The Financial Industry And Corporate Climate Action: A New Conversation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial Industry and Corporate Climate Action: A New Conversation

The global financial industry is undergoing a seismic shift, driven not by market forces alone, but by the urgent need for corporate climate action. For years, the conversation around climate change was largely relegated to environmental agencies and activists. Now, however, financial institutions are taking center stage, recognizing both the risks and opportunities presented by a warming planet. This isn't just about ethical responsibility; it's about safeguarding investments and ensuring long-term profitability.

The Growing Pressure for Climate Disclosure and Transparency

One of the most significant developments is the increasing demand for transparency regarding environmental, social, and governance (ESG) factors. Regulators worldwide are implementing stricter reporting requirements, pushing companies to disclose their carbon footprint and climate-related risks. This includes everything from Scope 1 and Scope 2 emissions (direct and indirect emissions from energy consumption) to Scope 3 emissions (indirect emissions from the value chain). The Task Force on Climate-related Financial Disclosures (TCFD), for instance, has become a global benchmark for climate-related financial reporting, influencing how companies assess and communicate their climate risks and opportunities. [Link to TCFD website]

Financial Institutions Lead the Charge: Investing in a Sustainable Future

Financial institutions are no longer passive observers; they are actively shaping the future of corporate climate action. We're seeing a surge in:

- Sustainable finance initiatives: Banks are increasingly offering green loans and bonds, channeling capital towards projects that promote renewable energy, energy efficiency, and sustainable infrastructure.

- ESG investing: Investment funds are integrating ESG factors into their investment strategies, favoring companies with strong climate performance and commitment to sustainability. This includes divestment from high-carbon industries and increased investment in green technologies.

- Climate risk assessments: Financial institutions are incorporating climate-related risks into their risk management frameworks, evaluating the potential impact of climate change on their portfolios and operations. This involves sophisticated modeling and scenario analysis to understand potential financial losses from extreme weather events and policy changes.

Challenges and Opportunities in the Transition

Despite the progress, significant challenges remain. The transition to a low-carbon economy requires substantial investment and a fundamental shift in business models. Some of the key challenges include:

- Data availability and consistency: Accurate and reliable data on emissions and climate-related risks is crucial for effective decision-making. Inconsistencies in reporting standards and data quality remain a significant hurdle.

- Measuring the impact of ESG initiatives: Demonstrating the tangible financial benefits of ESG investments and sustainable practices can be challenging. Robust metrics and standardized reporting frameworks are needed.

- Greenwashing concerns: There are concerns about companies engaging in "greenwashing," exaggerating their environmental credentials to attract investors. Independent verification and rigorous auditing are crucial to prevent misleading claims.

The Future of Finance and Climate Action: A Collaborative Approach

The conversation around corporate climate action and the financial industry is far from over. It requires a collaborative effort involving governments, regulators, businesses, and investors. This includes:

- Developing robust and harmonized reporting standards: Creating globally consistent standards for climate-related disclosures will improve transparency and comparability.

- Promoting innovation in green technologies: Investing in research and development of clean energy technologies is crucial for accelerating the transition to a low-carbon economy.

- Encouraging stakeholder engagement: Companies need to engage with their stakeholders – investors, employees, customers, and communities – to understand their expectations and concerns regarding climate change.

The integration of climate action into the core business strategy of corporations is no longer optional; it is essential for long-term success. The financial industry’s evolving role underscores this reality, paving the way for a more sustainable and resilient future. The ongoing dialogue, fueled by increasing pressure and evolving regulations, promises a future where finance drives positive climate action, not just mitigates its risks.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial Industry And Corporate Climate Action: A New Conversation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Espanyol Vs Barcelona Enfrentamiento Directo Jornada 36 La Liga Alineaciones

May 16, 2025

Espanyol Vs Barcelona Enfrentamiento Directo Jornada 36 La Liga Alineaciones

May 16, 2025 -

Alineaciones Confirmadas Isco Antony Y Cucho En El Once Del Betis Ciss Regresa Al Rayo

May 16, 2025

Alineaciones Confirmadas Isco Antony Y Cucho En El Once Del Betis Ciss Regresa Al Rayo

