The Economic Impact Of Clean Energy Tax Proposals In The United States

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Economic Impact of Clean Energy Tax Proposals in the United States: A Complex Equation

The United States is at a crossroads, grappling with the urgent need to address climate change while simultaneously navigating the complexities of its economic landscape. Clean energy tax proposals, currently debated at both state and federal levels, are central to this challenge. These proposals aim to accelerate the transition to a cleaner energy future, but their economic consequences are multifaceted and far-reaching, sparking intense debate among policymakers, economists, and the public.

This article explores the potential economic impacts of these clean energy tax proposals, examining both the benefits and drawbacks, and considering the long-term implications for the US economy.

H2: Potential Economic Benefits of Clean Energy Tax Incentives

Proponents argue that clean energy tax credits and incentives offer substantial economic benefits:

-

Job Creation: The clean energy sector is a significant job creator. Tax incentives can accelerate growth in areas like solar panel manufacturing, wind turbine installation, energy storage development, and the broader green technology industry. Studies by organizations like the National Renewable Energy Laboratory (NREL) consistently point to the potential for substantial job growth in this sector. [Link to NREL study]

-

Economic Diversification: Investing in clean energy helps diversify the US economy, reducing reliance on fossil fuels and creating new opportunities in emerging technologies. This reduces vulnerability to volatile fossil fuel markets and geopolitical instability.

-

Technological Innovation: Tax incentives can stimulate research and development in clean energy technologies, leading to breakthroughs that improve efficiency, reduce costs, and enhance competitiveness in the global market. This fosters innovation and strengthens the US's position as a leader in green technology.

-

Reduced Healthcare Costs: Clean energy initiatives can lead to improved air and water quality, resulting in lower healthcare costs associated with pollution-related illnesses. This translates into significant long-term savings for individuals and the healthcare system.

-

Attracting Investment: Tax incentives can attract significant private investment in clean energy projects, boosting economic activity and creating a more sustainable and resilient economy. This can particularly benefit regions that have traditionally relied on fossil fuel industries.

H2: Potential Economic Challenges and Concerns

While the potential benefits are considerable, critics raise concerns about the economic challenges:

-

Increased Energy Costs: Some argue that the transition to clean energy could lead to higher energy prices in the short term, impacting consumers and businesses. However, proponents counter that long-term savings from reduced healthcare costs and energy independence could offset these initial increases.

-

Distributional Effects: The economic benefits of clean energy tax proposals may not be evenly distributed across all communities and demographics. Some regions heavily reliant on fossil fuels may face job losses during the transition, requiring targeted support and retraining programs.

-

Government Spending: Implementing substantial tax incentives requires significant government spending, raising questions about the budgetary implications and the potential need for offsetting tax increases elsewhere. This necessitates careful consideration of fiscal responsibility and strategic investment.

-

International Competitiveness: Concerns exist regarding the competitiveness of US industries if the costs of clean energy transition significantly outpace those in other countries with less stringent environmental regulations.

H2: Navigating the Complexities: A Balanced Approach

The economic impact of clean energy tax proposals is a complex issue with no easy answers. A balanced approach is crucial, one that carefully considers both the potential benefits and challenges. This involves:

-

Targeted Investments: Focusing tax incentives on specific technologies and industries with high potential for job creation and economic growth.

-

Just Transition Policies: Implementing programs to support workers and communities affected by the shift away from fossil fuels, ensuring a fair and equitable transition.

-

Long-Term Economic Modeling: Conducting thorough economic modeling to assess the long-term impacts of these proposals on various sectors and demographics.

-

International Cooperation: Collaborating internationally to establish consistent standards and regulations that promote global competitiveness while addressing climate change.

H3: The Future of Clean Energy in the US Economy

The future of the US economy is inextricably linked to the success of its clean energy transition. Well-designed clean energy tax proposals, implemented strategically and responsibly, can unlock significant economic opportunities while mitigating the risks. However, careful consideration of the potential challenges and the development of robust mitigation strategies are essential to ensure a smooth and equitable transition to a cleaner, more sustainable future. The ongoing debate surrounding these proposals highlights the critical need for informed public discourse and evidence-based policymaking. The stakes are high, and the decisions made today will shape the economic landscape for generations to come.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Economic Impact Of Clean Energy Tax Proposals In The United States. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

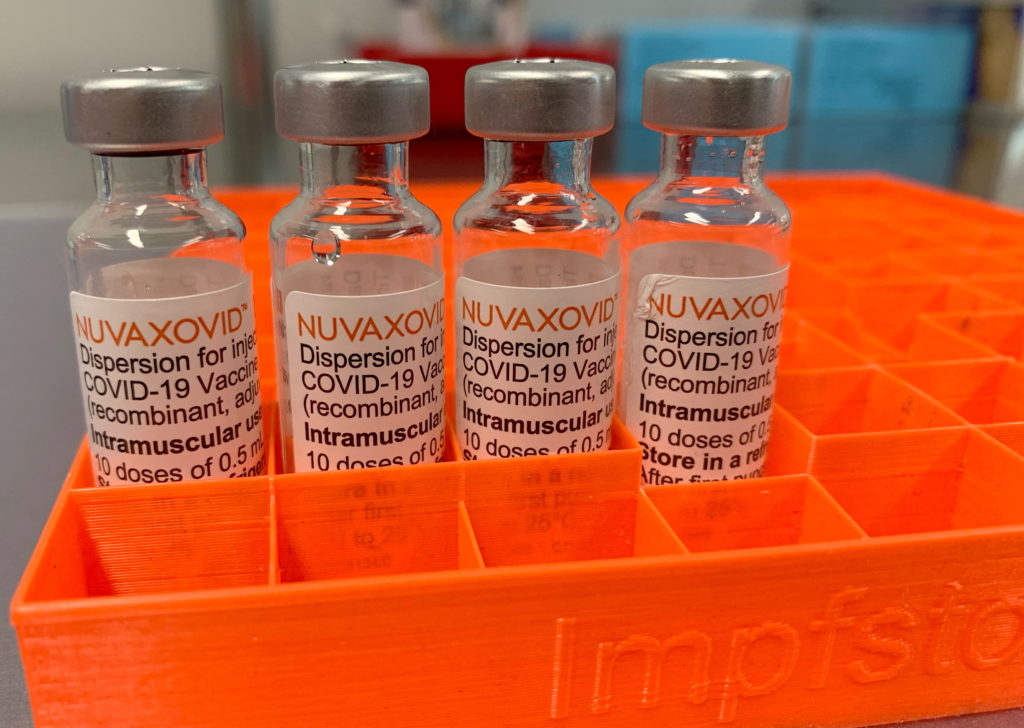

Novavax Covid 19 Vaccine Fda Approval Comes With Significant Restrictions

May 20, 2025

Novavax Covid 19 Vaccine Fda Approval Comes With Significant Restrictions

May 20, 2025 -

I M Done Jon Jones Cryptic Message Fuels Ufc Retirement Speculation

May 20, 2025

I M Done Jon Jones Cryptic Message Fuels Ufc Retirement Speculation

May 20, 2025 -

Helldivers 2 Masters Of Ceremony Warbond Drops Arrive May 15th

May 20, 2025

Helldivers 2 Masters Of Ceremony Warbond Drops Arrive May 15th

May 20, 2025 -

Star Wars Battlefronts Unexpected Revival Analyzing The Comeback

May 20, 2025

Star Wars Battlefronts Unexpected Revival Analyzing The Comeback

May 20, 2025 -

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Fallout

May 20, 2025

Brett Favre Sexting Scandal Jenn Sterger Details The Emotional Fallout

May 20, 2025