The Impact Of Climate Change On Business And Finance: A Real-World Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of Climate Change on Business and Finance: A Real-World Look

Climate change is no longer a distant threat; it's a present reality significantly impacting businesses and the global financial system. From extreme weather events causing operational disruptions to stricter environmental regulations reshaping industries, the financial implications are profound and far-reaching. This article explores the multifaceted ways climate change is transforming the business and finance landscape, offering a real-world perspective on the challenges and opportunities it presents.

H2: Physical Risks: The Tangible Impacts of a Changing Climate

Businesses are increasingly exposed to the physical risks of climate change. These are the direct consequences of extreme weather events and gradual environmental shifts.

- Increased frequency and intensity of extreme weather: Hurricanes, floods, wildfires, and droughts are becoming more common and severe, causing billions of dollars in damage to infrastructure, disrupting supply chains, and impacting operational efficiency. Think of the recent devastation caused by Hurricane Ian, which crippled businesses in Florida and beyond, highlighting the vulnerability of even well-established companies.

- Sea-level rise and coastal erosion: Businesses located in coastal areas face the imminent threat of sea-level rise and coastal erosion, leading to property damage, relocation costs, and potential business closures. This is particularly relevant for industries like tourism and real estate.

- Water scarcity: Many industries rely heavily on water resources. Increased droughts and changing precipitation patterns are leading to water scarcity, impacting agricultural production, energy generation, and manufacturing processes. [Link to a relevant article on water scarcity and business impact]

H2: Transition Risks: Adapting to a Low-Carbon Economy

The shift towards a low-carbon economy presents transition risks for businesses. These risks stem from the need to adapt to changing regulations, technological advancements, and evolving consumer preferences.

- Carbon pricing and emissions regulations: Governments worldwide are implementing carbon pricing mechanisms, such as carbon taxes and emissions trading schemes, to incentivize emissions reductions. Businesses failing to adapt to these regulations face significant financial penalties and competitive disadvantages.

- Shifting consumer preferences: Consumers are increasingly demanding environmentally friendly products and services. Companies that fail to incorporate sustainability into their business models risk losing market share to more environmentally conscious competitors.

- Technological disruption: The transition to a low-carbon economy is driving innovation in renewable energy, energy efficiency, and sustainable materials. Businesses that fail to adopt new technologies risk becoming obsolete.

H2: Financial Implications: Assessing the Costs and Opportunities

The financial implications of climate change are substantial. Investors are increasingly incorporating climate-related risks into their investment decisions, leading to changes in asset valuations and capital allocation.

- Stranded assets: Fossil fuel reserves and infrastructure may become "stranded assets" if the transition to a low-carbon economy accelerates faster than anticipated. This poses a significant risk to companies heavily invested in the fossil fuel industry.

- Increased insurance premiums: The increased frequency and severity of extreme weather events are leading to higher insurance premiums for businesses located in high-risk areas.

- Green investment opportunities: The transition to a low-carbon economy also presents significant investment opportunities in renewable energy, energy efficiency technologies, and sustainable infrastructure. [Link to a relevant article on green investment opportunities]

H2: Adapting and Mitigating: Strategies for Businesses

Businesses need to proactively adapt and mitigate the risks of climate change. This involves:

- Implementing climate risk assessments: Businesses should conduct thorough assessments to identify and quantify their climate-related risks and opportunities.

- Developing climate change adaptation strategies: Businesses should develop robust strategies to manage the physical and transition risks of climate change.

- Investing in climate-friendly technologies: Businesses should invest in renewable energy, energy efficiency, and other climate-friendly technologies to reduce their environmental footprint.

- Engaging with stakeholders: Businesses should engage with stakeholders, including investors, customers, and regulators, to address climate-related concerns.

