Trump Tax Law: Key Takeaways And Steps To Prevent Tax Fraud

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tax Law: Key Takeaways and Steps to Prevent Tax Fraud

The 2017 Tax Cuts and Jobs Act, often referred to as the "Trump Tax Law," significantly altered the US tax code. While it offered lower tax rates for many, it also introduced complexities that increased the risk of tax fraud. Understanding the key changes and taking proactive steps to ensure compliance is crucial for individuals and businesses alike.

Key Takeaways from the Trump Tax Law

The Trump Tax Law brought several notable changes, including:

- Reduced individual income tax rates: Many taxpayers saw their tax brackets lowered. However, the standard deduction increased, potentially offsetting some of these benefits for lower-income earners.

- Increased standard deduction: This simplification benefited many, eliminating the need for itemizing deductions for some.

- Changes to itemized deductions: Several itemized deductions were altered or eliminated, including limitations on state and local tax (SALT) deductions. This particularly impacted high-tax states.

- Expanded child tax credit: The child tax credit was significantly expanded, offering more relief to families with children.

- Changes to corporate tax rates: The corporate tax rate was slashed from 35% to 21%, a major change impacting businesses across the country.

- Pass-through business deductions: New deductions were introduced for pass-through businesses like sole proprietorships and partnerships. However, these deductions had specific limitations and requirements.

These changes, while potentially beneficial, also created avenues for tax fraud if not carefully navigated.

Preventing Tax Fraud After Tax Law Changes

Navigating the complexities of the Trump Tax Law requires vigilance. Here's how to minimize your risk of tax fraud:

1. Maintain Accurate Records:

- Digital record-keeping: Utilizing accounting software or cloud-based solutions can simplify the process and ensure data security.

- Organized documentation: Keep all receipts, invoices, and bank statements meticulously organized. This is crucial for both individual and business tax returns.

- Regular reconciliation: Periodically reconcile your financial records with your bank statements to catch discrepancies early.

2. Seek Professional Tax Advice:

- Certified Public Accountant (CPA): A CPA can help you understand the intricacies of the tax law and ensure you're taking advantage of all legitimate deductions and credits.

- Tax attorney: For complex situations or potential audits, a tax attorney can provide expert legal guidance.

- Financial advisor: A financial advisor can help you develop a long-term financial plan that considers tax implications.

3. Understand the Implications of the SALT Deduction Cap:

The limitation on the SALT deduction significantly impacts taxpayers in high-tax states. Understanding this cap and its potential effect on your tax liability is crucial. Consider exploring alternative strategies to mitigate its impact.

4. Be Wary of Tax Scams:

- Phishing emails: Be cautious of emails requesting personal financial information. Never click on suspicious links or provide sensitive data unless you're certain of the sender's identity.

- Identity theft: Protect your Social Security number and other sensitive information to prevent identity theft, which can lead to fraudulent tax returns being filed in your name.

5. File on Time and Accurately:

Filing your taxes accurately and on time is paramount. Late filing can lead to penalties, even if your return is ultimately accurate.

Conclusion: Proactive Compliance is Key

The Trump Tax Law presented both opportunities and challenges. By understanding its key features and taking proactive steps to ensure accurate record-keeping and compliance, you can significantly reduce your risk of tax fraud and maximize your tax benefits. Remember, seeking professional guidance is often the best way to navigate these complexities and avoid potential pitfalls. Don't hesitate to consult with a qualified tax professional for personalized advice.

Disclaimer: This article provides general information and should not be considered professional tax advice. Consult with a qualified tax professional for advice tailored to your specific circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tax Law: Key Takeaways And Steps To Prevent Tax Fraud. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Dogecoin A Good Investment Under 0 25 Expert Analysis

Aug 14, 2025

Is Dogecoin A Good Investment Under 0 25 Expert Analysis

Aug 14, 2025 -

Is Wasd The Future Of League Of Legends New Control Scheme In Testing

Aug 14, 2025

Is Wasd The Future Of League Of Legends New Control Scheme In Testing

Aug 14, 2025 -

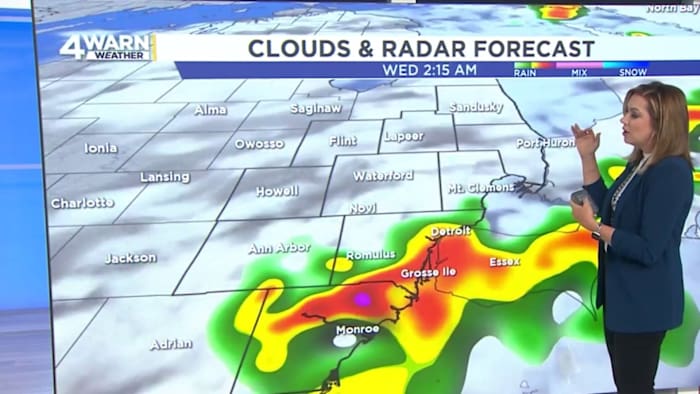

Tracking Tuesdays Storms Southeast Michigan Rainfall Timeline

Aug 14, 2025

Tracking Tuesdays Storms Southeast Michigan Rainfall Timeline

Aug 14, 2025 -

The Untold Story Of Flight 123 A Comprehensive Look At Japans Worst Aviation Disaster

Aug 14, 2025

The Untold Story Of Flight 123 A Comprehensive Look At Japans Worst Aviation Disaster

Aug 14, 2025 -

Record Breaking Heat Las Vegas Valley Faces 2025s Highest Temperature

Aug 14, 2025

Record Breaking Heat Las Vegas Valley Faces 2025s Highest Temperature

Aug 14, 2025

Latest Posts

-

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025

Reduced Crime Accidents And Substance Abuse The Impact Of Adhd Medication

Aug 14, 2025 -

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025 -

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025 -

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025