Trump Tax Cuts: Lessons For Americans & Preventing Future Tax Evasion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump Tax Cuts: Lessons Learned and Preventing Future Tax Evasion

The 2017 Tax Cuts and Jobs Act, spearheaded by then-President Donald Trump, significantly reshaped the American tax code. While touted as a boon for economic growth, the legislation sparked considerable debate and raised important questions about its long-term effects and the potential for increased tax evasion. This article examines the key lessons learned from the Trump tax cuts and explores strategies to prevent future instances of tax evasion.

The Impact of the Trump Tax Cuts:

The Trump tax cuts implemented several key changes, including:

- Reduced corporate tax rates: The corporate tax rate was slashed from 35% to 21%, a dramatic reduction aimed at stimulating business investment and job creation.

- Individual income tax rate reductions: Individual income tax rates were also lowered across the board, though the extent of the reduction varied depending on income bracket.

- Standard deduction increase: The standard deduction was significantly increased, simplifying tax filing for many Americans but potentially reducing the tax burden for higher-income individuals as well.

While proponents argued these changes spurred economic growth and job creation, critics pointed to increased national debt and concerns about the disproportionate benefits accruing to high-income earners. Empirical evidence on the overall economic impact remains mixed, with ongoing debates among economists. [Link to a reputable economic analysis of the tax cuts]

Lessons Learned: Beyond the Numbers

Beyond the purely economic impacts, the Trump tax cuts highlighted several crucial lessons:

- The complexity of tax policy: The legislation itself was incredibly complex, leading to confusion among taxpayers and businesses alike. This complexity can inadvertently create opportunities for tax evasion.

- The need for robust enforcement: Significant tax cuts often necessitate increased vigilance in tax enforcement to prevent revenue loss through evasion. Insufficient enforcement can undermine the intended benefits of any tax policy.

- Distributional effects: The impact of tax cuts is rarely uniform. Understanding how different income groups and sectors are affected is crucial for evaluating the overall success and fairness of the legislation. The Trump tax cuts sparked significant debate on this front. [Link to an article discussing the distributional effects of the tax cuts]

Preventing Future Tax Evasion: Proactive Measures

To mitigate the risk of future tax evasion, several strategies are vital:

- Simplified tax code: A simpler, more transparent tax code can reduce confusion and make it harder to exploit loopholes.

- Enhanced IRS enforcement: Increased funding and resources for the IRS are crucial for effective audits and detection of tax evasion. This includes investment in technology and data analytics to identify suspicious patterns.

- International cooperation: Combating cross-border tax evasion requires strong international cooperation and information sharing among tax authorities.

- Whistleblower programs: Incentivizing whistleblowers to report tax evasion can be a powerful tool in uncovering and prosecuting illegal activities. [Link to IRS whistleblower program information]

- Promoting tax literacy: Educating the public about tax laws and responsibilities is essential to ensuring compliance and discouraging intentional evasion.

Conclusion:

The Trump tax cuts serve as a valuable case study in the complexities of tax policy and its potential consequences. Learning from the experiences of the past, including the debates surrounding the 2017 legislation, is crucial for designing future tax policies that are both effective and equitable. By focusing on simplification, enhanced enforcement, and international cooperation, we can strive to create a fairer and more transparent tax system while minimizing opportunities for tax evasion. The ongoing discussion about the long-term effects of the Trump tax cuts highlights the importance of continuous monitoring, evaluation, and adaptation of tax policies to meet the evolving economic landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Trump Tax Cuts: Lessons For Americans & Preventing Future Tax Evasion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

