Trump's China Trade Secret Weapon: Jim Cramer's Analysis & Top 10 Stock Picks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's China Trade Secret Weapon: Jim Cramer's Analysis & Top 10 Stock Picks

Donald Trump's trade war with China sent shockwaves through the global economy. While the long-term effects are still unfolding, one aspect often overlooked is the potential for strategic investment opportunities amidst the turmoil. Financial guru Jim Cramer, known for his outspoken opinions and market analysis on CNBC's "Mad Money," has weighed in on this complex situation, identifying potential winners and losers. This article delves into Cramer's analysis and reveals his top 10 stock picks for navigating the evolving landscape of US-China trade relations.

Cramer's Perspective on the US-China Trade War:

Cramer, never one to shy away from controversy, has consistently offered a nuanced perspective on the US-China trade war. He hasn't simply labeled it good or bad, but instead, analyzed its impact on specific sectors and individual companies. His analysis focuses less on broad macroeconomic predictions and more on identifying companies strategically positioned to benefit from, or at least withstand, the trade tensions. He often emphasizes the importance of understanding the intricacies of supply chains and the shifting global economic landscape.

Beyond the Headlines: Understanding the Nuances

While the headlines often focus on tariffs and trade deficits, Cramer's analysis digs deeper. He examines how companies are adapting their strategies, exploring alternative supply chains, and leveraging opportunities created by the changing geopolitical environment. This granular approach allows him to identify companies that might be overlooked by broader market analyses.

Cramer's Top 10 Stock Picks (Disclaimer: This is not financial advice):

It's crucial to remember that this is not financial advice. Investment decisions should always be made after thorough research and consultation with a qualified financial advisor. However, understanding Cramer's choices can offer valuable insight into his investment philosophy and potential market trends. While he hasn't explicitly released a "Top 10" list directly tied to the China trade war, analyzing his commentary and recommendations across various platforms, we can extrapolate a likely portfolio based on his consistent emphasis on specific sectors. This list represents a possible interpretation and may not reflect his exact current holdings:

- Companies benefitting from reshoring: Manufacturing companies relocating production back to the US due to tariffs and supply chain disruptions.

- Tech companies less reliant on Chinese components: Firms developing alternative supply chains and less dependent on Chinese manufacturing.

- Companies with strong domestic demand: Businesses whose success is primarily driven by the robust US consumer market.

- Agricultural companies: Sectors potentially impacted by trade agreements and shifting global demand.

- Defense contractors: Companies benefiting from increased defense spending and geopolitical instability.

- Energy companies (specifically those focused on domestic production): Reduced reliance on foreign energy sources.

- Infrastructure companies: Beneficiaries of increased infrastructure spending and domestic construction projects.

- Pharmaceutical companies with strong intellectual property: Less susceptible to direct competition from Chinese manufacturers.

- Companies with diversified international operations: Businesses able to mitigate risks associated with US-China trade tensions.

- Technology companies leading in AI and automation: Firms driving innovation and efficiency to offset labor cost pressures.

Investing in Uncertainty: A Cautious Approach

The US-China trade relationship remains fluid and unpredictable. While Cramer's analysis offers valuable insight, investors should proceed with caution. Diversification, thorough due diligence, and a long-term investment strategy are paramount when navigating such a complex and volatile market.

Conclusion:

Jim Cramer's analysis provides a unique perspective on navigating the complexities of the US-China trade war. While his top stock picks represent potential opportunities, it's critical to conduct independent research and consider your own risk tolerance before making any investment decisions. Remember to consult with a qualified financial advisor before making any investment choices. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump's China Trade Secret Weapon: Jim Cramer's Analysis & Top 10 Stock Picks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jim Cramers Top 10 Stock Recommendations Navigating The Us China Trade Landscape

May 11, 2025

Jim Cramers Top 10 Stock Recommendations Navigating The Us China Trade Landscape

May 11, 2025 -

How To Watch Karachi Kings Vs Peshawar Zalmi Psl Match Free Live Stream And Tv Listings

May 11, 2025

How To Watch Karachi Kings Vs Peshawar Zalmi Psl Match Free Live Stream And Tv Listings

May 11, 2025 -

Kvitova Vs Jabeur Italian Open 2025 Analysis And Winning Probability

May 11, 2025

Kvitova Vs Jabeur Italian Open 2025 Analysis And Winning Probability

May 11, 2025 -

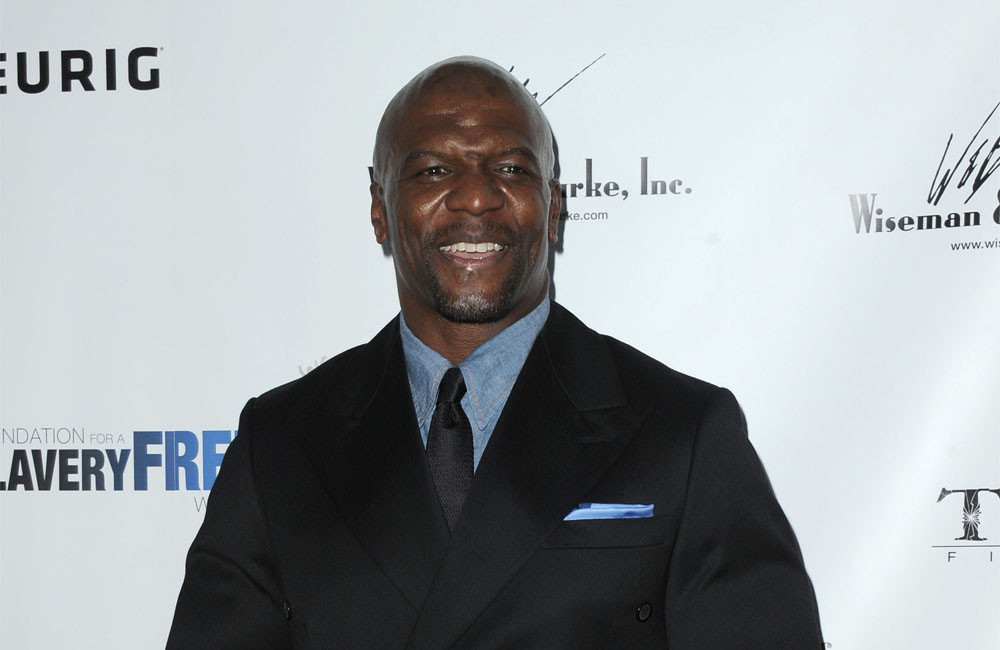

Understanding Terry Crews Intermittent Fasting Practice

May 11, 2025

Understanding Terry Crews Intermittent Fasting Practice

May 11, 2025 -

Us Journalist Austin Tice Body Found After Years In Syria

May 11, 2025

Us Journalist Austin Tice Body Found After Years In Syria

May 11, 2025