The Stock Market's Unexpected Strength: Navigating The Uncertainty Of Trump's Tariffs

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Stock Market's Unexpected Strength: Navigating the Uncertainty of Trump's Tariffs

The stock market's recent performance has defied expectations, exhibiting surprising resilience in the face of ongoing trade tensions and the uncertainty surrounding President Trump's tariffs. While economists predicted a significant downturn, the market has largely held its ground, prompting questions about its underlying strength and the strategies investors are employing to navigate this volatile landscape. This unexpected strength raises crucial questions about the future of the market and the effectiveness of current economic policies.

Trump's Tariffs: A Continuing Saga

President Trump's imposition of tariffs on various goods, particularly from China, has been a major source of market volatility. These tariffs, aimed at protecting American industries and addressing trade imbalances, have sparked retaliatory measures from other countries, escalating the trade war and creating uncertainty for businesses and investors alike. The impact of these tariffs extends beyond immediate price increases, affecting supply chains, investment decisions, and overall economic growth. Understanding the intricacies of these trade disputes is crucial for any investor looking to successfully navigate the current climate. For more in-depth analysis on the ongoing trade disputes, you can consult resources from the Peterson Institute for International Economics [link to reputable source].

Why is the Market So Strong Despite the Uncertainty?

Several factors contribute to the stock market's unexpected resilience:

-

Strong Corporate Earnings: Despite the tariff headwinds, many US corporations have reported strong earnings, fueled by a robust domestic economy and consumer spending. This positive performance has bolstered investor confidence, mitigating some of the negative effects of the trade war.

-

Low Interest Rates: The Federal Reserve's decision to maintain low interest rates has provided a supportive environment for the stock market. Low interest rates make borrowing cheaper for businesses, encouraging investment and growth. This, in turn, supports higher stock valuations.

-

Investor Sentiment: While fear is certainly present, a degree of optimism persists among investors. Many believe that the current trade tensions are temporary and that a resolution will eventually be reached, leading to a resumption of normal trade relations. However, this optimism needs to be balanced with a cautious approach.

-

Market Volatility as Opportunity: Some investors view the market volatility as an opportunity to buy stocks at discounted prices. This "buy the dip" strategy, while risky, can be profitable for those with a long-term investment horizon and a risk tolerance for short-term fluctuations.

Navigating the Uncertainty: Strategies for Investors

Given the ongoing uncertainty, investors need to adopt a cautious and adaptable strategy:

-

Diversification: Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. This helps to cushion the impact of any single market downturn.

-

Long-Term Perspective: It's important to maintain a long-term investment horizon and avoid making impulsive decisions based on short-term market fluctuations. The current volatility presents opportunities for patient investors.

-

Due Diligence: Thorough research and due diligence are paramount. Understand the companies you're investing in and their exposure to trade-related risks.

The Future Outlook: Cautious Optimism

While the stock market's resilience is encouraging, the future remains uncertain. The outcome of the trade disputes will significantly influence the market's trajectory. Investors should stay informed about the latest developments and adjust their strategies accordingly. Maintaining a balanced and diversified portfolio, along with a long-term perspective, remains the best approach for navigating this complex landscape. Remember to consult with a financial advisor for personalized advice tailored to your specific financial situation and risk tolerance. The information provided here is for educational purposes only and should not be considered financial advice.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Stock Market's Unexpected Strength: Navigating The Uncertainty Of Trump's Tariffs. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025