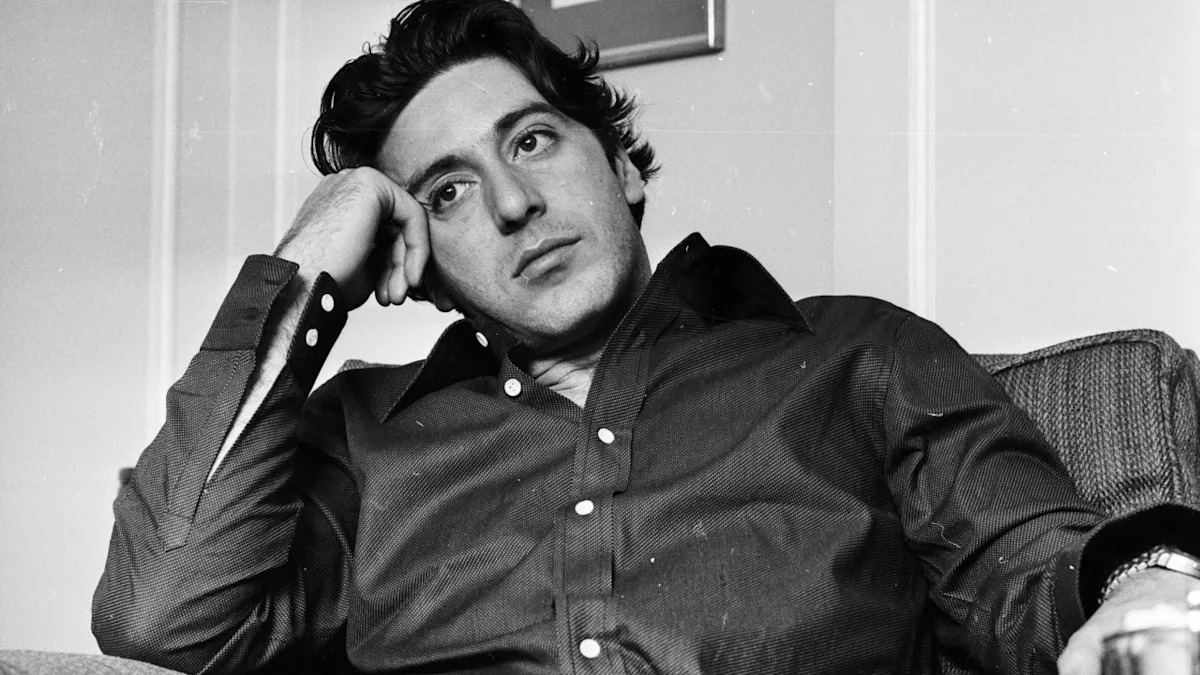

Dramatic Change 85 Year Old Film Icons Transformation Leaves Fans Speechless

Aug 13, 2025

Dramatic Change 85 Year Old Film Icons Transformation Leaves Fans Speechless

Aug 13, 2025 -

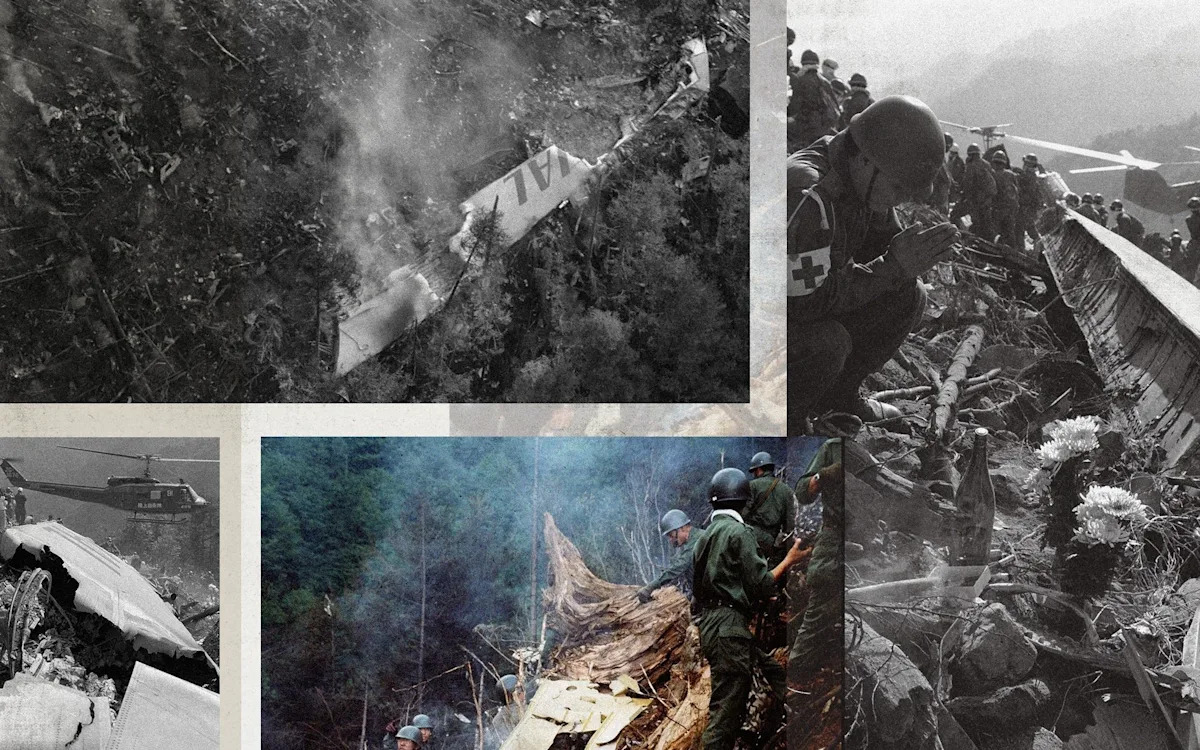

A Tragedy Revisited The Worlds Deadliest Plane Crash And Its Unseen Impact

Aug 13, 2025

A Tragedy Revisited The Worlds Deadliest Plane Crash And Its Unseen Impact

Aug 13, 2025 -

Resident Evil 4 Remake Leak Leons Send Off Game A Farewell To A Beloved Character

Aug 13, 2025

Resident Evil 4 Remake Leak Leons Send Off Game A Farewell To A Beloved Character

Aug 13, 2025 -

Pokemon Card Scalping Mc Donalds Unveils Countermeasures

Aug 13, 2025

Pokemon Card Scalping Mc Donalds Unveils Countermeasures

Aug 13, 2025 -

90 Children Secured During Active Shooter Investigation At Emory University Area Daycare

Aug 13, 2025

90 Children Secured During Active Shooter Investigation At Emory University Area Daycare

Aug 13, 2025