The Impact Of Climate Change On Business And Finance: A Deeper Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Impact of Climate Change on Business and Finance: A Deeper Look

Climate change is no longer a distant threat; it's a present reality profoundly impacting businesses and the global financial system. From shifting consumer preferences to increased regulatory scrutiny and the escalating costs of extreme weather events, companies across all sectors are grappling with the financial implications of a changing climate. This article delves into the multifaceted impact of climate change on business and finance, exploring both the risks and opportunities.

Rising Costs and Physical Risks: The Direct Impact

The most immediate impact of climate change is the escalating cost of physical risks. Extreme weather events – hurricanes, floods, wildfires, and droughts – are becoming more frequent and intense, causing billions of dollars in damage annually. Businesses face direct financial losses from property damage, supply chain disruptions, and lost productivity.

- Increased Insurance Premiums: As the frequency and severity of climate-related disasters rise, insurance premiums are skyrocketing, placing a significant burden on businesses, particularly those located in high-risk areas.

- Supply Chain Disruptions: Extreme weather can cripple transportation networks and disrupt the flow of goods, leading to production delays, shortages, and increased costs. This impact is felt across industries, from agriculture to manufacturing.

- Damage to Infrastructure: Critical infrastructure, including power grids, transportation systems, and communication networks, is vulnerable to climate-related damage, resulting in costly repairs and prolonged service interruptions.

Transition Risks: Adapting to a Low-Carbon Economy

Beyond physical risks, businesses face significant transition risks associated with the global shift towards a low-carbon economy. This involves adapting to new regulations, investing in cleaner technologies, and managing the risks associated with stranded assets – investments that lose value due to the transition to a low-carbon future.

- Carbon Pricing and Regulations: Governments worldwide are implementing carbon pricing mechanisms, such as carbon taxes and emissions trading schemes, to incentivize emissions reductions. These regulations can significantly increase the cost of doing business for high-carbon industries.

- Stranded Assets: Companies heavily reliant on fossil fuels face the risk of stranded assets as the demand for these resources declines. This poses a significant challenge to their long-term financial viability.

- Investment in Renewable Energy and Green Technologies: The shift to a low-carbon economy creates opportunities for businesses to invest in renewable energy, energy efficiency, and other green technologies. However, these investments require significant upfront capital and expertise.

Financial Market Implications: Assessing Climate-Related Financial Risks

The financial sector is increasingly recognizing the systemic risks posed by climate change. Investors and lenders are demanding greater transparency and accountability from companies regarding their climate-related risks and opportunities. This includes incorporating climate-related financial disclosures into their financial reporting.

- ESG Investing: Environmental, Social, and Governance (ESG) investing is gaining momentum, with investors increasingly considering climate-related factors when making investment decisions. Companies with strong ESG performance are often rewarded with higher valuations and lower borrowing costs.

- Climate-Related Financial Disclosures: Regulatory bodies are pushing for greater transparency in climate-related financial disclosures, requiring companies to report on their greenhouse gas emissions, climate-related risks, and strategies for mitigation and adaptation. Examples include the Task Force on Climate-related Financial Disclosures (TCFD) recommendations.

- Increased Scrutiny from Rating Agencies: Credit rating agencies are incorporating climate-related risks into their assessments, potentially impacting a company's credit rating and borrowing costs.

Opportunities for Businesses: Embracing Sustainability

While climate change presents significant challenges, it also creates opportunities for businesses that embrace sustainability. Companies that proactively address climate change can enhance their reputation, attract investors, and gain a competitive advantage.

- Innovation and Green Technologies: The transition to a low-carbon economy is driving innovation in green technologies, creating new markets and opportunities for businesses.

- Improved Energy Efficiency: Implementing energy-efficient practices can significantly reduce operating costs and enhance a company's environmental performance.

- Enhanced Brand Reputation: Companies demonstrating a commitment to sustainability often enjoy enhanced brand reputation and increased customer loyalty.

