Today's Stock Market: S&P 500 And Nasdaq Fall As Iran Tensions And Interest Rates Weigh

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: S&P 500 and Nasdaq Fall as Iran Tensions and Interest Rates Weigh

Wall Street experienced a downturn today, with both the S&P 500 and Nasdaq Composite closing lower. Rising geopolitical tensions in Iran and persistent concerns about interest rates are being cited as the primary drivers behind this market decline. Investors are grappling with uncertainty, leading to a sell-off across various sectors.

This dip follows a period of relative stability, leaving many wondering what the future holds for the markets. Let's delve deeper into the factors contributing to today's losses.

H2: Geopolitical Uncertainty: Iran Tensions Rattle Investors

The escalating situation in Iran is undeniably impacting investor sentiment. Recent events, including [link to reputable news source about Iran], have increased concerns about potential regional instability and its global economic repercussions. This uncertainty is prompting investors to adopt a more risk-averse strategy, leading to a flight from equities. The energy sector, particularly sensitive to geopolitical shifts, saw significant declines today.

H2: Interest Rate Concerns Remain a Major Headwind

The Federal Reserve's (Fed) ongoing battle against inflation continues to cast a long shadow over the stock market. While recent inflation data showed some signs of cooling [link to relevant economic data source], concerns remain that the Fed might maintain a hawkish stance on interest rates for longer than anticipated. Higher interest rates increase borrowing costs for businesses, potentially slowing economic growth and impacting corporate profitability. This concern is particularly relevant for growth-oriented technology stocks, which are heavily reliant on future earnings projections.

H3: Impact on Specific Sectors:

- Technology: The Nasdaq Composite, heavily weighted with technology companies, suffered a steeper decline than the broader S&P 500, reflecting the sector's sensitivity to interest rate hikes. High-growth tech stocks, often valued on future earnings, are particularly vulnerable in a high-interest-rate environment.

- Energy: Fluctuations in oil prices, driven by the Iranian situation, contributed to volatility within the energy sector. While some energy companies might benefit from higher oil prices, the overall uncertainty surrounding the geopolitical landscape negatively impacted investor confidence.

- Financials: Banks and other financial institutions are also susceptible to interest rate changes. While higher rates can boost their net interest margins, the impact on overall economic growth and loan defaults needs careful consideration.

H2: What to Expect Next?

Predicting the market's short-term movements is always challenging. However, analysts suggest that the current situation warrants cautious optimism. While the Iranian situation and interest rate policies remain key factors, the market's resilience and long-term growth potential shouldn't be discounted. Monitoring inflation data, Fed announcements, and developments in the Middle East will be crucial in the coming weeks.

H3: Investor Advice:

For individual investors, this period of uncertainty highlights the importance of:

- Diversification: Spreading investments across different asset classes can help mitigate risk.

- Long-term perspective: Short-term market fluctuations are normal. Focusing on a long-term investment strategy is crucial.

- Professional advice: Consulting a financial advisor can provide personalized guidance based on your individual circumstances.

Conclusion:

Today's market decline serves as a reminder of the interconnectedness of global events and their impact on financial markets. The interplay between geopolitical tensions and monetary policy creates a complex landscape for investors. Staying informed, maintaining a diversified portfolio, and adopting a long-term perspective are crucial strategies for navigating this dynamic environment. Keep an eye on further developments in both Iran and the Federal Reserve's policy decisions for a clearer outlook on the market's trajectory.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: S&P 500 And Nasdaq Fall As Iran Tensions And Interest Rates Weigh. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Red Sox Rumors Heat Up Trade Speculation Centers On Astros Kyle Tucker