May 16, 2025 -

David Hoggs Political Engagement An Analysis Of The Dncs Approach

May 16, 2025

David Hoggs Political Engagement An Analysis Of The Dncs Approach

May 16, 2025 -

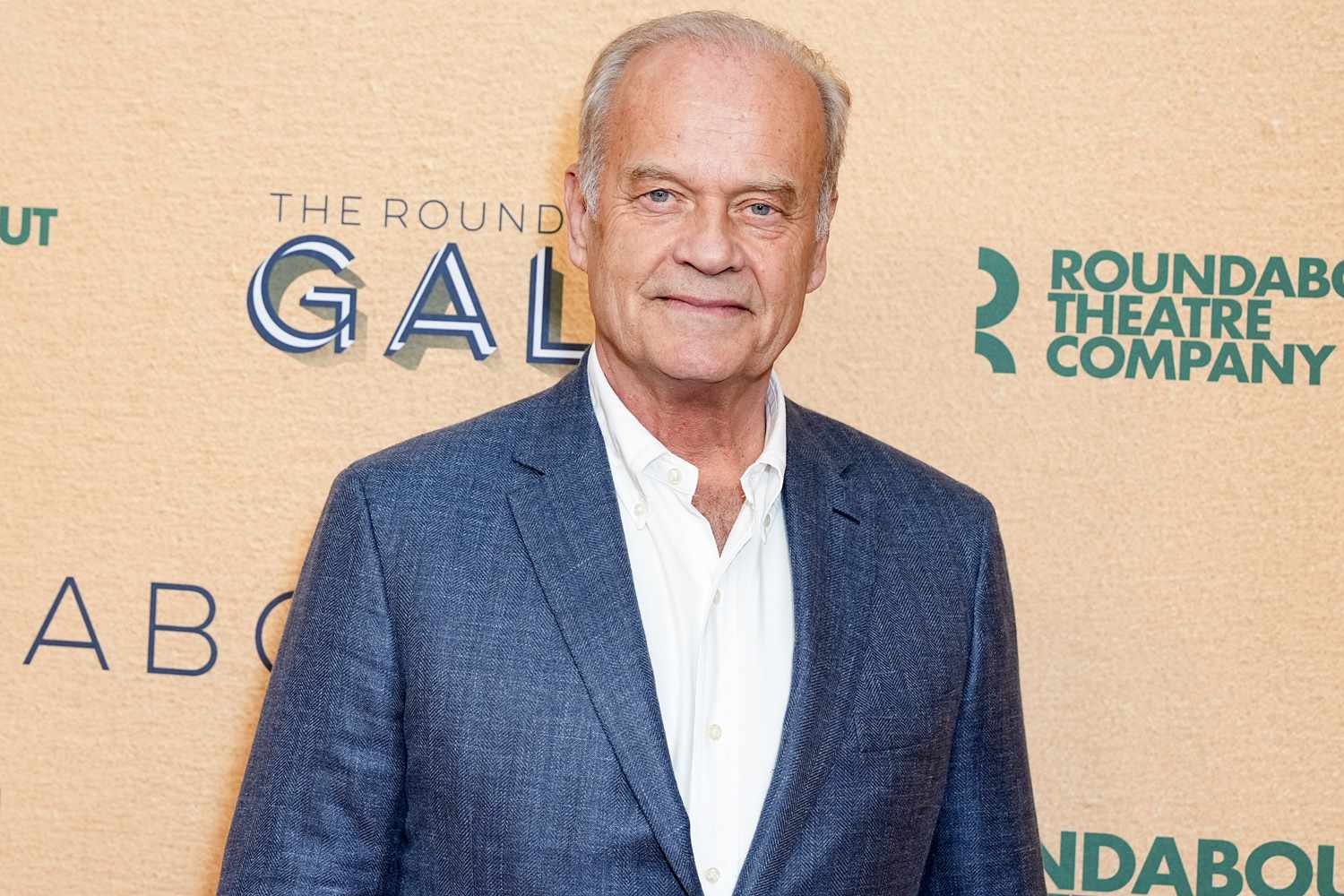

Grammers Painful Confession The Abortion That Haunts Him

May 16, 2025

Grammers Painful Confession The Abortion That Haunts Him

May 16, 2025 -

Espanyol Barcelona Posibles Onces Y Analisis Jornada 36 La Liga Santander

May 16, 2025

Espanyol Barcelona Posibles Onces Y Analisis Jornada 36 La Liga Santander

May 16, 2025