Today's Stock Market: S&P 500 And Nasdaq Declines Fueled By Fed And Geopolitical Uncertainty

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: S&P 500 and Nasdaq Decline Amidst Fed and Geopolitical Uncertainty

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq Composite indices closing lower, fueled by growing concerns over the Federal Reserve's monetary policy and escalating geopolitical tensions. Investors are grappling with uncertainty across multiple fronts, leading to a risk-off sentiment that impacted various sectors.

The S&P 500 shed [insert percentage]% today, closing at [insert closing value], while the tech-heavy Nasdaq Composite fell by [insert percentage]%, ending the day at [insert closing value]. This marks a continuation of recent volatility in the market, reflecting the complex interplay of economic and global factors.

H2: The Federal Reserve's Influence

The Federal Reserve's ongoing efforts to combat inflation remain a significant driver of market uncertainty. Recent statements from Fed officials have hinted at the possibility of further interest rate hikes, despite signs of slowing economic growth. This prospect worries investors who fear that aggressive rate increases could trigger a recession. The market is anxiously awaiting the next Fed meeting for further clarity on their monetary policy trajectory. Understanding the Fed's dual mandate – price stability and maximum employment – is crucial to interpreting market reactions. [Link to a reputable source explaining the Fed's dual mandate].

H2: Geopolitical Headwinds Add to the Pressure

Adding to the economic anxieties are escalating geopolitical tensions. [Clearly and concisely mention the specific geopolitical event impacting the market, e.g., the ongoing conflict in Ukraine, tensions in the South China Sea, etc.]. This uncertainty creates further volatility, as investors reassess risk profiles and adjust their portfolios accordingly. Geopolitical risk is often difficult to quantify, making accurate market prediction challenging. [Link to a reputable source providing geopolitical analysis].

H3: Sectoral Performance

Today's decline wasn't uniform across all sectors. While technology stocks, particularly in the Nasdaq, bore the brunt of the selling pressure, other sectors also experienced losses. [Mention specific sectors and their performance, e.g., "Financials also saw a significant drop, reflecting sensitivity to interest rate changes."]. However, [mention any sectors that performed relatively better, if applicable, and why].

H2: What This Means for Investors

The current market environment underscores the importance of a well-diversified investment strategy. Investors should consider their risk tolerance and long-term investment goals before making any significant changes to their portfolios. Consulting with a qualified financial advisor is recommended, especially during periods of heightened market volatility. It's crucial to avoid making impulsive decisions based on short-term market fluctuations.

H2: Looking Ahead

The coming weeks will be critical in determining the direction of the market. Close monitoring of economic data releases, Federal Reserve announcements, and geopolitical developments will be essential. Analysts are divided on the outlook, with some predicting a further downturn and others anticipating a potential rebound. [Link to a reputable source providing market analysis]. The current uncertainty highlights the need for a long-term perspective and a carefully considered investment approach.

Call to Action: Stay informed about market developments by following reputable financial news sources and consulting with a financial professional. Understanding the factors driving market movements is key to making informed investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: S&P 500 And Nasdaq Declines Fueled By Fed And Geopolitical Uncertainty. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jon Jones Storms Out Of Interview After Aspinall Question

Jun 21, 2025

Jon Jones Storms Out Of Interview After Aspinall Question

Jun 21, 2025 -

Narrow Victory For Astros Pressly Secures Win Against Pirates

Jun 21, 2025

Narrow Victory For Astros Pressly Secures Win Against Pirates

Jun 21, 2025 -

Gabbards Political Standing A Source Of Tension Within Trumps Circle

Jun 21, 2025

Gabbards Political Standing A Source Of Tension Within Trumps Circle

Jun 21, 2025 -

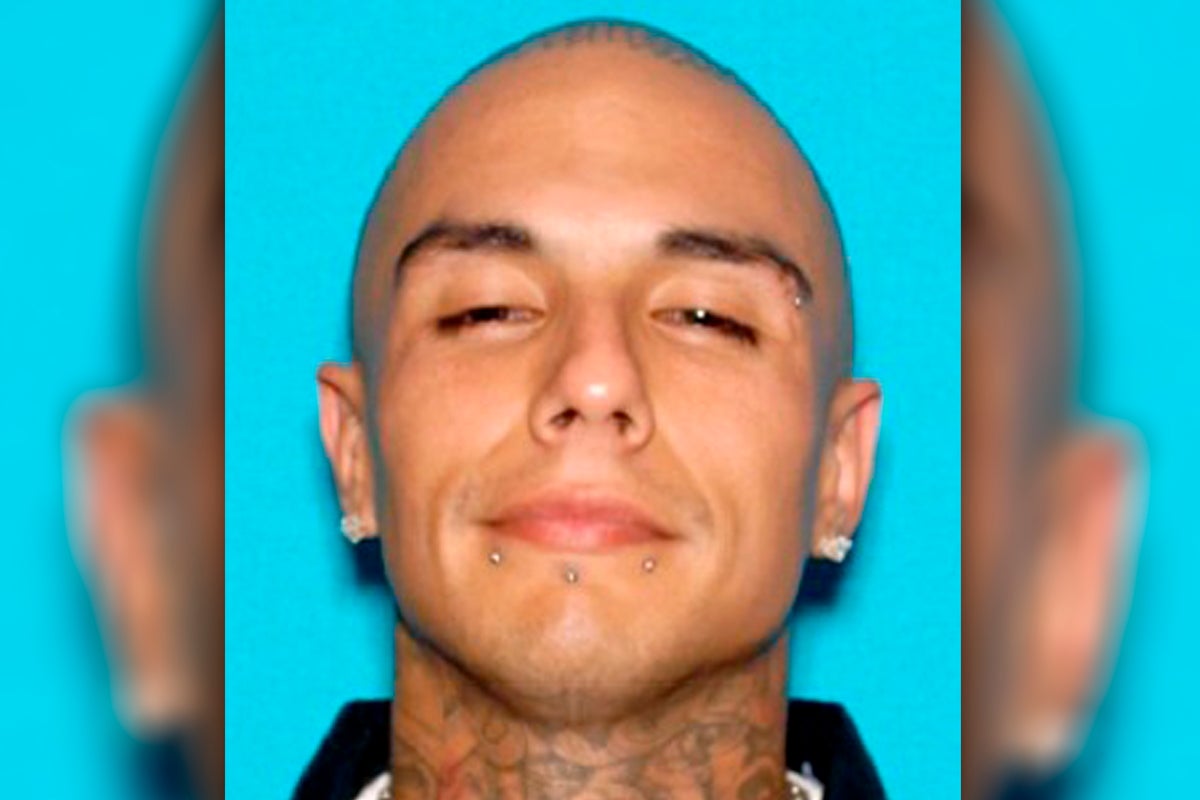

Rapper Targeted Massive Mexican Mafia Arrest In Murder For Hire Case

Jun 21, 2025

Rapper Targeted Massive Mexican Mafia Arrest In Murder For Hire Case

Jun 21, 2025 -

Unexpected Rafael Devers Trade Analysis Of The Timing

Jun 21, 2025

Unexpected Rafael Devers Trade Analysis Of The Timing

Jun 21, 2025