The Impact Of Trump's Tax Bill On Healthcare Access

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Trump's Tax Cuts: The Lingering Shadow on Healthcare Access

The 2017 Tax Cuts and Jobs Act, a landmark piece of legislation under the Trump administration, significantly reshaped the American tax code. While touted as a boon for the economy, its impact on healthcare access remains a complex and hotly debated topic. Did the bill's provisions inadvertently exacerbate existing inequalities in healthcare, leaving many Americans with less access to crucial medical services? Let's delve into the details.

The Repeal of the Individual Mandate: A Key Change

One of the most significant changes introduced by the Tax Cuts and Jobs Act was the repeal of the individual mandate penalty under the Affordable Care Act (ACA). The mandate, a key component of the ACA, required most individuals to maintain health insurance coverage or pay a penalty. Its repeal, effective in 2019, was predicted to impact healthcare access in several ways.

-

Increased Uninsured Rates: The Congressional Budget Office (CBO) projected that repealing the mandate would lead to a significant increase in the number of uninsured Americans. This prediction, while debated, aligned with observed trends showing a slight uptick in uninsured individuals following the change. [Link to CBO report]

-

Higher Premiums: With fewer healthy individuals enrolling in insurance plans, the risk pool shifted, potentially leading to higher premiums for those who remained insured. This disproportionately affected lower-income individuals and families, further limiting their access to affordable healthcare.

-

Weakening of the ACA Marketplaces: The repeal contributed to instability within the ACA marketplaces, impacting the availability of plans and potentially leading to insurers withdrawing from certain regions. This resulted in reduced competition and limited choices for consumers in some areas.

Indirect Impacts on Healthcare Funding

Beyond the direct impact on the individual mandate, the tax cuts also indirectly affected healthcare access through reduced federal revenue. While the tax cuts stimulated economic growth in certain sectors, the decreased tax revenue potentially limited federal funding for healthcare programs, impacting:

-

Medicaid and Medicare: While not directly targeted, reduced federal revenue could indirectly strain funding for Medicaid and Medicare, impacting the quality and availability of services for millions of beneficiaries.

-

Public Health Initiatives: Funding for crucial public health programs, including preventative care and disease control, may have been negatively affected by the decreased tax revenue, potentially leading to long-term health consequences.

The Ongoing Debate and Future Implications

The debate surrounding the impact of the Trump tax cuts on healthcare access continues. Supporters argue that the economic benefits of the tax cuts ultimately outweigh any negative effects on healthcare. However, critics maintain that the repeal of the individual mandate and the potential reduction in federal funding for healthcare programs have exacerbated existing inequalities and limited access to essential medical services for vulnerable populations. [Link to opposing viewpoint article]

Looking Ahead: Understanding the long-term consequences of these changes requires continued research and monitoring of healthcare access indicators. The debate highlights the complex interplay between tax policy and healthcare access, emphasizing the importance of considering the wider societal impact of such legislation. Further studies are needed to fully quantify the long-term effects of the 2017 Tax Cuts and Jobs Act on healthcare access and affordability for all Americans.

Call to Action: Stay informed about healthcare policy changes and advocate for policies that promote equitable access to quality healthcare for all.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of Trump's Tax Bill On Healthcare Access. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Everything You Need To Know Call Of Dutys Beavis And Butt Head Event Rewards

Jul 04, 2025

Everything You Need To Know Call Of Dutys Beavis And Butt Head Event Rewards

Jul 04, 2025 -

Anurag Basus Metro In Dino A Deep Dive Into Female Characters

Jul 04, 2025

Anurag Basus Metro In Dino A Deep Dive Into Female Characters

Jul 04, 2025 -

Advocates In Louisville Fight To Save Lgbtq Youth Suicide Prevention Lifeline

Jul 04, 2025

Advocates In Louisville Fight To Save Lgbtq Youth Suicide Prevention Lifeline

Jul 04, 2025 -

Understanding The Potential Changes To Snap Under Trumps Economic Policies

Jul 04, 2025

Understanding The Potential Changes To Snap Under Trumps Economic Policies

Jul 04, 2025 -

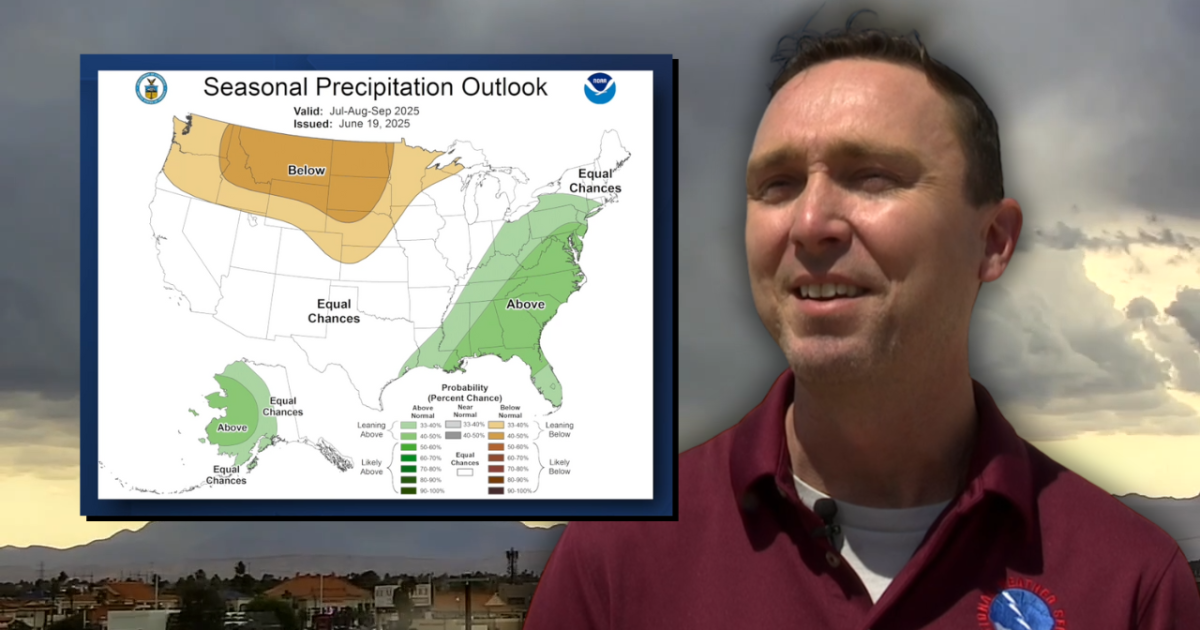

Will Southern Nevada Experience A Monsoon Or A Dry Season This Year

Jul 04, 2025

Will Southern Nevada Experience A Monsoon Or A Dry Season This Year

Jul 04, 2025

Latest Posts

-

Faith Journey A Christian Influencer Shares Why She No Longer Attends Church

Sep 10, 2025

Faith Journey A Christian Influencer Shares Why She No Longer Attends Church

Sep 10, 2025 -

France Vs Iceland Statistical Preview And Historical Head To Head For The Uefa World Cup Qualifiers

Sep 10, 2025

France Vs Iceland Statistical Preview And Historical Head To Head For The Uefa World Cup Qualifiers

Sep 10, 2025 -

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025

El Arte Del Entrenador Equilibrio Entre El Juego Y La Audiencia

Sep 10, 2025 -

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025

Unexpected Health Benefits Of Becoming A Grandparent

Sep 10, 2025 -

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025

Live Stream Details France Vs Iceland World Cup Qualifier Match Today

Sep 10, 2025