H2: Conclusion: A Call to Action

Climate change is a defining challenge of our time, and its impact on business and finance is undeniable. Proactive adaptation and mitigation are crucial for business survival and long-term success. By embracing sustainable practices and investing in climate-resilient solutions, businesses can not only reduce their environmental impact but also unlock new opportunities for growth and innovation. The future of business is inextricably linked to the future of our planet; ignoring this reality is no longer an option. Learn more about incorporating sustainability into your business strategy by visiting [link to a relevant resource or organization].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of Climate Change On Business And Finance: A Real-World Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Sin Abqar Coudet Cita A Toda La Plantilla Del Celta

May 14, 2025

Sin Abqar Coudet Cita A Toda La Plantilla Del Celta

May 14, 2025 -

Nvidia Drives Tech Surge Lifting S And P 500 Above 2023 Losses Live Market Updates

May 14, 2025

Nvidia Drives Tech Surge Lifting S And P 500 Above 2023 Losses Live Market Updates

May 14, 2025 -

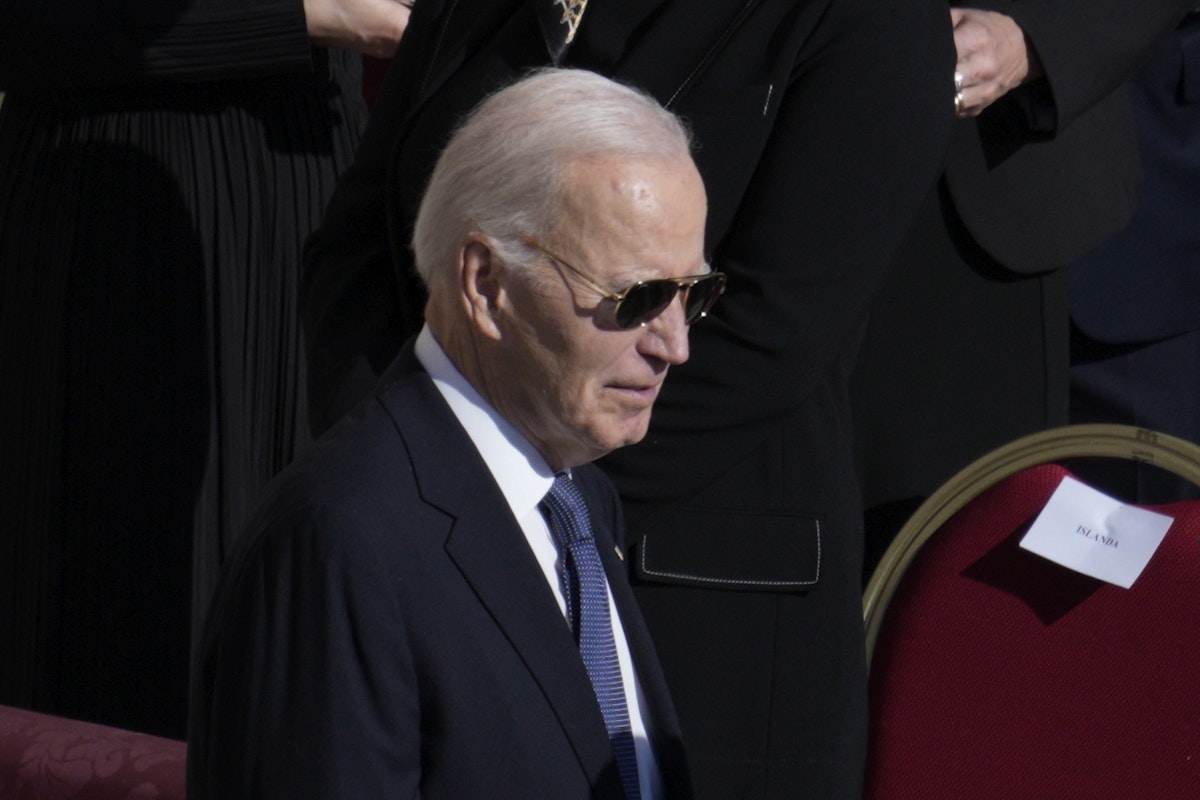

The Extent Of Bidens Cognitive Decline Staff Reports Raise Serious Questions

May 14, 2025

The Extent Of Bidens Cognitive Decline Staff Reports Raise Serious Questions

May 14, 2025 -

Market Reversal S And P 500 Climbs Erasing Projected 2025 Losses

May 14, 2025

Market Reversal S And P 500 Climbs Erasing Projected 2025 Losses

May 14, 2025 -

Partido Villarreal Leganes Resumen Goles Y Mejores Momentos De La Liga Ea Sports

May 14, 2025

Partido Villarreal Leganes Resumen Goles Y Mejores Momentos De La Liga Ea Sports

May 14, 2025