The Financial Industry's Response To Climate Change Risks

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial Industry's Evolving Response to Climate Change Risks

The financial industry, long a driver of economic growth, is increasingly grappling with the profound implications of climate change. From shifting regulatory landscapes to escalating physical and transition risks, the sector is undergoing a significant transformation in its approach to environmental, social, and governance (ESG) factors, particularly concerning climate change. This article explores the industry's evolving response, highlighting key challenges and promising developments.

H2: The Growing Recognition of Climate-Related Financial Risks

For years, climate change was often viewed as a peripheral issue for financial institutions. However, a growing body of evidence, including increasingly frequent and severe extreme weather events and the rapid acceleration of climate-related litigation, has forced a reassessment. The Task Force on Climate-related Financial Disclosures (TCFD), established by the Financial Stability Board (FSB), has played a crucial role in raising awareness and promoting consistent reporting of climate-related risks. The TCFD framework encourages companies to disclose their climate-related financial risks and opportunities, influencing investor decisions and regulatory actions.

H2: Key Climate Risks Facing the Financial Sector

Financial institutions face a dual challenge:

-

Physical Risks: These are the direct impacts of climate change, such as hurricanes, floods, wildfires, and sea-level rise. These events can damage assets, disrupt supply chains, and lead to significant financial losses for businesses and investors holding assets in vulnerable locations. Insurance companies, for example, are already experiencing increased claims related to extreme weather.

-

Transition Risks: These risks stem from the global shift towards a low-carbon economy. This includes policy changes, technological advancements, and shifting consumer preferences that could render carbon-intensive assets stranded, leading to significant write-downs and losses. Companies heavily reliant on fossil fuels are particularly vulnerable to transition risks.

H3: Examples of Industry Responses

The financial industry is responding in several ways:

-

Increased ESG Investing: There's a surge in investment in sustainable and responsible initiatives. More investors are incorporating ESG factors into their investment decisions, leading to a growth in green bonds, sustainable funds, and impact investing.

-

Climate Scenario Analysis: Many financial institutions are now conducting climate scenario analyses to assess their portfolio's vulnerability to different climate change scenarios. This helps them understand potential future risks and inform their investment strategies.

-

Carbon Footprint Reduction: Banks and other financial institutions are setting ambitious targets to reduce their own carbon footprint, often focusing on operational emissions and financing of sustainable projects.

-

Regulatory Scrutiny: Governments worldwide are implementing stricter regulations to address climate-related financial risks. This includes mandatory climate-related disclosures, stress tests incorporating climate scenarios, and increased scrutiny of lending to high-carbon industries. The EU's Sustainable Finance Disclosure Regulation (SFDR) is a prime example of this trend.

H2: Challenges and Opportunities

Despite significant progress, challenges remain:

-

Data Availability and Quality: Accurate and consistent data on climate-related risks is still scarce, hindering effective risk assessment and management.

-

Standardization of Metrics: The lack of standardized metrics for measuring and reporting climate-related risks makes comparisons between companies difficult.

-

Greenwashing Concerns: The increasing focus on ESG has led to concerns about "greenwashing," where companies exaggerate their environmental credentials.

However, the transition to a low-carbon economy also presents significant opportunities for innovation and growth in the financial sector. The development of green finance products, the financing of renewable energy projects, and the creation of new sustainable business models are all areas with immense potential.

H2: The Path Forward

The financial industry's response to climate change risks is still evolving, but the trend is clear: a growing recognition of the urgency and importance of integrating climate considerations into all aspects of financial decision-making. Collaboration between governments, regulators, financial institutions, and investors is crucial to navigate the challenges and seize the opportunities presented by the transition to a sustainable economy. Further development of robust methodologies for assessing and managing climate risks, improved data availability, and stronger regulatory frameworks will be essential in fostering a more resilient and sustainable financial system. This transition requires ongoing vigilance and commitment from all stakeholders. Learn more about the TCFD framework by visiting their website [link to TCFD website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial Industry's Response To Climate Change Risks. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Syria Sanctions Relief Analyzing Trumps Decision And Meeting With Assad

May 16, 2025

Syria Sanctions Relief Analyzing Trumps Decision And Meeting With Assad

May 16, 2025 -

Quail Hollow Club Notable Pga Pro Skips 2025 Championship Heres Why

May 16, 2025

Quail Hollow Club Notable Pga Pro Skips 2025 Championship Heres Why

May 16, 2025 -

Prepare For Rain Occasional Showers And Storms Predicted

May 16, 2025

Prepare For Rain Occasional Showers And Storms Predicted

May 16, 2025 -

Rising Temperatures Rising Risks Climate Change And Pregnancy Complications

May 16, 2025

Rising Temperatures Rising Risks Climate Change And Pregnancy Complications

May 16, 2025 -

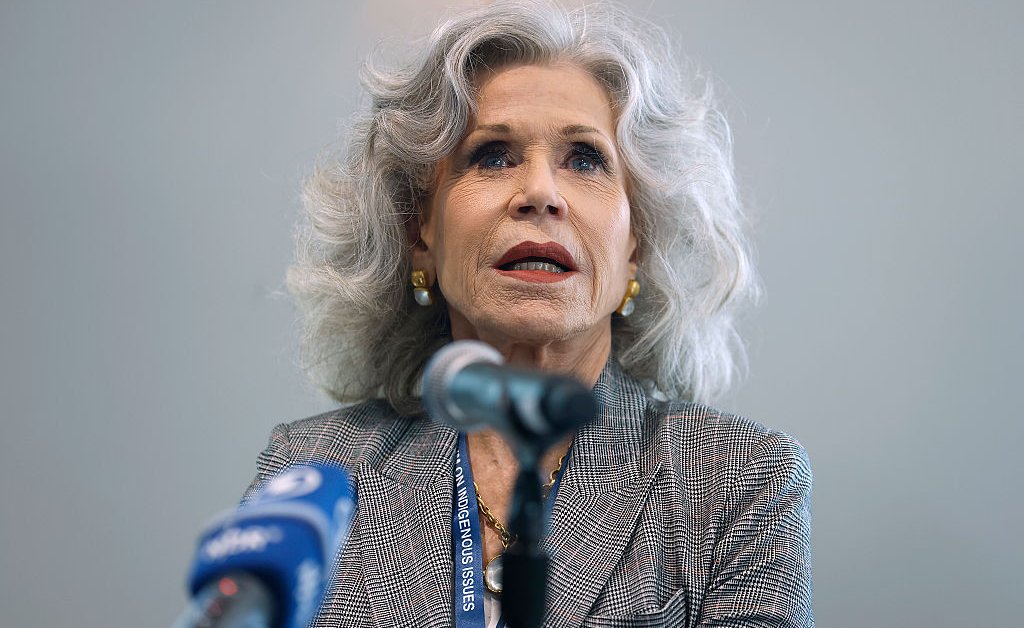

Actress Jane Fonda Leads Charge To Save Ecuadorian Rainforest

May 16, 2025

Actress Jane Fonda Leads Charge To Save Ecuadorian Rainforest

May 16, 2025