Conclusion:

Climate change is a defining challenge of our time, and its impact on businesses and finance is undeniable. By proactively addressing climate-related risks and embracing sustainable practices, companies can not only mitigate their exposure to financial losses but also unlock new opportunities for growth and innovation. Ignoring these risks, however, poses a significant threat to long-term financial stability and competitiveness. For further information on climate-related financial disclosures, refer to the .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Impact Of Climate Change On Business And Finance: A Deeper Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

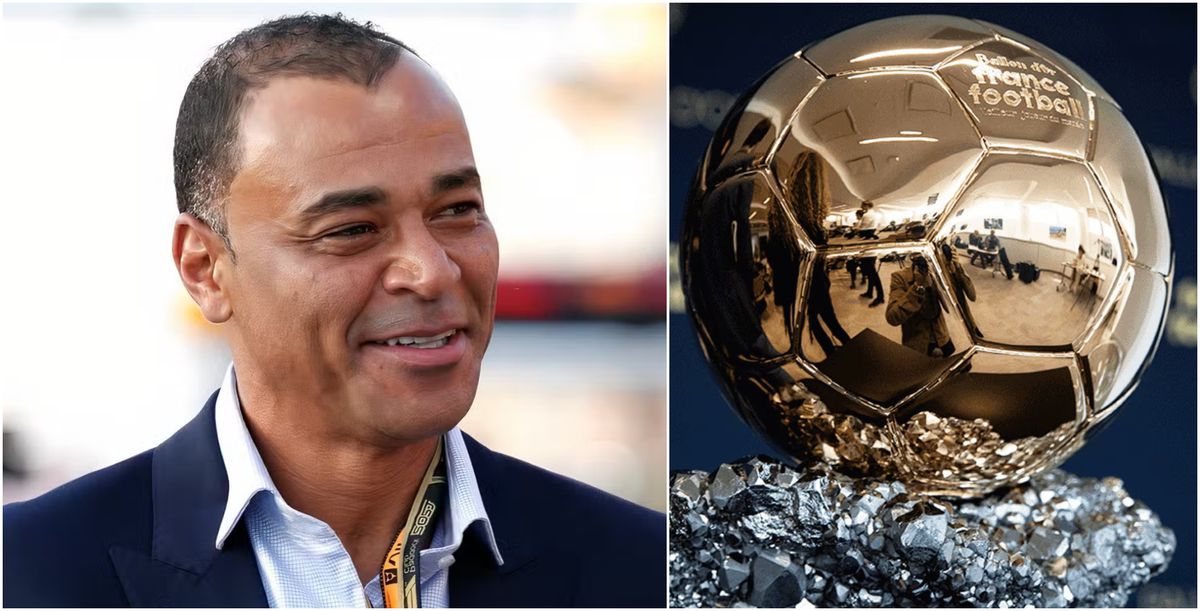

World Cup Winner Cafu Reveals His Ballon D Or 2025 Favorites

May 12, 2025

World Cup Winner Cafu Reveals His Ballon D Or 2025 Favorites

May 12, 2025 -

American Journalist Austin Tice New Report Details The Discovery Of His Body

May 12, 2025

American Journalist Austin Tice New Report Details The Discovery Of His Body

May 12, 2025 -

Lamine Yamal Vs Messi A Skillset Comparison And Areas For Growth

May 12, 2025

Lamine Yamal Vs Messi A Skillset Comparison And Areas For Growth

May 12, 2025 -

Six Goals In 45 Minutes Barcelona Real Madrid El Clasico Live Updates

May 12, 2025

Six Goals In 45 Minutes Barcelona Real Madrid El Clasico Live Updates

May 12, 2025 -

Carolina Panthers Rookie Minicamp Mc Millans Return

May 12, 2025

Carolina Panthers Rookie Minicamp Mc Millans Return

May 12, 2025