The Stock Market's Ascent Amidst Trump's Tariff Chaos: Explanations And Predictions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Stock Market's Ascent Amidst Trump's Tariff Chaos: Explanations and Predictions

The stock market's recent climb has defied expectations, particularly considering the ongoing uncertainty surrounding President Trump's trade policies and the escalating tariff battles. While many predicted a significant market downturn in response to the trade war, the reality has been surprisingly different. This article delves into the potential reasons behind this seemingly paradoxical situation and offers insights into future market predictions.

Understanding the Unexpected Rally:

The stock market's resilience in the face of tariff-related uncertainty isn't solely driven by one factor. Instead, it's a complex interplay of several economic and psychological influences:

-

Resilient Corporate Earnings: Despite the tariffs, many US companies have reported strong earnings, indicating a degree of resilience and adaptability. This positive performance has boosted investor confidence. While some sectors are undoubtedly suffering, others are finding ways to mitigate the impact.

-

Low Interest Rates: The Federal Reserve's decision to maintain low interest rates has injected liquidity into the market, encouraging borrowing and investment. This monetary policy acts as a cushion against the negative effects of the trade war.

-

Investor Sentiment and Market Psychology: A significant factor is investor psychology. Some analysts believe that the market has largely priced in the negative impacts of the tariffs, meaning investors have already factored in potential losses into their valuations. Any news less negative than anticipated could lead to a market upswing. Furthermore, a "wait-and-see" attitude prevails, with investors hoping for a resolution to the trade disputes.

-

Global Economic Growth (Relatively): While global growth has slowed, it hasn't collapsed. Emerging markets, despite facing challenges, continue to show signs of life. This relative global stability provides some support for US equities.

Sector-Specific Impacts:

The impact of tariffs isn't uniform across all sectors. While industries heavily reliant on imported goods or exports have suffered, others have experienced minimal disruption. For example, the technology sector has generally fared well, driven by strong domestic demand and innovation. Conversely, sectors like agriculture and manufacturing have faced significant challenges.

Predicting the Future:

Predicting the stock market's future performance is notoriously difficult, especially amidst geopolitical uncertainty. However, considering the current factors, we can offer some potential scenarios:

-

Resolution of Trade Disputes: A swift and comprehensive resolution to the trade disputes could trigger a substantial market rally. This would eliminate uncertainty and allow companies to plan their strategies more effectively.

-

Escalation of Trade Tensions: A further escalation of the trade war, including the imposition of new tariffs or retaliatory measures, could lead to a market correction. This scenario would negatively impact investor confidence and potentially trigger widespread sell-offs.

-

Continued Stagnation: The market could continue its sideways movement, with moderate gains and losses depending on economic data and news regarding trade negotiations.

Conclusion:

The stock market's resilience in the face of Trump's tariff chaos is a complex issue with multiple contributing factors. While the current trajectory is positive, significant uncertainty remains. Investors should adopt a diversified approach, carefully monitoring economic indicators and developments in trade negotiations. The long-term impact will depend heavily on the resolution (or escalation) of the ongoing trade conflicts. It's crucial to stay informed and consult with a financial advisor before making any significant investment decisions. Staying updated on financial news sources like [link to reputable financial news site] is key to navigating this volatile landscape.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Stock Market's Ascent Amidst Trump's Tariff Chaos: Explanations And Predictions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

California Governor Newsom Sets Ultimatum For Trumps Redistricting Proposal

Aug 14, 2025

California Governor Newsom Sets Ultimatum For Trumps Redistricting Proposal

Aug 14, 2025 -

Crypto Market Buzz Peter Thiels Stake Sparks 182 Stock Surge

Aug 14, 2025

Crypto Market Buzz Peter Thiels Stake Sparks 182 Stock Surge

Aug 14, 2025 -

Crypto Stock Explodes 182 Surge After Thiel Stake Purchase

Aug 14, 2025

Crypto Stock Explodes 182 Surge After Thiel Stake Purchase

Aug 14, 2025 -

Social Media Frenzy Over Obi Wan Kenobis Ahsoka Appearance Lucasfilm Responds

Aug 14, 2025

Social Media Frenzy Over Obi Wan Kenobis Ahsoka Appearance Lucasfilm Responds

Aug 14, 2025 -

O Rourkes Blocked Funding Texas Democrats Redistricting Walkout

Aug 14, 2025

O Rourkes Blocked Funding Texas Democrats Redistricting Walkout

Aug 14, 2025

Latest Posts

-

Increased Light Levels Impact On Eye Health

Aug 14, 2025

Increased Light Levels Impact On Eye Health

Aug 14, 2025 -

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025

Brighter Lights Is This A Threat To Your Vision

Aug 14, 2025 -

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025

Newsoms Deadline For Trump A Crucial Moment In California Redistricting

Aug 14, 2025 -

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025

Taylor Swift Announces New Album The Life Of A Showgirl A Deep Dive

Aug 14, 2025 -

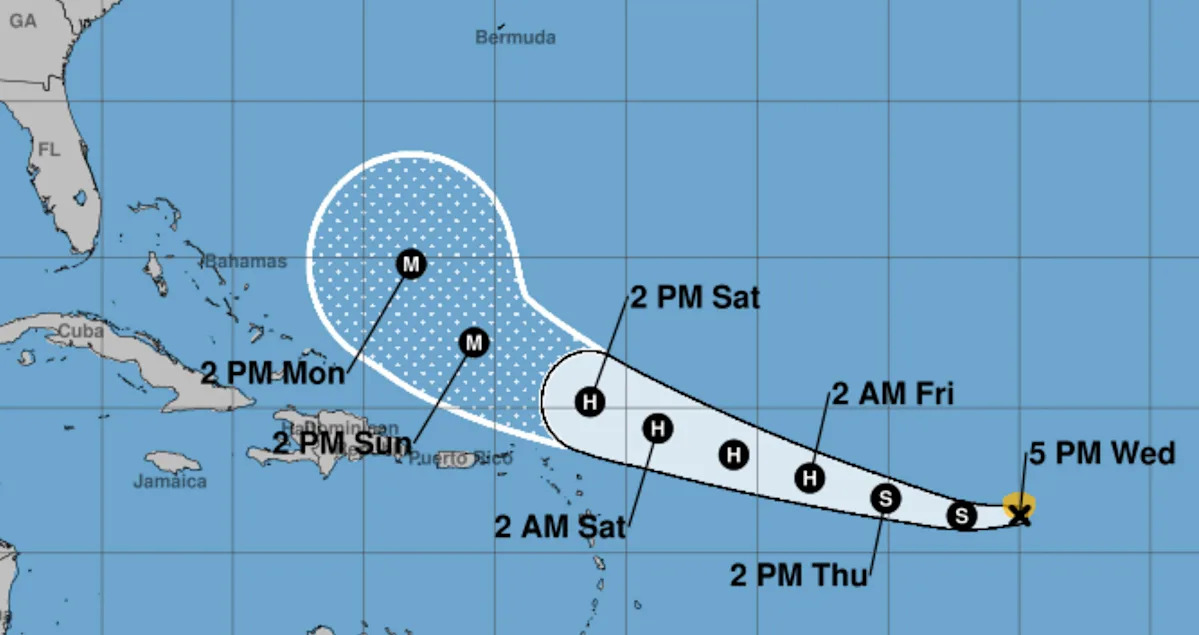

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025

Hurricane Erin Forecast Update Projected Path And Strengthening Potential This Week

Aug 14, 2025