The Financial Industry's Response To Climate Change: A Deeper Look

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial Industry's Response to Climate Change: A Deeper Look

The financial industry, long a driver of economic growth, is increasingly facing pressure to address its role in climate change. From the devastating impacts of extreme weather events to the growing awareness of environmental, social, and governance (ESG) factors, the sector is undergoing a significant transformation. This article delves into the complexities of the financial industry's response to climate change, exploring both progress and persistent challenges.

Growing Awareness and Regulatory Pressure

The urgency surrounding climate action is undeniable. Scientists warn of catastrophic consequences if greenhouse gas emissions aren't drastically reduced. This awareness has translated into heightened regulatory scrutiny and investor demands for greater transparency and accountability regarding climate-related risks. Governments worldwide are implementing stricter regulations, including mandatory climate-related financial disclosures, like those championed by the Task Force on Climate-related Financial Disclosures (TCFD). These regulations aim to standardize reporting and provide investors with the information needed to assess climate-related risks and opportunities. Failure to comply can result in significant financial penalties and reputational damage.

Integrating ESG Factors into Investment Decisions

The rise of ESG investing signifies a shift in how financial institutions evaluate investment opportunities. ESG factors, encompassing environmental, social, and governance considerations, are increasingly integrated into investment strategies. This means assessing a company's carbon footprint, its social impact, and its governance practices alongside traditional financial metrics. This approach recognizes that environmental and social factors can significantly impact a company's long-term financial performance and stability. More and more investors are actively seeking out companies with strong ESG profiles, driving demand for sustainable and responsible investments. [Link to a reputable source on ESG investing]

Challenges and Obstacles

Despite the growing momentum, the financial industry still faces several significant challenges in addressing climate change. These include:

- Data availability and reliability: Accurate and consistent data on climate-related risks is often lacking, hindering effective risk assessment.

- Measuring the impact of climate policies: Predicting the long-term financial implications of climate policies and regulations remains difficult.

- Stranded assets: Companies heavily invested in fossil fuels face the risk of stranded assets – assets that become worthless due to climate action policies. This poses a major challenge for banks and investors.

- Greenwashing: The risk of "greenwashing" – misleading claims about environmental performance – remains a concern.

The Role of Green Finance

Green finance plays a crucial role in driving the transition to a low-carbon economy. This involves channeling capital towards sustainable projects and technologies, including renewable energy, energy efficiency, and sustainable transportation. Green bonds, for example, are a key instrument for raising capital for climate-friendly projects. [Link to a reputable source on green bonds] However, the scale of green finance needs to significantly increase to meet the demands of the climate crisis.

The Path Forward

The financial industry's response to climate change is an ongoing process, marked by both progress and challenges. Collaboration between governments, regulators, financial institutions, and investors is essential to effectively address the climate crisis. Transparency, robust data, and standardized reporting are crucial to fostering trust and driving informed decision-making. The future success hinges on a commitment to integrating climate considerations into all aspects of financial decision-making, ultimately fostering a more sustainable and resilient global economy. Further research and development into climate-risk modeling and sustainable finance instruments will be critical in navigating this complex landscape.

Call to Action: Stay informed about the latest developments in climate finance and advocate for policies that promote sustainable investment and responsible business practices. Learn more about ESG investing and the role you can play in shaping a sustainable future.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial Industry's Response To Climate Change: A Deeper Look. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maduro Y La Crisis Petrolera Los Barcos Varados De Maracaibo Como Evidencia Del Fracaso

May 12, 2025

Maduro Y La Crisis Petrolera Los Barcos Varados De Maracaibo Como Evidencia Del Fracaso

May 12, 2025 -

Pm Modis Red Line Pakistan Must Discuss Po K For Kashmir Talks To Begin

May 12, 2025

Pm Modis Red Line Pakistan Must Discuss Po K For Kashmir Talks To Begin

May 12, 2025 -

Barcelona Real Madrid El Clasico Live Score And First Half Highlights

May 12, 2025

Barcelona Real Madrid El Clasico Live Score And First Half Highlights

May 12, 2025 -

American Journalist Austin Tice Report Confirms Remains Found

May 12, 2025

American Journalist Austin Tice Report Confirms Remains Found

May 12, 2025 -

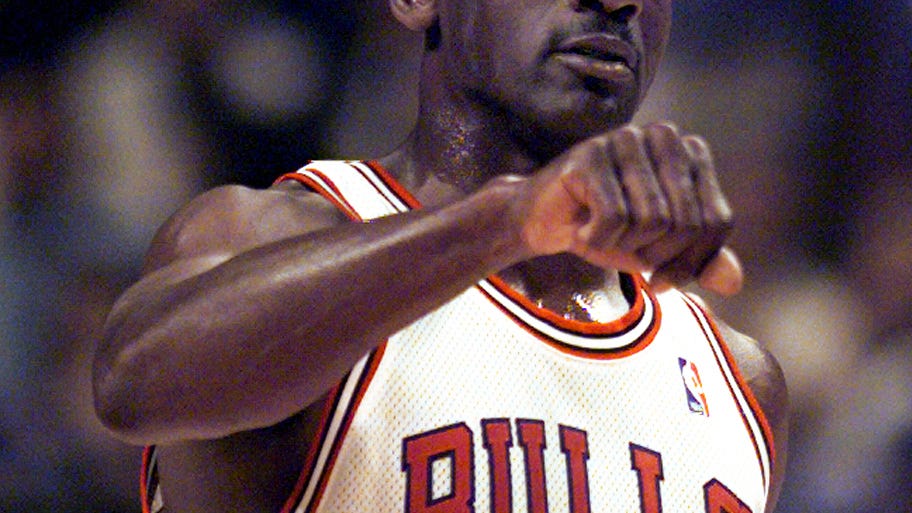

Exclusive Michael Jordan Partners With Nbc For Sports Broadcasting

May 12, 2025

Exclusive Michael Jordan Partners With Nbc For Sports Broadcasting

May 12, 2025