Today's Stock Market: Analysis Of S&P 500 And Nasdaq Declines Amidst Iran And Interest Rate Worries

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Today's Stock Market: S&P 500 and Nasdaq Decline Amidst Iran Tensions and Interest Rate Concerns

Wall Street experienced a downturn today, with the S&P 500 and Nasdaq Composite suffering notable declines amidst escalating geopolitical tensions in Iran and persistent worries about future interest rate hikes. Investors are grappling with a complex interplay of factors, leaving many uncertain about the market's short-term trajectory.

The S&P 500 closed down [insert percentage]% at [insert closing value], while the Nasdaq Composite fell [insert percentage]% to [insert closing value]. This marks a significant reversal from recent gains and reflects a growing sense of caution among investors.

H2: Iran Tensions Fuel Market Volatility

The recent escalation of tensions between Iran and the West is a primary driver behind today's market dip. Increased uncertainty regarding potential military conflict in the Middle East has rattled investors, prompting a flight to safety and a sell-off in riskier assets like equities. The impact on oil prices, already volatile, further exacerbates concerns about inflation and its potential effects on corporate earnings. Experts are closely monitoring the situation, warning that further escalation could lead to more significant market corrections. You can read more about the Iran situation and its global implications on [link to reputable news source about Iran].

H2: Interest Rate Hikes Continue to Cast a Long Shadow

Adding to the market's woes are ongoing concerns about the Federal Reserve's monetary policy. While the Fed paused its rate-hiking cycle at its last meeting, market participants remain anxious about the potential for further increases in the near future. [Mention any recent statements from Fed officials]. The persistent threat of inflation, fueled by factors like high energy prices and robust consumer spending, keeps pressure on the central bank to maintain a hawkish stance. This uncertainty over future interest rate decisions creates volatility and discourages long-term investments for some investors. Understanding the complexities of Federal Reserve policy is crucial; you can learn more at [link to reputable source explaining Fed policy].

H2: Sector-Specific Performances

Today's decline wasn't uniform across all sectors. While technology stocks, heavily represented in the Nasdaq, experienced a particularly sharp drop, other sectors showed more resilience. [Insert specific examples of sector performance, e.g., "The energy sector bucked the trend, showing slight gains due to rising oil prices."]. This divergence highlights the nuanced impact of geopolitical events and economic indicators on different market segments.

H3: Key Takeaways:

- Geopolitical risks: The Iran situation is a significant factor driving market volatility.

- Interest rate uncertainty: The Fed's future actions remain a major source of concern.

- Sectoral divergence: The market's response isn't monolithic; certain sectors showed resilience.

H2: What to Expect Next?

Predicting the market's next move is always challenging, but several factors will likely shape its trajectory in the coming days and weeks. Close monitoring of developments in Iran, further statements from the Federal Reserve, and the release of key economic data (such as inflation figures and employment reports) will be crucial for investors. Analysts suggest that maintaining a diversified portfolio and adhering to a long-term investment strategy are key to navigating this period of uncertainty.

H2: Seeking Professional Advice

Navigating the complexities of the stock market requires careful consideration. Consulting with a qualified financial advisor is always recommended before making any significant investment decisions. They can help you create a personalized strategy that aligns with your financial goals and risk tolerance.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Today's Stock Market: Analysis Of S&P 500 And Nasdaq Declines Amidst Iran And Interest Rate Worries. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Bayern Vs Boca Key Players And Tactical Battleground June 20 2025

Jun 21, 2025

Bayern Vs Boca Key Players And Tactical Battleground June 20 2025

Jun 21, 2025 -

Mark Cuban Reveals Harris Campaigns Request For Vp Vetting Papers

Jun 21, 2025

Mark Cuban Reveals Harris Campaigns Request For Vp Vetting Papers

Jun 21, 2025 -

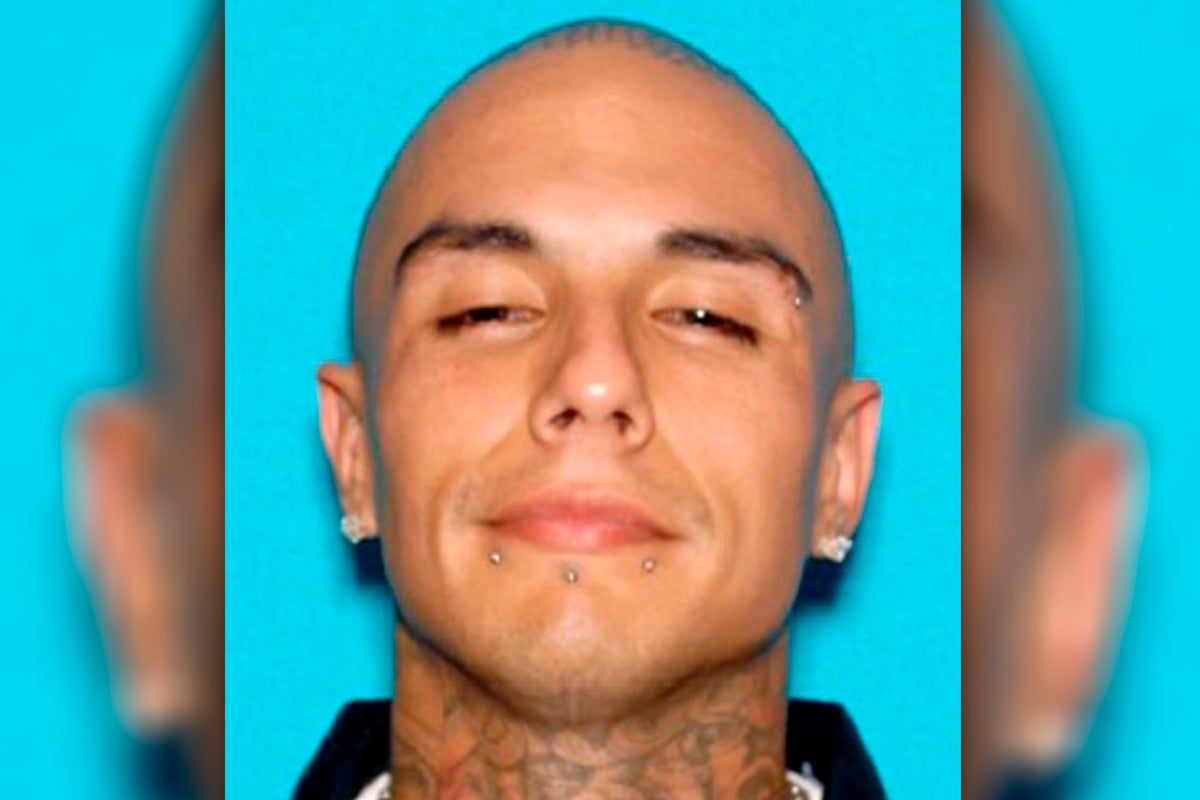

Gangland Plot 19 Mexican Mafia Members Charged In Rapper Murder Scheme

Jun 21, 2025

Gangland Plot 19 Mexican Mafia Members Charged In Rapper Murder Scheme

Jun 21, 2025 -

Analysis Why Tulsi Gabbards Input Was Absent From Key Israel Iran Policy Talks

Jun 21, 2025

Analysis Why Tulsi Gabbards Input Was Absent From Key Israel Iran Policy Talks

Jun 21, 2025 -

Renewed Charges Barry Morphew Rearrested For Suzannes Death

Jun 21, 2025

Renewed Charges Barry Morphew Rearrested For Suzannes Death

Jun 21, 2025