The Clean Energy Tax Debate: Weighing Economic Impact And Environmental Goals

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

The Clean Energy Tax Debate: Weighing Economic Impact and Environmental Goals

The push for a green future is colliding head-on with economic realities in a fierce debate surrounding clean energy tax policies. Governments worldwide are grappling with how to incentivize the transition to renewable energy sources while mitigating potential negative impacts on businesses and consumers. This complex issue involves navigating a delicate balance between environmental protection and economic stability, sparking passionate arguments on both sides.

The Case for Clean Energy Tax Incentives:

Proponents argue that investing in clean energy through tax breaks and subsidies is crucial for combating climate change and securing long-term economic prosperity. They point to the numerous benefits of transitioning away from fossil fuels, including:

- Reduced carbon emissions: Clean energy sources like solar, wind, and geothermal produce significantly fewer greenhouse gas emissions than traditional fossil fuels, helping to mitigate the effects of climate change. [Link to IPCC report on climate change]

- Job creation: The clean energy sector is a rapidly growing industry, creating numerous jobs in manufacturing, installation, maintenance, and research. This can revitalize struggling economies and offer high-skilled employment opportunities. [Link to a relevant government report on clean energy jobs]

- Energy independence: A shift towards domestic renewable energy sources reduces reliance on volatile global fossil fuel markets, enhancing national energy security and price stability.

- Improved public health: Reducing air pollution from fossil fuel combustion leads to significant improvements in public health, reducing respiratory illnesses and other health problems. [Link to a study on the health impacts of air pollution]

Economic Concerns and Counterarguments:

However, critics raise concerns about the economic consequences of implementing substantial clean energy tax policies. These concerns include:

- Increased energy costs: The initial investment in renewable energy infrastructure and the potential phasing out of fossil fuel subsidies can lead to higher energy prices for consumers and businesses.

- Job displacement: The transition away from fossil fuels could lead to job losses in the traditional energy sector, although proponents argue that these losses will be offset by new jobs in the clean energy sector.

- Tax burden: Funding clean energy initiatives through tax increases can place an additional burden on taxpayers, particularly low- and middle-income households.

- Competitive disadvantages: Some argue that imposing stricter environmental regulations and higher energy costs could make businesses less competitive on a global scale.

Finding a Balanced Approach:

The key to resolving this debate lies in finding a balanced approach that effectively promotes clean energy while minimizing negative economic consequences. This could involve:

- Phased implementation: Gradually transitioning to clean energy sources allows for adaptation and minimizes immediate economic shocks.

- Targeted subsidies: Focusing support on specific technologies and regions can maximize the effectiveness of tax incentives.

- Investing in retraining programs: Providing retraining and job placement assistance for workers displaced from the fossil fuel industry can help mitigate job losses.

- Carbon pricing mechanisms: Implementing carbon taxes or cap-and-trade systems can incentivize emissions reductions while generating revenue that can be used to fund clean energy initiatives. [Link to an article explaining carbon pricing]

The Future of Clean Energy Tax Policy:

The debate surrounding clean energy tax policies is far from over. As the urgency to address climate change intensifies, governments will need to carefully weigh the economic and environmental considerations involved. Finding a path that fosters sustainable economic growth while achieving ambitious environmental goals will require innovative solutions, political compromise, and a commitment to long-term planning. The ongoing discussion and policy adjustments will be crucial in shaping the future of energy and the global economy. Stay informed and engage in the conversation; the future of our planet depends on it.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on The Clean Energy Tax Debate: Weighing Economic Impact And Environmental Goals. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Washington D C Hosts World Pride A Test Of Inclusivity Under The Trump Shadow

May 19, 2025

Washington D C Hosts World Pride A Test Of Inclusivity Under The Trump Shadow

May 19, 2025 -

Charles Legacy Continues Rebounding Great Leads Connecticut Sun In Multiple Areas

May 19, 2025

Charles Legacy Continues Rebounding Great Leads Connecticut Sun In Multiple Areas

May 19, 2025 -

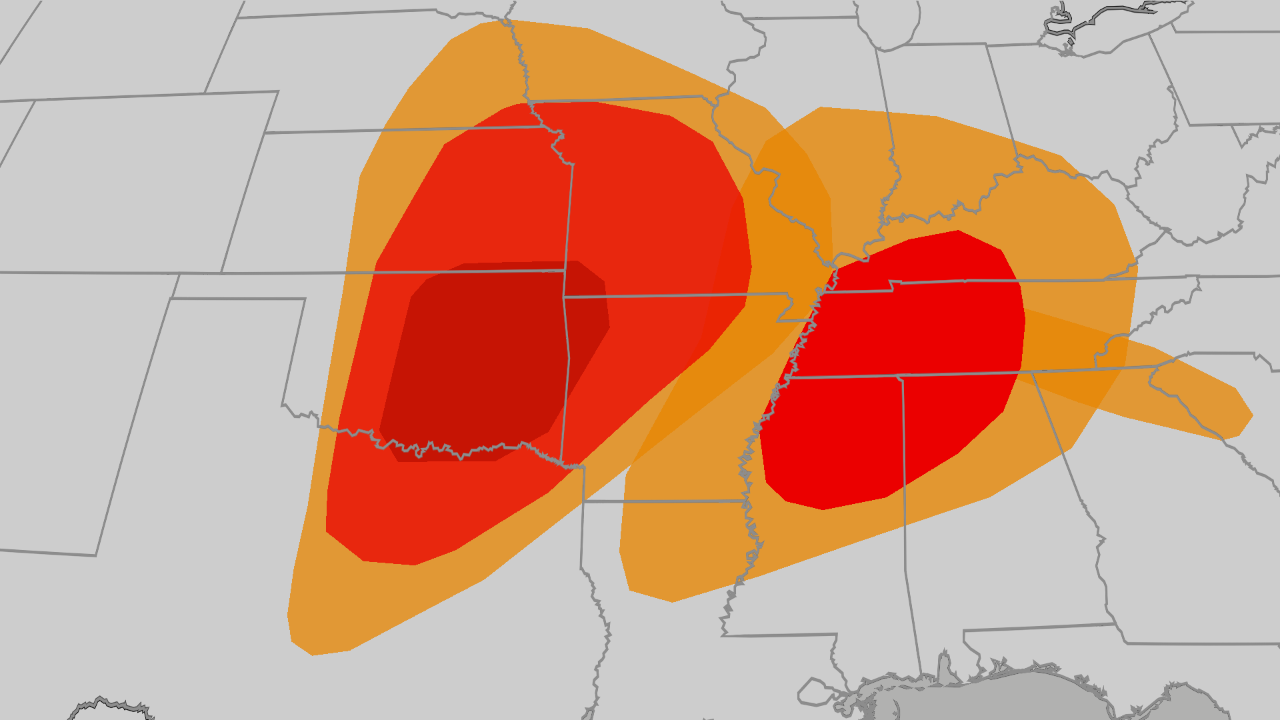

Midwest South And Plains Under Tornado Watch Severe Weather Update

May 19, 2025

Midwest South And Plains Under Tornado Watch Severe Weather Update

May 19, 2025 -

Find The Best Mortgage Refinance Rates May 19 2025 Market Overview

May 19, 2025

Find The Best Mortgage Refinance Rates May 19 2025 Market Overview

May 19, 2025 -

West Hams Coufal Addresses Fans In Personal Letter

May 19, 2025

West Hams Coufal Addresses Fans In Personal Letter

May 19, 2025