The Evolving Conversation: Climate Change In Business And Finance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Evolving Conversation: Climate Change in Business and Finance

The conversation surrounding climate change is no longer a niche discussion; it's a dominant theme reshaping the global landscape of business and finance. From boardrooms to trading floors, the urgency of addressing climate risks and opportunities is undeniable. This evolution isn't simply about environmental responsibility; it's about financial stability, long-term growth, and future-proofing businesses for a rapidly changing world.

The Growing Importance of ESG Investing

Environmental, Social, and Governance (ESG) investing is no longer a fringe movement. It's rapidly becoming mainstream, with investors increasingly demanding transparency and accountability from companies regarding their environmental impact. This shift is driven by several factors:

- Growing awareness of climate-related financial risks: Extreme weather events, regulatory changes, and the transition to a low-carbon economy pose significant financial risks to businesses unprepared for the shift.

- Increased investor demand for sustainable investments: More and more investors, including institutional investors and individual investors, are actively seeking out companies with strong ESG profiles.

- Enhanced regulatory scrutiny: Governments worldwide are introducing stricter regulations related to climate change disclosure and reporting, forcing companies to be more transparent about their environmental performance.

Climate Risk: Beyond the Environmental Impact

Understanding climate risk goes far beyond simply reducing carbon emissions. It involves analyzing:

- Physical risks: These include the direct impacts of climate change, such as extreme weather events (hurricanes, floods, droughts) that can damage infrastructure, disrupt supply chains, and impact operations.

- Transition risks: These relate to the changes needed to move towards a low-carbon economy, including policy changes, technological advancements, and shifts in consumer preferences. For example, companies heavily reliant on fossil fuels face significant transition risks.

- Opportunities for innovation and growth: The transition to a low-carbon economy also presents significant opportunities for businesses to develop and implement innovative solutions, creating new markets and driving economic growth. This includes investments in renewable energy, energy efficiency technologies, and sustainable agriculture.

How Businesses are Adapting

Forward-thinking businesses are actively adapting to the changing landscape by:

- Setting ambitious emissions reduction targets: Many companies are committing to net-zero emissions targets, aligning their operations with the goals of the Paris Agreement.

- Integrating climate risk into their business strategies: Companies are increasingly incorporating climate risk into their overall risk management frameworks, assessing potential impacts and developing mitigation strategies.

- Investing in renewable energy and energy efficiency: Many businesses are investing in renewable energy sources and implementing energy-efficient technologies to reduce their carbon footprint and operational costs.

- Improving transparency and reporting: Companies are improving their ESG disclosures, providing more detailed information on their environmental performance and climate-related risks.

The Financial Sector's Role

The financial sector plays a crucial role in driving the transition to a low-carbon economy. Banks, insurers, and investors are increasingly incorporating ESG factors into their investment decisions and lending practices. This includes:

- Green financing: Providing financing for renewable energy projects and other sustainable initiatives.

- Sustainable investing: Investing in companies with strong ESG profiles.

- Divestment from fossil fuels: Some investors are divesting from companies with significant exposure to fossil fuels.

Conclusion: Embracing the Change

The integration of climate change considerations into business and finance is not just a trend; it's a fundamental shift. Companies and investors who fail to adapt risk falling behind, facing significant financial and reputational risks. By embracing the challenges and opportunities presented by climate change, businesses and the financial sector can build a more sustainable and resilient future for all. Learn more about sustainable investing strategies by exploring resources from organizations like the and the . The future of business is green, and the time to act is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Evolving Conversation: Climate Change In Business And Finance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Villarreal Leganes Toda La Informacion Del Partido De La Liga Ea Sports

May 14, 2025

Villarreal Leganes Toda La Informacion Del Partido De La Liga Ea Sports

May 14, 2025 -

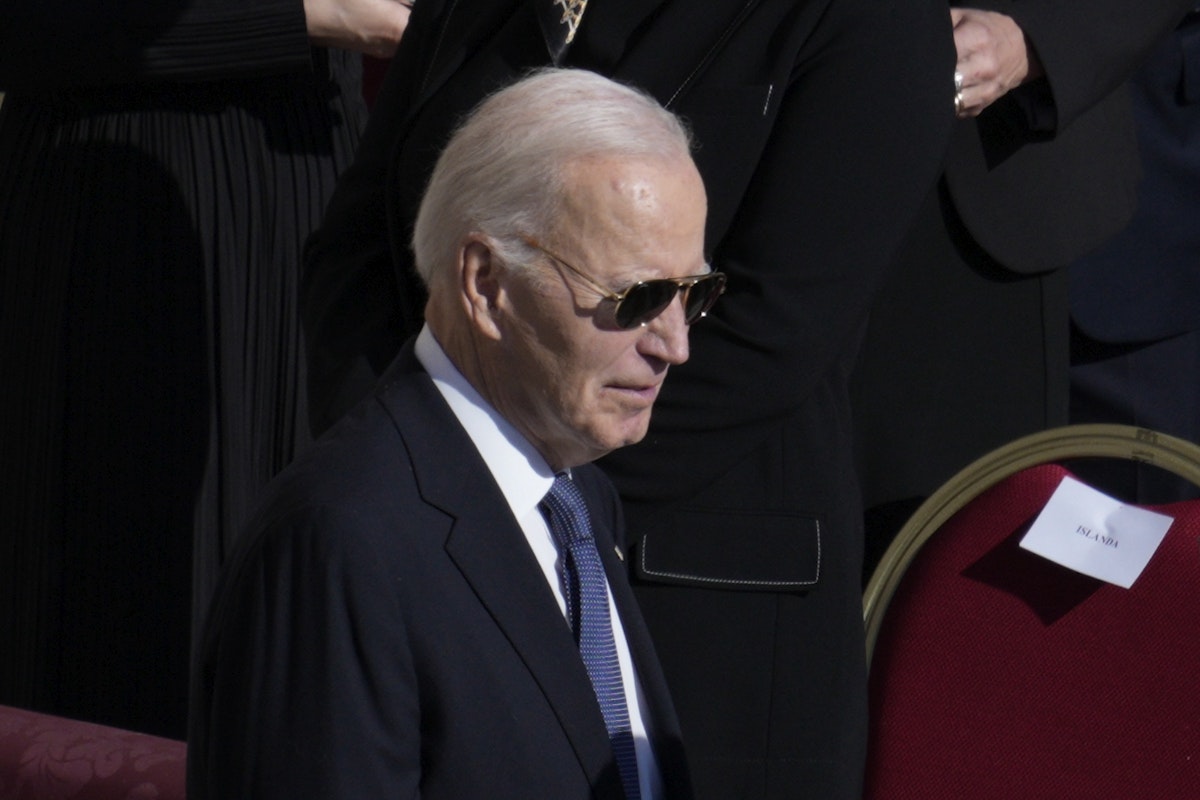

Bidens Cognitive Abilities Unreported Concerns From Within

May 14, 2025

Bidens Cognitive Abilities Unreported Concerns From Within

May 14, 2025 -

The Impact Of Climate Change On Business And Finance A New Conversation

May 14, 2025

The Impact Of Climate Change On Business And Finance A New Conversation

May 14, 2025 -

Over 6 000 Microsoft Employees Impacted By New Layoff Announcement

May 14, 2025

Over 6 000 Microsoft Employees Impacted By New Layoff Announcement

May 14, 2025 -

6 000 Job Cuts Announced At Microsoft What We Know

May 14, 2025

6 000 Job Cuts Announced At Microsoft What We Know

May 14, 2025