The Financial Industry And Climate Change: A Candid Conversation

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Financial Industry and Climate Change: A Candid Conversation

The financial industry, long a driver of economic growth, is increasingly facing a reckoning: climate change. No longer a distant threat, the impacts of a warming planet are already disrupting markets, impacting investments, and presenting both significant risks and unprecedented opportunities. This candid conversation delves into the evolving relationship between finance and climate, exploring the challenges and the path forward.

The Mounting Risks: More Than Just a PR Problem

For years, the financial sector's response to climate change was often perceived as superficial, focused primarily on public relations rather than fundamental shifts in strategy. However, the narrative is rapidly changing. The physical risks of climate change – extreme weather events, sea-level rise, and resource scarcity – are translating into tangible financial losses. Insurance companies are facing escalating payouts for climate-related damages, while infrastructure investments are becoming increasingly vulnerable.

- Increased Insurance Costs: The cost of insuring assets in climate-vulnerable regions is skyrocketing, impacting property values and investment decisions. [Link to a relevant insurance industry report on climate risk]

- Stranded Assets: Fossil fuel reserves and infrastructure are facing the risk of becoming "stranded assets," losing their economic value as the world transitions to cleaner energy sources. This poses a significant challenge for investors holding these assets.

- Supply Chain Disruptions: Climate change is disrupting global supply chains, leading to production delays, increased costs, and potential shortages of essential goods.

Embracing the Transition: Opportunities in a Green Economy

While the risks are undeniable, the transition to a low-carbon economy also presents enormous opportunities. The burgeoning green economy is attracting significant investment, creating new markets in renewable energy, energy efficiency, and sustainable technologies.

- Green Finance Initiatives: Governments and international organizations are implementing policies to incentivize green investments, including carbon pricing mechanisms and green bond initiatives. [Link to a relevant governmental or international organization report on green finance]

- ESG Investing: Environmental, Social, and Governance (ESG) investing is gaining mainstream acceptance, with investors increasingly demanding transparency and accountability from companies on their environmental performance. [Link to a reputable ESG investing resource]

- Technological Innovation: The drive towards decarbonization is fueling innovation in clean technologies, offering exciting investment prospects and potential for high returns.

Regulatory Scrutiny and Transparency: The Path Forward

Increasingly stringent regulations are forcing the financial industry to confront climate change more directly. Disclosures of climate-related risks are becoming mandatory in many jurisdictions, pushing companies to assess and manage their environmental impact more rigorously.

What Needs to Happen?

The financial industry needs to move beyond superficial commitments and integrate climate risk management into its core operations. This requires:

- Accurate and Transparent Data: Reliable data on climate-related risks is crucial for informed decision-making.

- Robust Scenario Planning: Financial institutions need to develop robust scenarios to assess the potential impacts of different climate change pathways.

- Collaboration and Information Sharing: Effective climate risk management requires collaboration across the industry and with other stakeholders.

- Investment in Green Technologies: Significant investments are needed to develop and deploy clean technologies at scale.

The financial industry's response to climate change is not merely a matter of ethical responsibility; it's a matter of financial prudence. By proactively managing climate-related risks and embracing the opportunities presented by the green economy, the financial sector can ensure its long-term stability and contribute to a more sustainable future. The conversation continues, and its outcome will significantly shape the world's economic landscape for decades to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Financial Industry And Climate Change: A Candid Conversation. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

