Today's Stock Market: S&P 500 And Nasdaq Losses Fueled By Interest Rate Concerns And Iran Situation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: S&P 500 and Nasdaq Losses Driven by Interest Rate Fears and Iran Tensions

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq posting significant losses. The sell-off was primarily fueled by growing concerns over interest rate hikes and escalating geopolitical tensions surrounding Iran. Investors are grappling with uncertainty across multiple fronts, impacting market sentiment and leading to widespread declines.

This article will delve into the key factors contributing to today's market slump, examining the influence of interest rate expectations and the Iranian situation on investor confidence. We'll also explore potential implications and what investors can expect in the coming days.

Interest Rate Hikes: The Looming Shadow Over Wall Street

The Federal Reserve's (Fed) aggressive stance on combating inflation continues to be a major source of anxiety for investors. The expectation of further interest rate increases, aimed at curbing rising prices, is dampening investor enthusiasm. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profits – a key driver of stock prices. Analysts are closely monitoring upcoming economic data releases for clues about the Fed's future policy decisions. This uncertainty is translating into volatility and risk aversion in the market.

-

Impact on specific sectors: Interest-sensitive sectors like technology and real estate are particularly vulnerable to rising interest rates. High-growth technology companies, often valued on future earnings, are especially susceptible to higher discount rates.

-

Long-term implications: The sustained period of higher interest rates could lead to a recalibration of valuations across the market, potentially resulting in a prolonged period of lower returns. Investors are urged to reassess their portfolio allocations and risk tolerance in light of this evolving landscape.

Iran Tensions Add to Market Volatility

Adding to the interest rate concerns is the escalating geopolitical situation in the Middle East, particularly involving Iran. Recent events, including [insert specific recent event and link to reputable news source], have heightened anxieties about potential regional instability. This uncertainty is creating a ripple effect, impacting global oil prices and investor sentiment. Geopolitical risks often trigger a "flight to safety," as investors move their money into safer assets like government bonds, further depressing stock prices.

-

Oil price fluctuations: The situation in Iran directly affects global oil supply and prices. Any disruptions to oil production can lead to increased inflation and further pressure on the economy, negatively impacting market performance.

-

Global implications: The Iranian situation is not isolated; it has broader geopolitical implications that impact investor confidence worldwide. The interconnected nature of global markets means that instability in one region can quickly spread, affecting financial markets across the globe.

What to Expect in the Coming Days

The market's future trajectory remains uncertain. Investors will be closely monitoring key economic indicators, including inflation data and employment figures, for clues about the Fed's next move. Developments in the Iran situation will also continue to play a significant role. Volatility is likely to persist in the short term, underscoring the need for a cautious approach to investment.

For further analysis and insights, consider exploring:

- [Link to a reputable financial news website]

- [Link to a financial analysis firm's report]

Disclaimer: This article provides general information and should not be considered investment advice. Consult with a qualified financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: S&P 500 And Nasdaq Losses Fueled By Interest Rate Concerns And Iran Situation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