Jun 21, 2025

Red Sox Rumors Heat Up Trade Speculation Centers On Astros Kyle Tucker

Jun 21, 2025 -

Raleighs Record Breaking 2 Hr Game Surpassing Benchs Mark

Jun 21, 2025

Raleighs Record Breaking 2 Hr Game Surpassing Benchs Mark

Jun 21, 2025 -

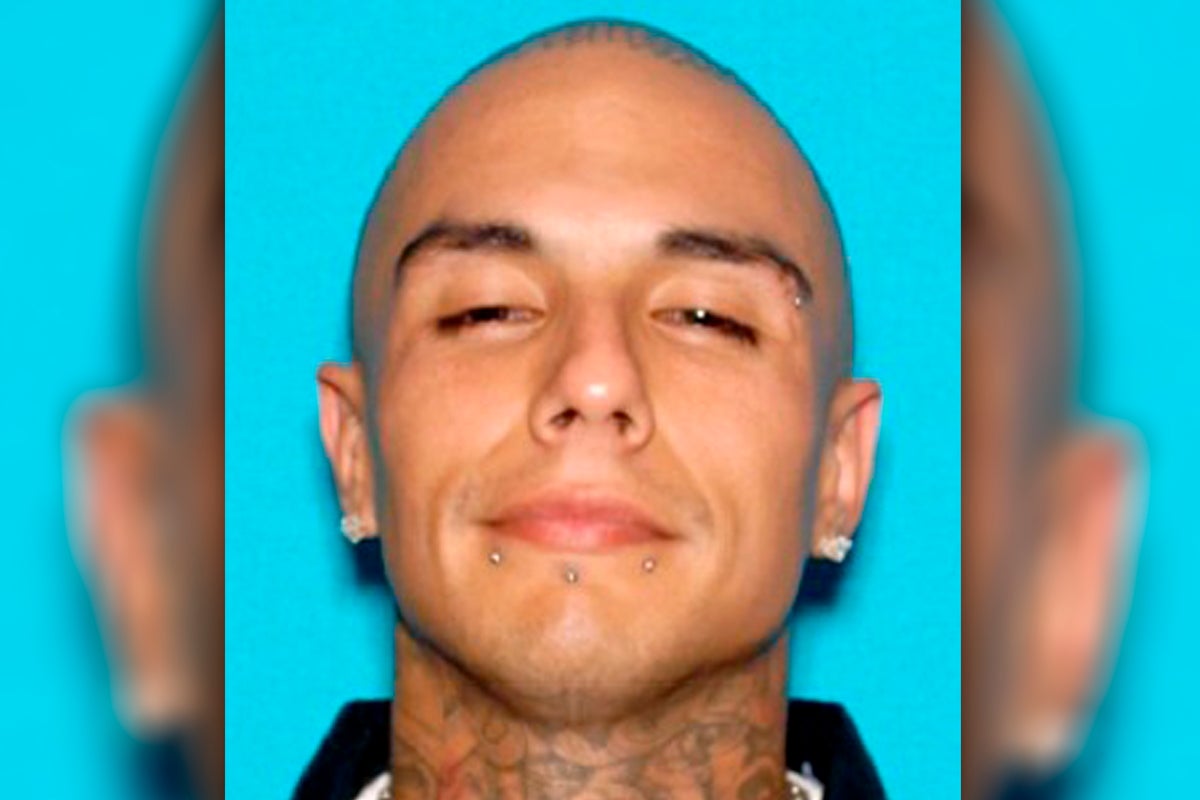

Rapper Targeted 19 Mexican Mafia Associates Face Charges In Murder Plot

Jun 21, 2025

Rapper Targeted 19 Mexican Mafia Associates Face Charges In Murder Plot

Jun 21, 2025 -

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Key Players And Potential Lineups

Jun 21, 2025

Bayern Munich Vs Boca Juniors Club World Cup Match Preview Key Players And Potential Lineups

Jun 21, 2025 -

Devers Trade Shockwaves Mlb Managers And Coaches Weigh In

Jun 21, 2025

Devers Trade Shockwaves Mlb Managers And Coaches Weigh In

Jun 21, 2025