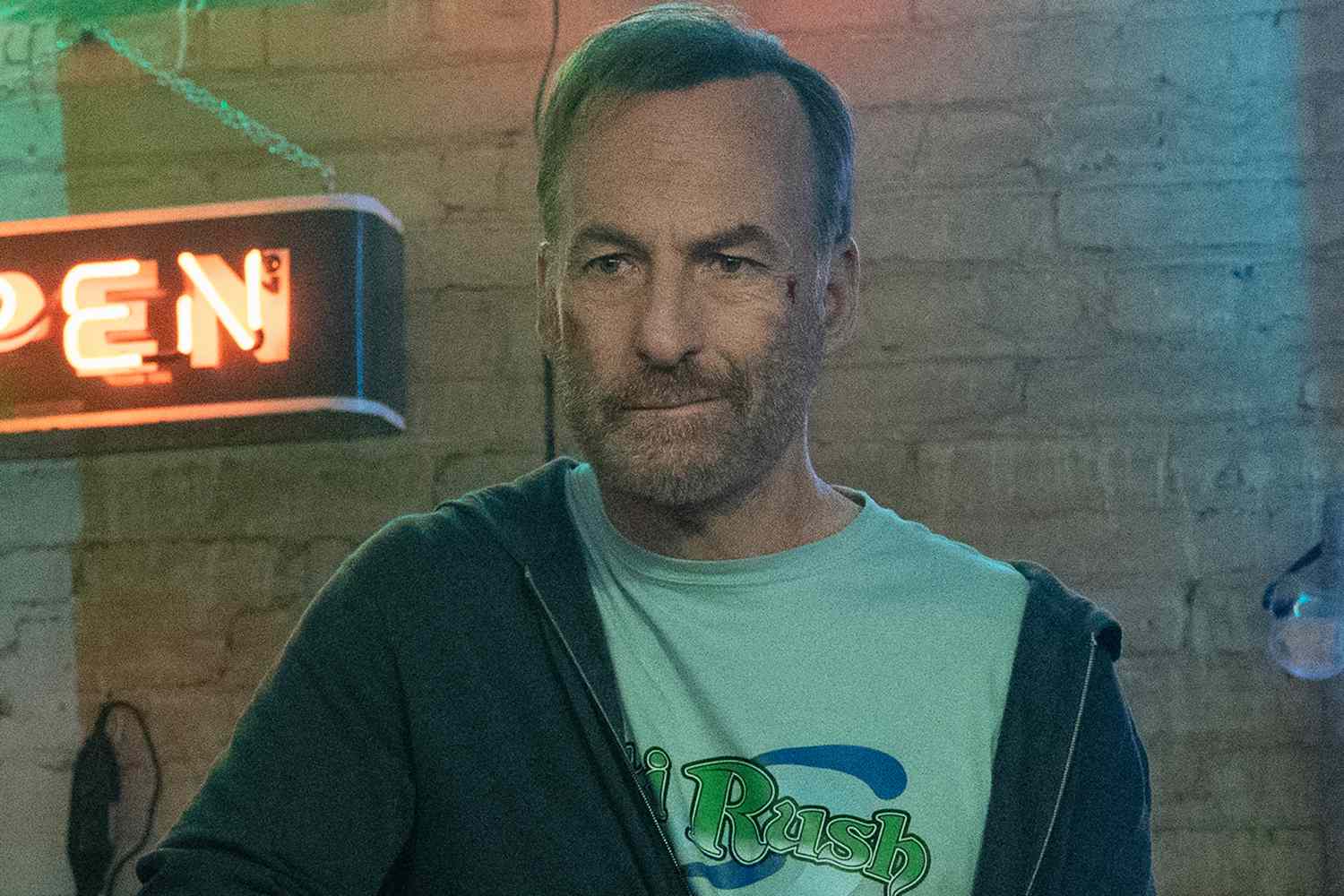

Bob Odenkirk Unleashes Fury In The Nobody 2 Trailer A Family Vacation Gone Wrong

May 14, 2025

Bob Odenkirk Unleashes Fury In The Nobody 2 Trailer A Family Vacation Gone Wrong

May 14, 2025 -

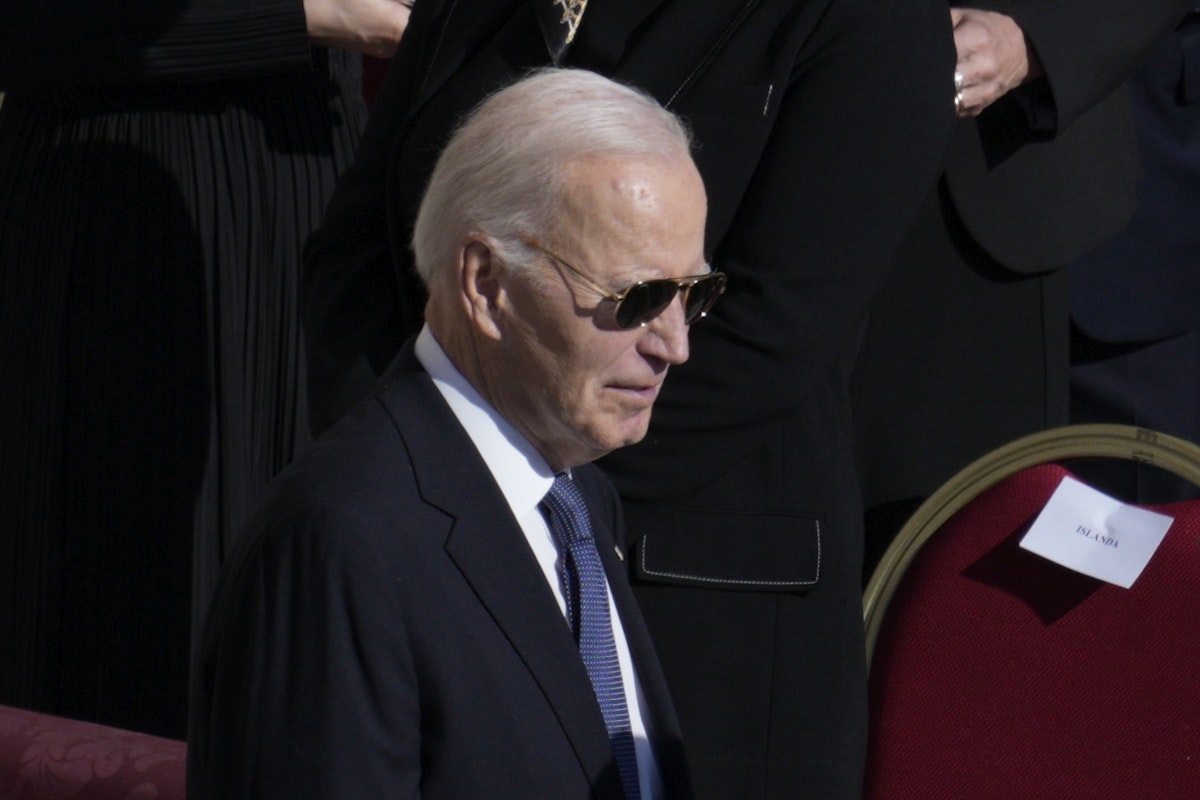

Bidens Health Internal Concerns Over Cognitive Abilities Surface

May 14, 2025

Bidens Health Internal Concerns Over Cognitive Abilities Surface

May 14, 2025 -

Nvidia Drives Tech Surge S And P 500 Recovers 2023 Losses Live Market Updates

May 14, 2025

Nvidia Drives Tech Surge S And P 500 Recovers 2023 Losses Live Market Updates

May 14, 2025 -

Strong 6 1 Earthquake Reported Off The Coast Of Greece Usgs Update

May 14, 2025

Strong 6 1 Earthquake Reported Off The Coast Of Greece Usgs Update

May 14, 2025 -

Nelsons Next Chapter From Nba Court To 76ers Front Office

May 14, 2025

Nelsons Next Chapter From Nba Court To 76ers Front Office

May 14, 2025