Extreme Heat Returns To Southern Nevada Prepare For 114 F

Aug 13, 2025 -

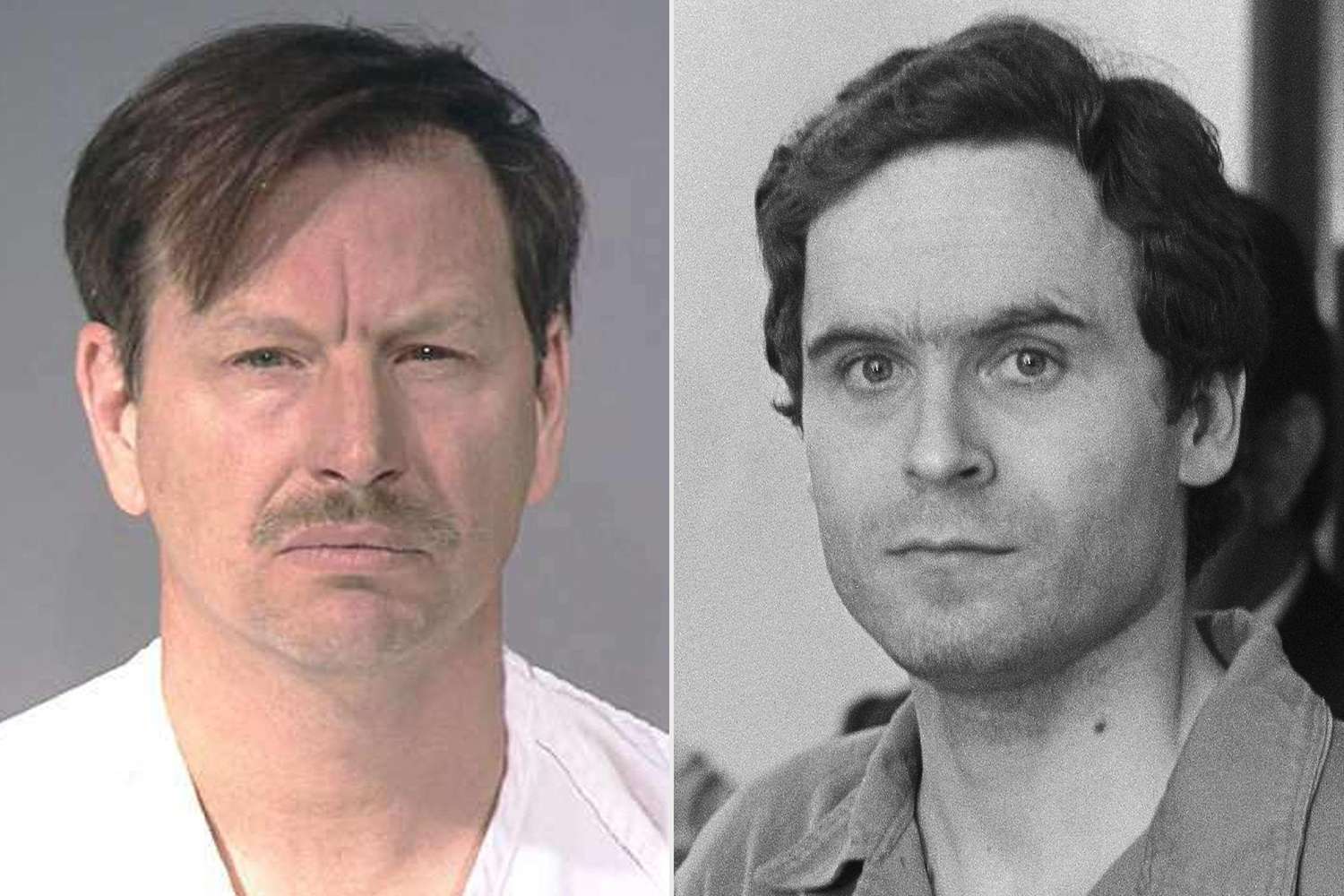

Confronting Evil A Documentary Revealing A Detectives Talks With A Serial Killer

Aug 13, 2025

Confronting Evil A Documentary Revealing A Detectives Talks With A Serial Killer

Aug 13, 2025 -

Farmers Almanac Winter Outlook Significant Snow And Early Cold For Maine

Aug 13, 2025

Farmers Almanac Winter Outlook Significant Snow And Early Cold For Maine

Aug 13, 2025 -

Hbo Max Enters Southeast Asian Market With Viu Collaboration

Aug 13, 2025

Hbo Max Enters Southeast Asian Market With Viu Collaboration

Aug 13, 2025 -

Inside The Mind Of Gary Ridgway Understanding The Green River Killer

Aug 13, 2025

Inside The Mind Of Gary Ridgway Understanding The Green River Killer

Aug 13, 2025