocacy groups are calling for policy changes to incentivize charitable giving, along with increased government funding for food assistance programs. Increased public awareness is also crucial. Individuals can help by:

- Donating to local food banks and pantries. Even small donations can make a significant difference.

- Volunteering their time. Many food pantries rely on volunteers to sort food, pack boxes, and distribute food to those in need.

- Contacting their elected officials. Urging for policy changes that support food security is vital.

The impact of the Trump tax bill on Iowa's food pantries is a complex issue with far-reaching consequences. While the initial intentions of the legislation may have been different, the unintended consequences are now severely impacting the most vulnerable members of society. Addressing this situation requires immediate attention and collective action. The question is not just about economics; it's about the moral responsibility of ensuring that everyone has access to the basic necessities of life, including food. Ignoring this growing crisis is not an option.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's Tax Bill: A Looming Crisis For Iowa Food Pantries?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

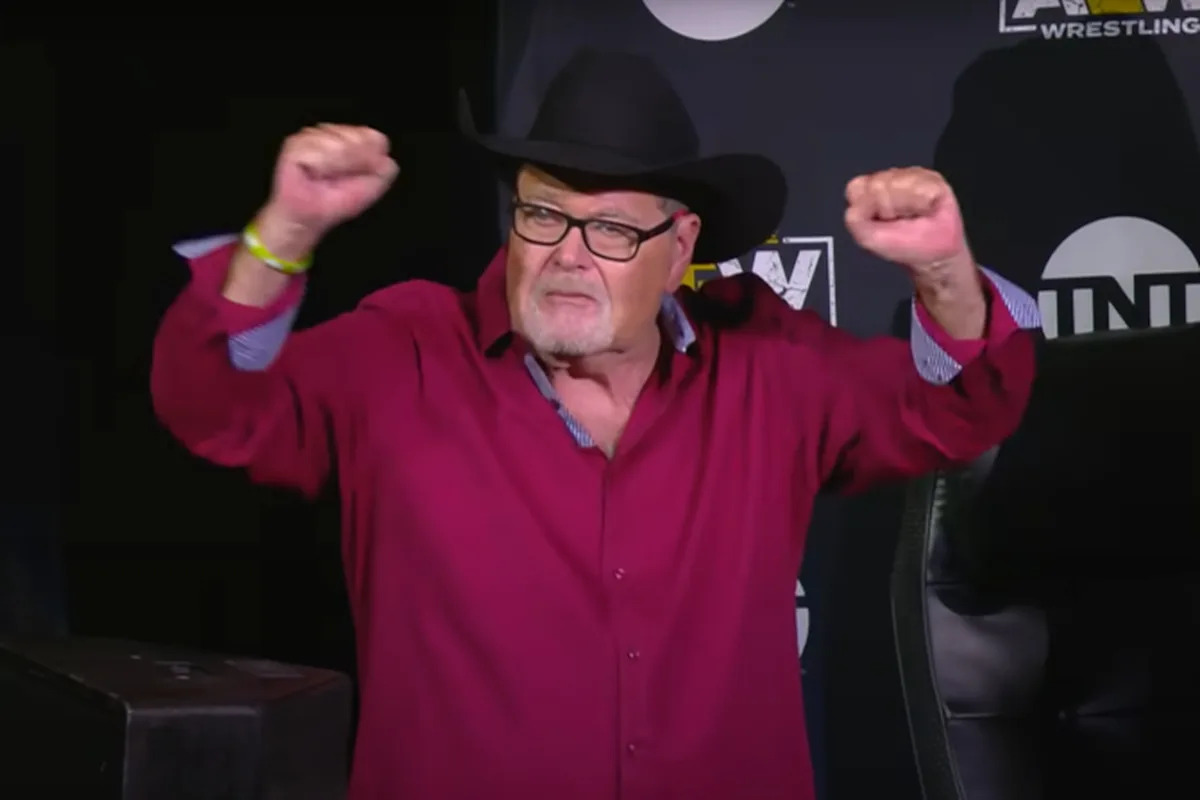

Jim Ross All In Texas Appearance Cancer Free And Ready To Rumble

Jul 08, 2025

Jim Ross All In Texas Appearance Cancer Free And Ready To Rumble

Jul 08, 2025 -

Northeast Battles Rising Tick Numbers And The Spread Of Lyme Disease

Jul 08, 2025

Northeast Battles Rising Tick Numbers And The Spread Of Lyme Disease

Jul 08, 2025 -

Israeli Airstrikes Target Yemeni Ports And Galaxy Leader Vessel Idf Confirms

Jul 08, 2025

Israeli Airstrikes Target Yemeni Ports And Galaxy Leader Vessel Idf Confirms

Jul 08, 2025 -

Pro Wrestling News Jim Ross All In 2025 Commentary Return

Jul 08, 2025

Pro Wrestling News Jim Ross All In 2025 Commentary Return

Jul 08, 2025 -

South Africas Mulder A Commanding Performance As Interim Test Captain

Jul 08, 2025

South Africas Mulder A Commanding Performance As Interim Test Captain

Jul 08, 2025