The USCIT Tariff Ruling: A Comprehensive Guide To Its Meaning And Effects

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The USCIT Tariff Ruling: A Comprehensive Guide to its Meaning and Effects

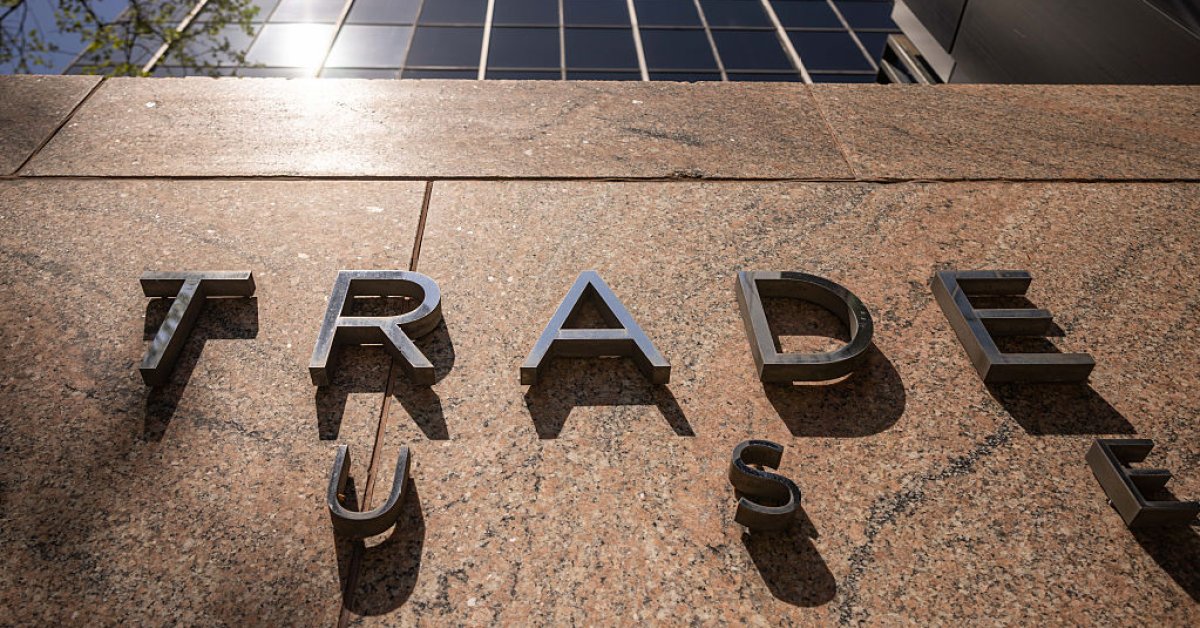

The United States Court of International Trade (USCIT) recently issued a significant ruling impacting tariffs, sending ripples through various industries. Understanding the implications of this decision is crucial for businesses involved in international trade. This comprehensive guide breaks down the USCIT tariff ruling, exploring its meaning, effects, and potential future ramifications.

What was the USCIT Tariff Ruling About?

The specific details of the ruling will vary depending on the case. However, USCIT rulings often center on challenges to the classification, valuation, or application of tariffs imposed by the U.S. Customs and Border Protection (CBP). These challenges can arise from importers disputing the CBP's assessment of duties, arguing for different tariff classifications, or contesting the methodology used in determining the value of imported goods. Recent rulings have focused on issues like:

- Tariff Classification Disputes: Importers frequently challenge the CBP's classification of their goods under the Harmonized Tariff Schedule (HTS). Incorrect classification can lead to significantly higher tariffs than necessary. A USCIT ruling might overturn the CBP's classification, resulting in retroactive refunds for importers.

- Valuation Challenges: The correct valuation of imported goods is critical in determining the amount of duty owed. Disputes can arise over factors such as transaction value, deductive valuation, or computed value. A USCIT ruling could set a precedent for how specific valuation methods should be applied in the future.

- Anti-dumping and Countervailing Duties: These duties are imposed to counteract unfair trade practices, such as dumping (selling goods below market value) or subsidization. USCIT rulings on these duties often involve complex legal arguments about the existence of dumping or subsidization, and the appropriate level of duties to be imposed.

Understanding the Effects of the Ruling

The impact of a specific USCIT ruling depends greatly on its details. However, some common effects include:

- Financial Implications for Importers and Exporters: A favorable ruling for an importer could lead to substantial refunds of previously paid duties. Conversely, an unfavorable ruling could result in increased costs. Exporters may see shifts in market competitiveness depending on how the ruling impacts their products' tariffs.

- Changes in Trade Practices: The ruling could influence how businesses classify their goods, prepare for customs inspections, and handle valuation issues. It might lead to changes in supply chains and sourcing strategies.

- Legal Precedents: USCIT rulings can set important legal precedents that guide future CBP decisions and other court cases. This creates greater legal certainty (or uncertainty) depending on the clarity and implications of the ruling.

Navigating the Complexities of Tariff Law

Navigating the complexities of U.S. tariff law can be challenging. Businesses should consider:

- Seeking expert legal advice: Consulting with customs brokers and trade lawyers familiar with USCIT procedures is crucial for understanding the implications of the ruling and for navigating future trade-related disputes.

- Staying informed about legal updates: Regularly monitoring updates from the USCIT and CBP is vital to ensure compliance with evolving regulations. Trade publications and legal databases are valuable resources.

- Proactive compliance: Implementing strong internal compliance procedures can help minimize the risk of disputes and ensure accurate tariff classification and valuation.

Conclusion:

The USCIT's tariff rulings play a significant role in shaping international trade in the United States. Understanding the implications of these rulings, especially those impacting your specific industry, is critical for success in the global marketplace. By staying informed and seeking expert guidance, businesses can effectively manage the complexities of tariffs and avoid costly mistakes. Remember to consult with legal professionals for personalized advice on how these rulings might specifically affect your business operations.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The USCIT Tariff Ruling: A Comprehensive Guide To Its Meaning And Effects. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Angela Marmol La Influencer Que Enamoro A Tom Cruise Sorprende Con Nuevo Video

May 30, 2025

Angela Marmol La Influencer Que Enamoro A Tom Cruise Sorprende Con Nuevo Video

May 30, 2025 -

Gops Trump Train Push Examining Recent Renaming Efforts

May 30, 2025

Gops Trump Train Push Examining Recent Renaming Efforts

May 30, 2025 -

The U S A Welcomes International Soccer Fans Preparations And Excitement

May 30, 2025

The U S A Welcomes International Soccer Fans Preparations And Excitement

May 30, 2025 -

Sidney Crosby And The Penguins A New Coachs Headaches Begin

May 30, 2025

Sidney Crosby And The Penguins A New Coachs Headaches Begin

May 30, 2025 -

French Open Recap Highs Lows And Head Scratching Scheduling Decisions

May 30, 2025

French Open Recap Highs Lows And Head Scratching Scheduling Decisions

May 30, 2025