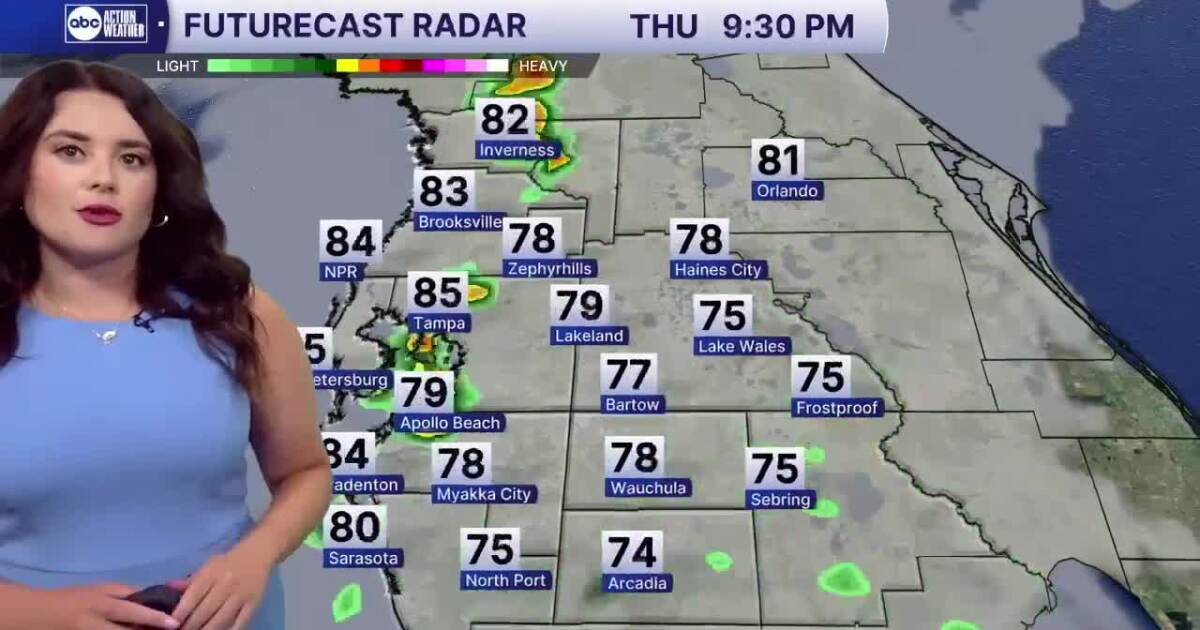

Todays Forecast Prepare For Muggy Air And Potential Late Day Showers

Jun 21, 2025

Todays Forecast Prepare For Muggy Air And Potential Late Day Showers

Jun 21, 2025 -

Todays Forecast Showers Likely High Humidity Throughout The Day

Jun 21, 2025

Todays Forecast Showers Likely High Humidity Throughout The Day

Jun 21, 2025 -

Keshas Attention A Review Of The Song And Its Potential Impact

Jun 21, 2025

Keshas Attention A Review Of The Song And Its Potential Impact

Jun 21, 2025 -

Cuban On Harris Vp Pursuit A Rejected Invitation Revealed

Jun 21, 2025

Cuban On Harris Vp Pursuit A Rejected Invitation Revealed

Jun 21, 2025 -

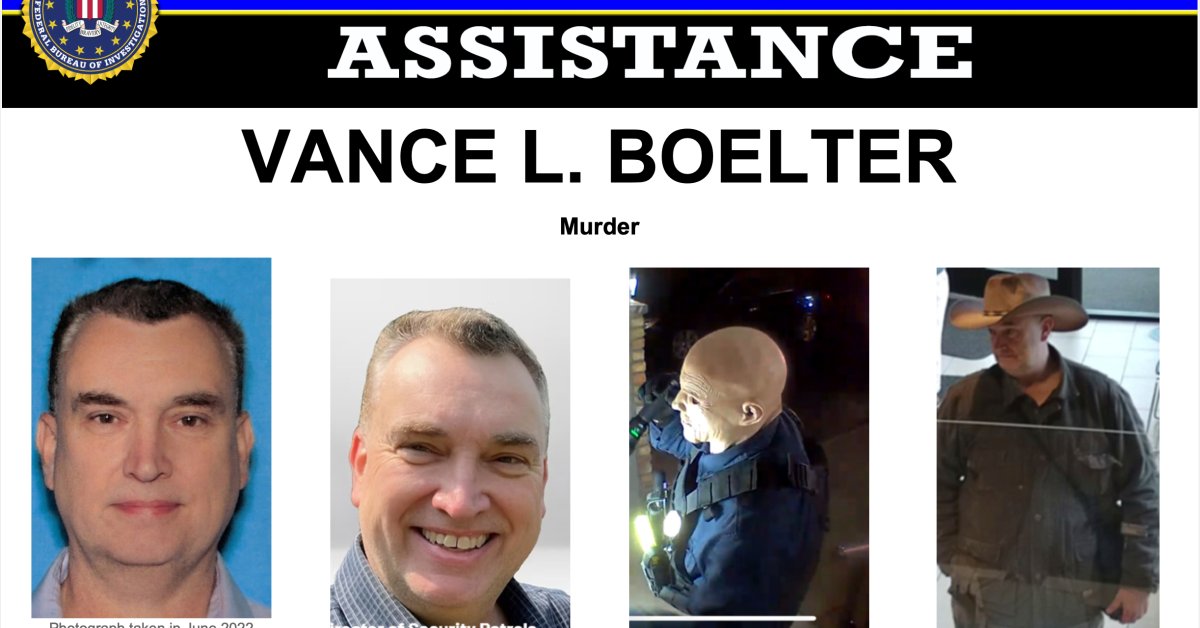

Minnesota Lawmakers Shooting Who Is Vance L Boelter And What We Know So Far

Jun 21, 2025

Minnesota Lawmakers Shooting Who Is Vance L Boelter And What We Know So Far

Jun 21, 2025