Today's Stock Market: Uncertainty Over Fed Policy And Iran Impacts S&P 500, Nasdaq Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: Uncertainty Over Fed Policy and Iran Impacts S&P 500, Nasdaq Performance

Wall Street experienced a rollercoaster ride today, with the S&P 500 and Nasdaq showing significant volatility amidst growing uncertainty surrounding Federal Reserve policy and escalating tensions in Iran. Investors grapple with conflicting signals, leaving many wondering what tomorrow holds for the market.

The major indices ended the day with mixed results, reflecting the turbulent trading session. While some sectors saw gains, others experienced significant losses, highlighting the market's current fragility and the impact of geopolitical events and economic forecasts.

H2: Fed Policy Remains the Central Focus

The Federal Reserve's ongoing battle against inflation continues to dominate market sentiment. Recent economic data, including [link to relevant economic data source, e.g., Bureau of Labor Statistics report], has fueled debate over the pace and extent of future interest rate hikes. Some analysts believe the Fed might need to adopt a more aggressive stance to curb inflation, while others argue that a more measured approach is warranted to avoid triggering a recession. This uncertainty is a major factor contributing to the market's volatility. The lack of clear guidance from the Fed leaves investors hesitant to make significant commitments.

H2: Iran Tensions Add to Market Jitters

Adding to the uncertainty, the escalating tensions in Iran have injected a dose of geopolitical risk into the market. Recent events in [mention specific relevant events, e.g., Iranian nuclear program developments, regional conflicts] have raised concerns about potential disruptions to global energy markets and supply chains. This uncertainty is prompting investors to seek safer havens, leading to some capital flight from riskier assets. The impact of these geopolitical developments on the global economy remains to be seen, but the market is clearly reacting negatively to the increased uncertainty.

H2: Sectoral Performance Highlights Market Divisions

Today's market performance wasn't uniform across all sectors. While technology stocks, heavily represented in the Nasdaq, experienced [mention percentage change and direction], the energy sector saw [mention percentage change and direction], largely driven by the ongoing concerns about Iranian oil exports. Defensive sectors, such as consumer staples and utilities, generally performed [mention overall performance and direction], reflecting investors' search for stability in a volatile market. This divergence underscores the market's current fragmented state and the impact of specific geopolitical and economic factors on different sectors.

H3: Key Takeaways for Investors:

- Volatility is likely to persist: Given the ongoing uncertainty surrounding Fed policy and geopolitical risks, expect market fluctuations to continue in the near term.

- Diversification is crucial: A well-diversified portfolio can help mitigate the impact of market volatility.

- Stay informed: Keep abreast of economic data releases and geopolitical developments that could impact the market.

- Consider your risk tolerance: Before making any investment decisions, carefully assess your risk tolerance and investment goals.

H2: Looking Ahead: What to Expect

The coming days and weeks will be crucial in determining the market's trajectory. Close monitoring of Federal Reserve announcements, economic data releases, and the evolving situation in Iran will be key to understanding the market's direction. Investors should prepare for continued volatility and adjust their investment strategies accordingly. The market's response to these factors will ultimately shape the future performance of the S&P 500 and Nasdaq. Consult with a financial advisor to discuss your portfolio and tailor it to your specific needs and risk appetite.

Disclaimer: This article provides general information and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: Uncertainty Over Fed Policy And Iran Impacts S&P 500, Nasdaq Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Update Barry Morphew Re Arrested In Connection With Suzanne Morphews Death

Jun 21, 2025

Update Barry Morphew Re Arrested In Connection With Suzanne Morphews Death

Jun 21, 2025 -

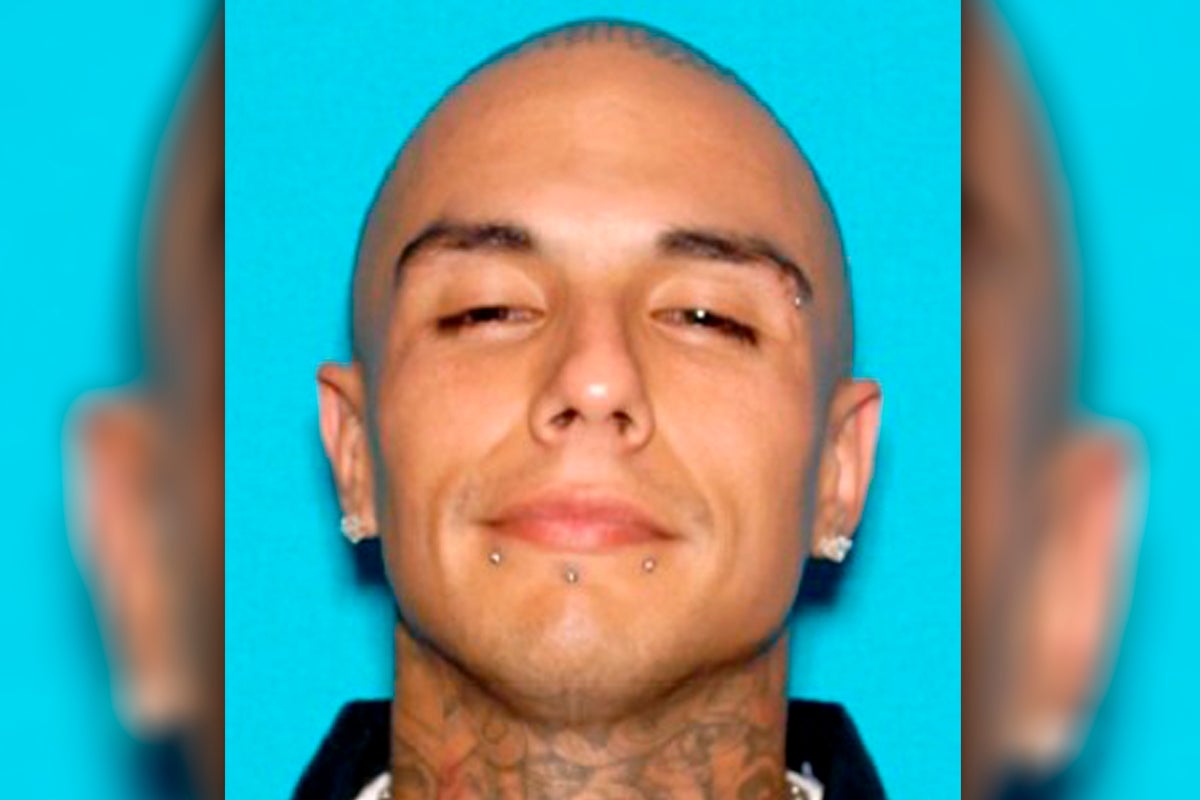

Rapper Targeted In Murder Plot 19 Mexican Mafia Associates Charged

Jun 21, 2025

Rapper Targeted In Murder Plot 19 Mexican Mafia Associates Charged

Jun 21, 2025 -

Fluminense Vs Ulsan Hyundai Comprehensive Match Preview And Lineup Analysis

Jun 21, 2025

Fluminense Vs Ulsan Hyundai Comprehensive Match Preview And Lineup Analysis

Jun 21, 2025 -

Club World Cup Bayern Munich Boca Juniors Everything You Need To Know

Jun 21, 2025

Club World Cup Bayern Munich Boca Juniors Everything You Need To Know

Jun 21, 2025 -

19 Charged In Conspiracy To Assassinate Prominent Rapper Mexican Mafia Link

Jun 21, 2025

19 Charged In Conspiracy To Assassinate Prominent Rapper Mexican Mafia Link

Jun 21, 2025